Question: (Include the MACRS Table from the Appendix.) Casa Grande Farms is considering purchasing multiple tractors for a total purchase price of $540,000. These tractors are

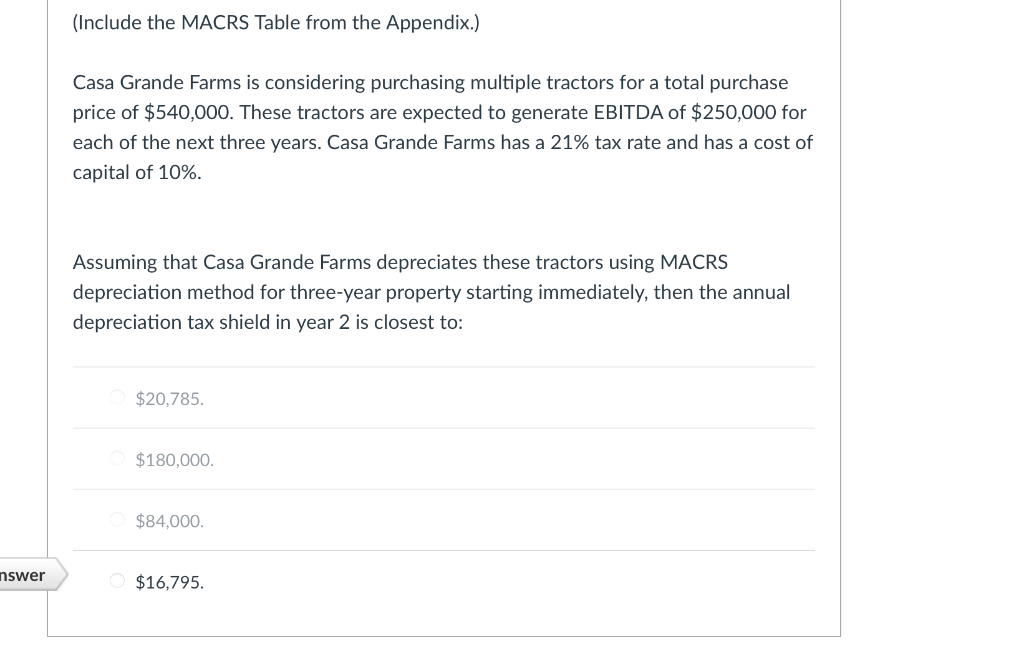

(Include the MACRS Table from the Appendix.) Casa Grande Farms is considering purchasing multiple tractors for a total purchase price of $540,000. These tractors are expected to generate EBITDA of $250,000 for each of the next three years. Casa Grande Farms has a 21% tax rate and has a cost of a capital of 10%. Assuming that Casa Grande Farms depreciates these tractors using MACRS depreciation method for three-year property starting immediately, then the annual depreciation tax shield in year 2 is closest to: $20,785. $180,000. $84,000. nswer $16,795

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts