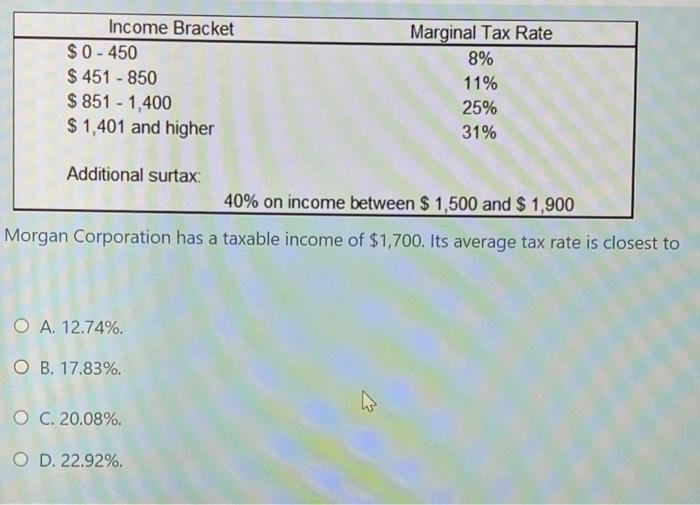

Question: Income Bracket $ 0 - 450 $ 451 - 850 $ 851 - 1,400 $ 1,401 and higher Marginal Tax Rate 8% 11% 25% 31%

Income Bracket $ 0 - 450 $ 451 - 850 $ 851 - 1,400 $ 1,401 and higher Marginal Tax Rate 8% 11% 25% 31% Additional surtax: 40% on income between $ 1,500 and $ 1,900 Morgan Corporation has a taxable income of $1,700. Its average tax rate is closest to O A. 12.74% O B. 17.83%. 2 O C. 20.08% O D. 22.92%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts