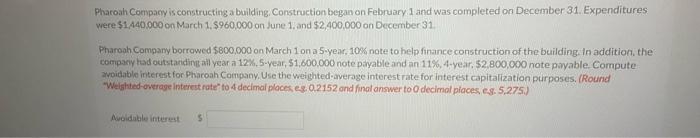

Question: include explanation please Pharoah Company is constructing a building, Construction began on February 1 and was completed on December 31. Expenditures were $1440.000 on March

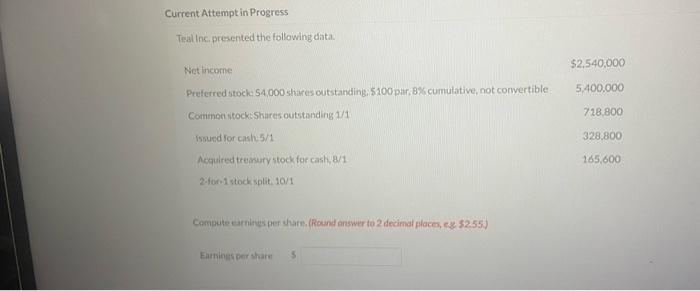

Pharoah Company is constructing a building, Construction began on February 1 and was completed on December 31. Expenditures were $1440.000 on March 1, $960,000 on June 1, and $2,400,000 on December 31 Pharoah Company borrowed $800.000 on March 1 on a 5-year, 10% note to help finance construction of the building. In addition, the company had outstanding all year a 12%, 5-year, 51,600.000 note payable and an 11%, 4-year. 52,800,000 note payable Compute avoidable interest for Pharoah Company. Use the weighted average interest rate for interest capitalization purposes. (Round "Weighted average interest rate" to 4 decimal places, es 02152 and final answer to decimal places, es. 5.275) Avoidable interest Current Attempt in Progress Teal Inc. presented the following data $2.540,000 Net income 5,400,000 Preferred stock 54000 shares outstanding, $100 par, 8% cumulative, not convertible Common stock: Shares outstanding 1/1 718,800 Issued for cash 5/1 328,800 Acquired treasury stock for cash, 8/1 165,600 2-for-1 stock split 10/1 Compute camins per share. (Round answer to 2 decimal places, es $2.55) Earnings per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts