Question: Income Statement Analysis 2.5 points possible (graded) Horizontal Analysis Below is your comparative income statement. Using horizontal analysis, first calculate the amount of the change

Income Statement Analysis

2.5 points possible (graded)

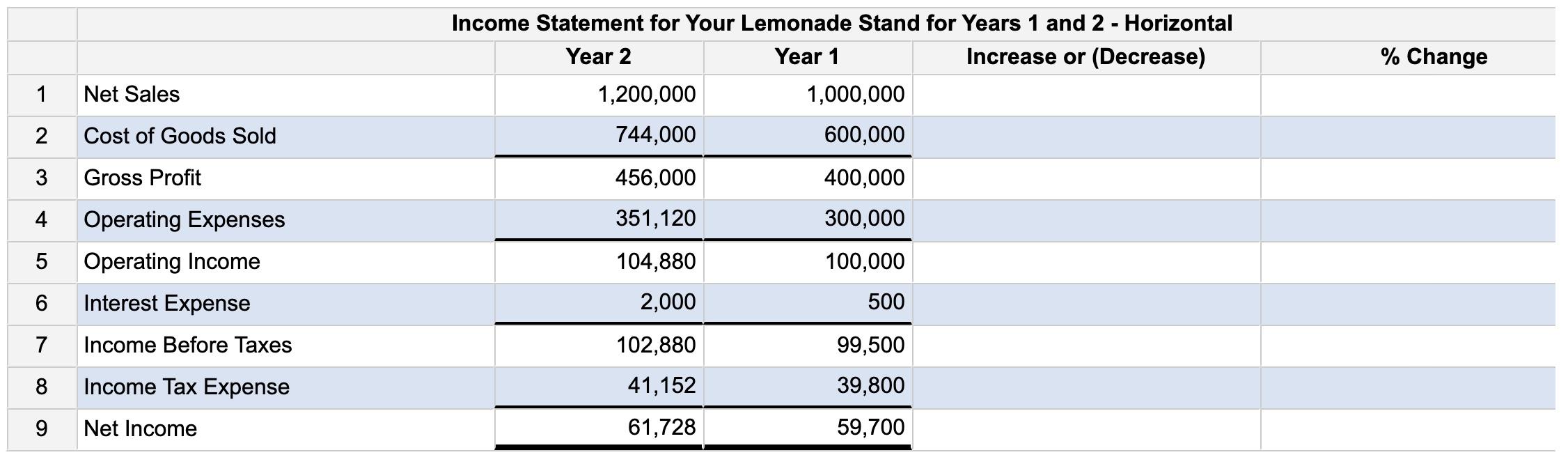

Horizontal Analysis

Below is your comparative income statement. Using horizontal analysis, first calculate the amount of the change from Year 1 to Year 2. For accounts that decreased, enter amount as negative. For the last column, calculate the percentage change from Year 1 to Year 2. For amounts that decreased, enter as negative.

For dollar amounts, do not enter commas, dollar signs, or decimals. For percentages, convert to percent format (e.g. 0.6543 to 65.43).

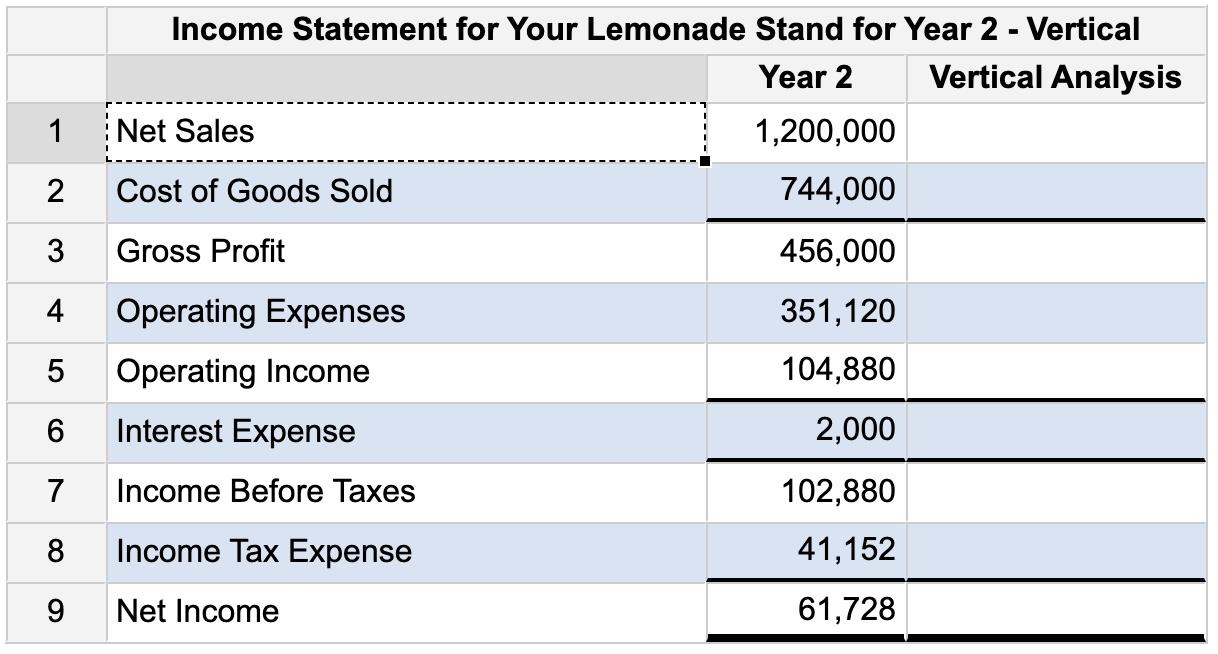

Vertical Analysis

Below is select information from your income statement. Perform vertical analysis for Year 2. For percentages, convert to percent format (e.g. 0.6543 to 65.43). Round answers to two decimal places.

% Change Income Statement for Your Lemonade Stand for Years 1 and 2 - Horizontal Year 2 Year 1 Increase or (Decrease) 1,200,000 1,000,000 744,000 600,000 1 Net Sales 2 Cost of Goods Sold 3 Gross Profit 456,000 351,120 400,000 300,000 4 Operating Expenses 5 Operating Income 104,880 100,000 6 Interest Expense 2,000 500 7 Income Before Taxes 102,880 99,500 8 Income Tax Expense 41,152 39,800 9 Net Income 61,728 59,700 % Change Income Statement for Your Lemonade Stand for Years 1 and 2 - Horizontal Year 2 Year 1 Increase or (Decrease) 1,200,000 1,000,000 744,000 600,000 1 Net Sales 2 Cost of Goods Sold 3 Gross Profit 456,000 351,120 400,000 300,000 4 Operating Expenses 5 Operating Income 104,880 100,000 6 Interest Expense 2,000 500 7 Income Before Taxes 102,880 99,500 8 Income Tax Expense 41,152 39,800 9 Net Income 61,728 59,700 Income Statement for Your Lemonade Stand for Year 2 - Vertical Year 2 Vertical Analysis Net Sales 1,200,000 1 2 Cost of Goods Sold 744,000 3 Gross Profit 456,000 4 Operating Expenses Operating Income Interest Expense 351,120 104,880 5 6 2,000 7 Income Before Taxes 102,880 41,152 8 8 Income Tax Expense 9 Net Income 61,728

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts