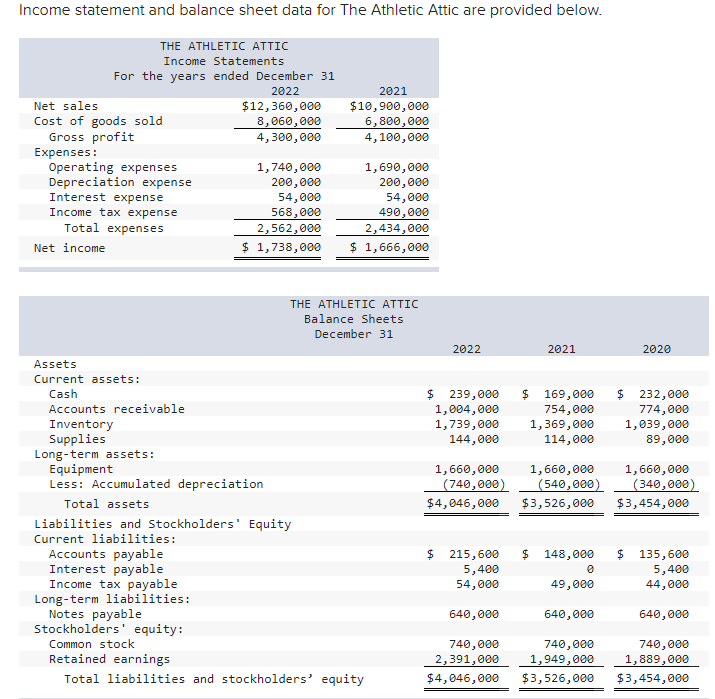

Question: Income statement and balance sheet data for The Athletic Attic are provided below. 2021 $10,900,000 6,800,000 4,100,000 THE ATHLETIC ATTIC Income Statements For the years

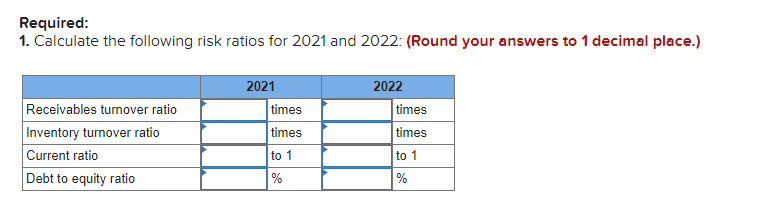

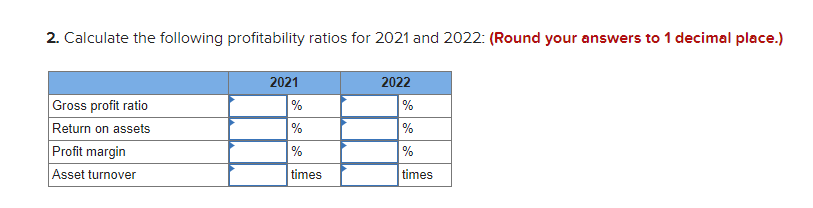

Income statement and balance sheet data for The Athletic Attic are provided below. 2021 $10,900,000 6,800,000 4,100,000 THE ATHLETIC ATTIC Income Statements For the years ended December 31 2022 Net sales $12,360,000 Cost of goods sold 8,060,000 Gross profit 4,300,000 Expenses : Operating expenses 1,740,000 Depreciation expense 200,000 Interest expense 54,000 Income tax expense 568,000 Total expenses 2,562,000 Net income $ 1,738,000 1,690,000 200,000 54,000 490,000 2,434,000 $ 1,666,000 THE ATHLETIC ATTIC Balance Sheets December 31 2022 2021 2020 $ 239,000 1,004,000 1,739,000 144,000 $ 169,000 754,000 1,369,000 114,000 $ 232,000 774,000 1,039,000 89,000 1,660,000 (740,000) $4,046,000 1,660,000 (540,000) $3,526,000 1,660,000 (340,000) $3,454,000 Assets Current assets: Cash Accounts receivable Inventory Supplies Long-term assets: Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity $ 148,000 $ 215,600 5,400 54,000 $ 135,600 5,400 44,000 49,000 640,000 640,000 640,000 740,000 2,391,000 $4,046,000 740,000 1,949,000 $3,526,000 740,000 1,889,000 $3,454,000 Required: 1. Calculate the following risk ratios for 2021 and 2022: (Round your answers to 1 decimal place.) 2021 times times Receivables turnover ratio Inventory turnover ratio Current ratio Debt to equity ratio 2022 times times to 1 % to 1 % 2. Calculate the following profitability ratios for 2021 and 2022: (Round your answers to 1 decimal place.) Gross profit ratio Return on assets Profit margin Asset turnover 2021 % % % 2022 % % % times times

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts