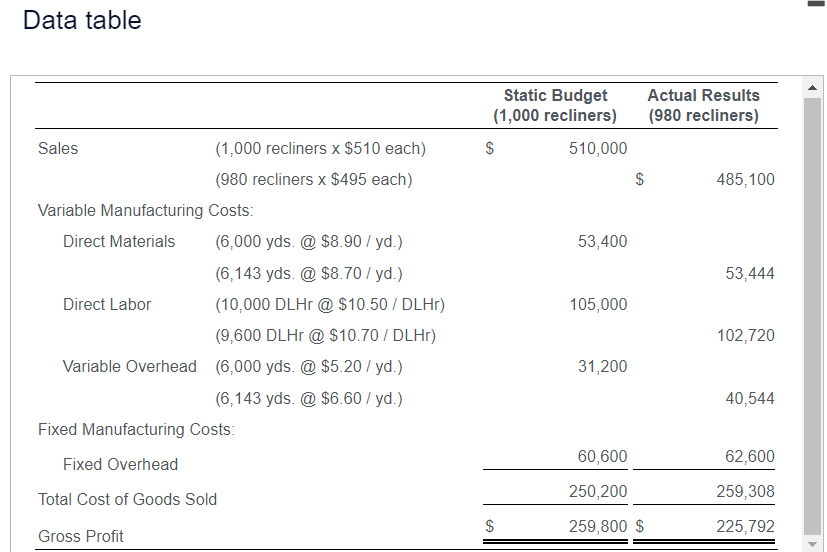

Question: includes the following selected data: (Click the icon to view the selected data.) Data table Requirements 1. Prepare a flexible budget based on the actual

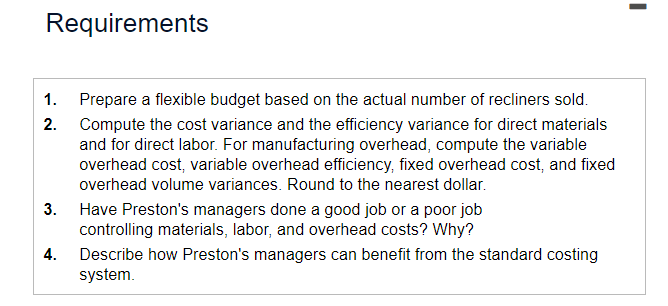

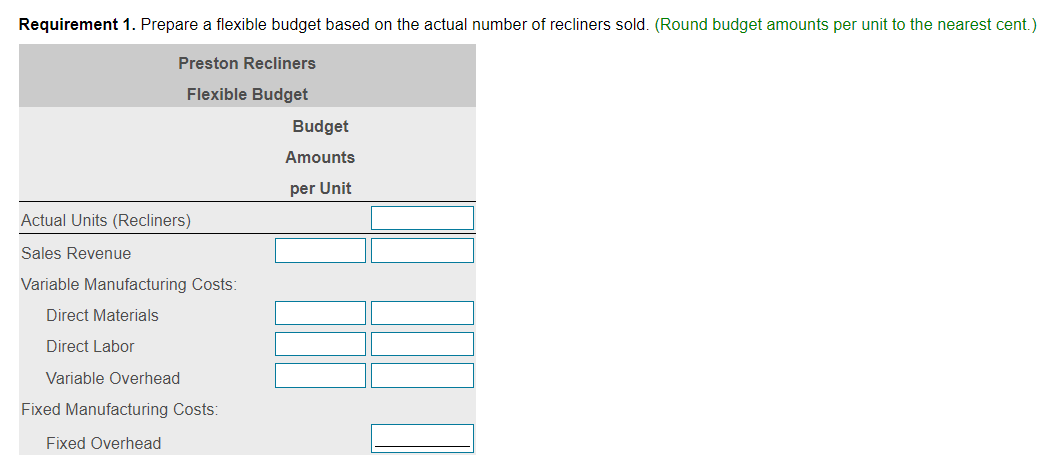

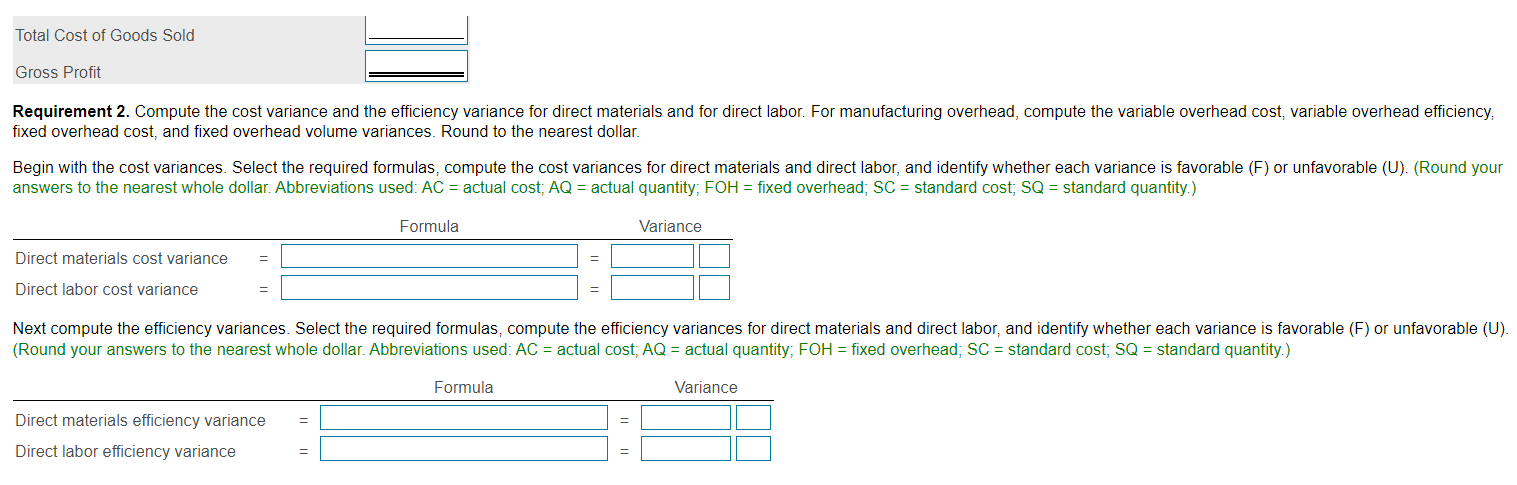

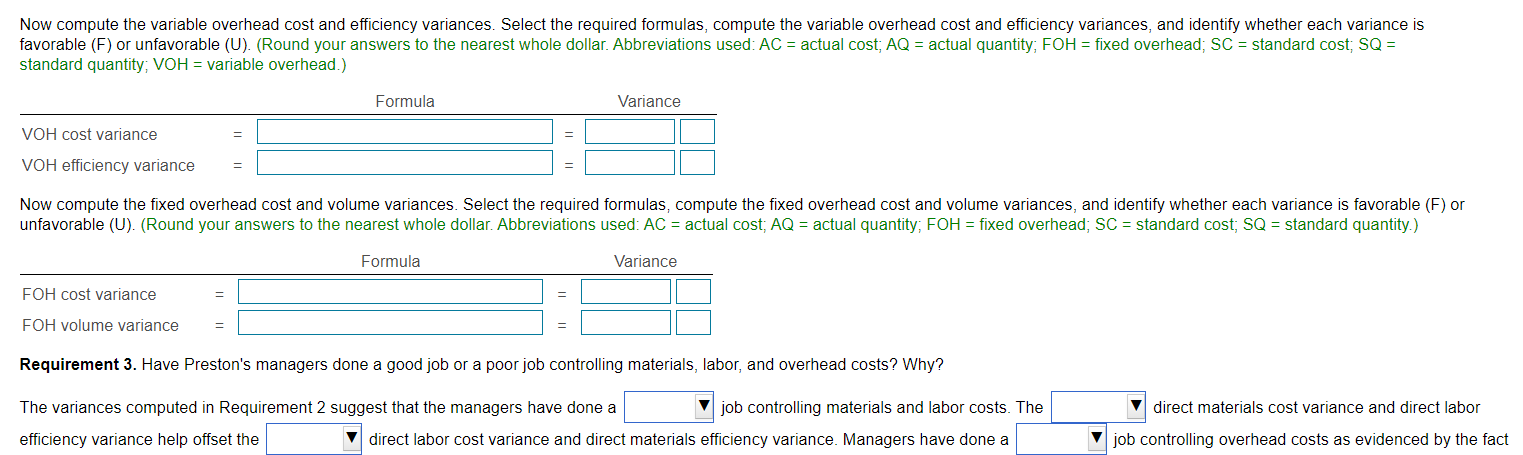

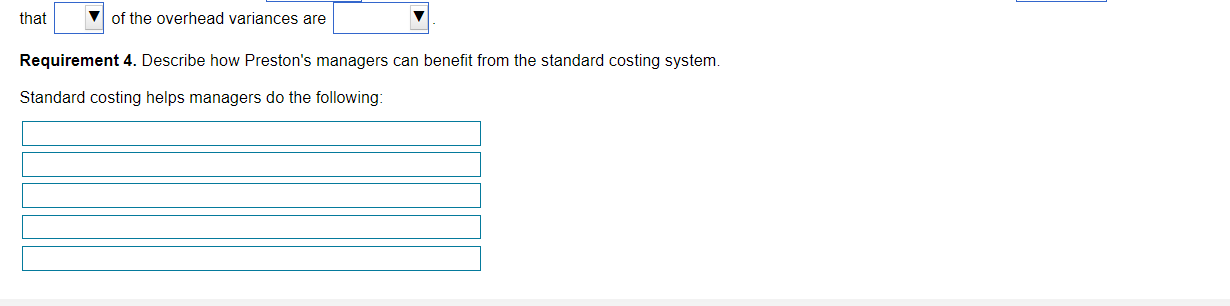

includes the following selected data: (Click the icon to view the selected data.) Data table Requirements 1. Prepare a flexible budget based on the actual number of recliners sold. 2. Compute the cost variance and the efficiency variance for direct materials and for direct labor. For manufacturing overhead, compute the variable overhead cost, variable overhead efficiency, fixed overhead cost, and fixed overhead volume variances. Round to the nearest dollar. 3. Have Preston's managers done a good job or a poor job controlling materials, labor, and overhead costs? Why? 4. Describe how Preston's managers can benefit from the standard costing system. Requirement 1. Prepare a flexible budget based on the actual number of recliners sold. (Round budget amounts per unit to the nearest cent.) Preston Recliners Flexible Budget Budget Amounts per Unit Actual Units (Recliners) Sales Revenue Variable Manufacturing Costs: Direct Materials Direct Labor Variable Overhead Fixed Manufacturing Costs: Fixed Overhead fixed overhead cost, and fixed overhead volume variances. Round to the nearest dollar. answers to the nearest whole dollar. Abbreviations used: AC= actual cost; AQ= actual quantity; FOH= fixed overhead; SC=standard cost; SQ= standard quantity.) Now compute the variable overhead cost and efficiency variances. Select the required formulas, compute the variable overhead cost and efficiency variances, and identify whether each variance is favorable (F) or unfavorable (U). (Round your answers to the nearest whole dollar. Abbreviations used: AC= actual cost; AQ= actual quantity; FOH= fixed overhead; SC= standard cost; SQ= standard quantity; VOH= variable overhead.) Now compute the fixed overhead cost and volume variances. Select the required formulas, compute the fixed overhead cost and volume variances, and identify whether each variance is favorable ( F) or unfavorable (U). (Round your answers to the nearest whole dollar. Abbreviations used: AC= actual cost; AQ= actual quantity; FOH= fixed overhead; SC= standard cost; SQ= standard quantity.) Requirement 3. Have Preston's managers done a good job or a poor job controlling materials, labor, and overhead costs? Why? The variances computed in Requirement 2 suggest that the managers have done a direct materials cost variance and direct lab efficiency variance help offset the direct labor cost variance and direct materials efficiency variance. Managers have done a job controlling overhead costs as evidenced by th Requirement 4. Describe how Preston's managers can benefit from the standard costing system. Standard costing helps managers do the following: includes the following selected data: (Click the icon to view the selected data.) Data table Requirements 1. Prepare a flexible budget based on the actual number of recliners sold. 2. Compute the cost variance and the efficiency variance for direct materials and for direct labor. For manufacturing overhead, compute the variable overhead cost, variable overhead efficiency, fixed overhead cost, and fixed overhead volume variances. Round to the nearest dollar. 3. Have Preston's managers done a good job or a poor job controlling materials, labor, and overhead costs? Why? 4. Describe how Preston's managers can benefit from the standard costing system. Requirement 1. Prepare a flexible budget based on the actual number of recliners sold. (Round budget amounts per unit to the nearest cent.) Preston Recliners Flexible Budget Budget Amounts per Unit Actual Units (Recliners) Sales Revenue Variable Manufacturing Costs: Direct Materials Direct Labor Variable Overhead Fixed Manufacturing Costs: Fixed Overhead fixed overhead cost, and fixed overhead volume variances. Round to the nearest dollar. answers to the nearest whole dollar. Abbreviations used: AC= actual cost; AQ= actual quantity; FOH= fixed overhead; SC=standard cost; SQ= standard quantity.) Now compute the variable overhead cost and efficiency variances. Select the required formulas, compute the variable overhead cost and efficiency variances, and identify whether each variance is favorable (F) or unfavorable (U). (Round your answers to the nearest whole dollar. Abbreviations used: AC= actual cost; AQ= actual quantity; FOH= fixed overhead; SC= standard cost; SQ= standard quantity; VOH= variable overhead.) Now compute the fixed overhead cost and volume variances. Select the required formulas, compute the fixed overhead cost and volume variances, and identify whether each variance is favorable ( F) or unfavorable (U). (Round your answers to the nearest whole dollar. Abbreviations used: AC= actual cost; AQ= actual quantity; FOH= fixed overhead; SC= standard cost; SQ= standard quantity.) Requirement 3. Have Preston's managers done a good job or a poor job controlling materials, labor, and overhead costs? Why? The variances computed in Requirement 2 suggest that the managers have done a direct materials cost variance and direct lab efficiency variance help offset the direct labor cost variance and direct materials efficiency variance. Managers have done a job controlling overhead costs as evidenced by th Requirement 4. Describe how Preston's managers can benefit from the standard costing system. Standard costing helps managers do the following

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts