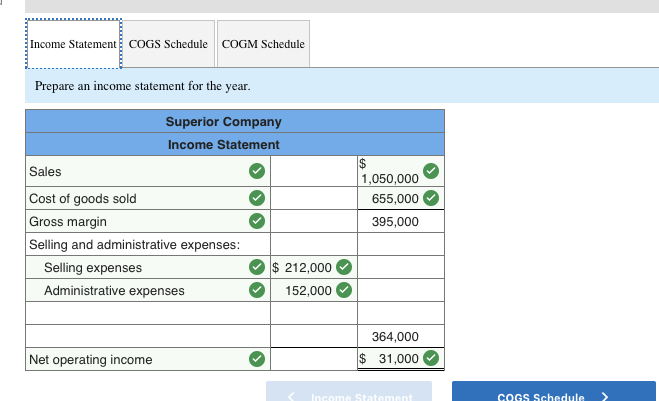

Question: Income Statement COGS Schedule COGM Schedule Prepare an income statement for the year. Superior Company Income Statement 1,050,000 655,000 395,000 Sales Cost of goods sold

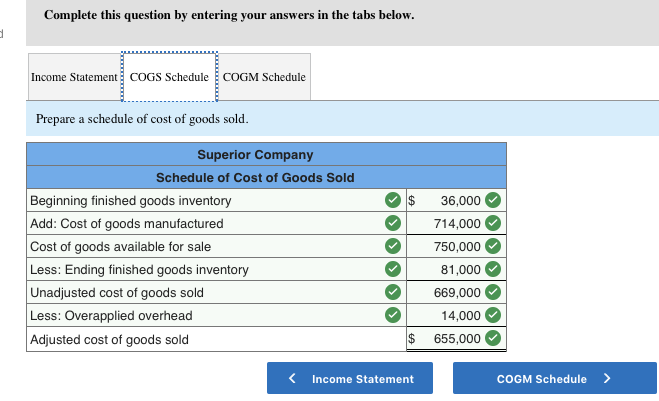

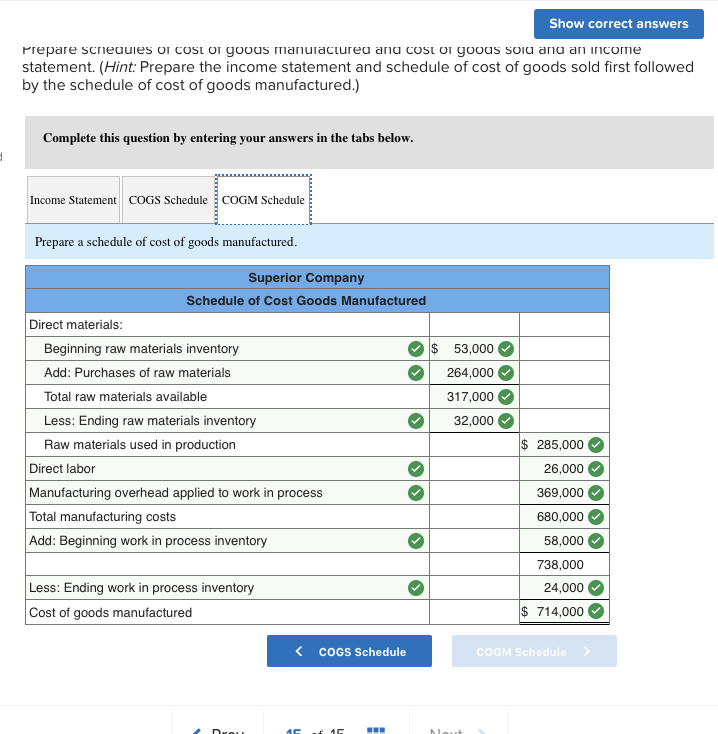

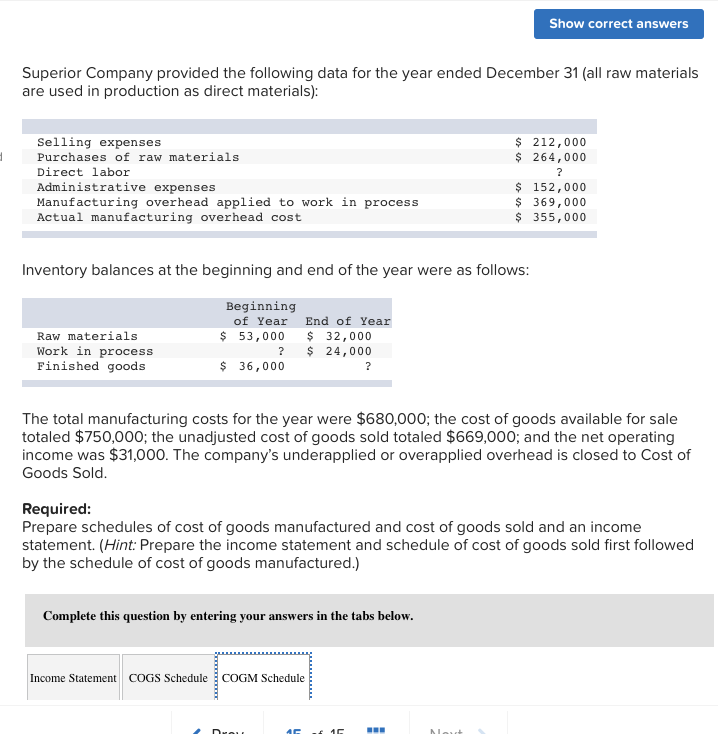

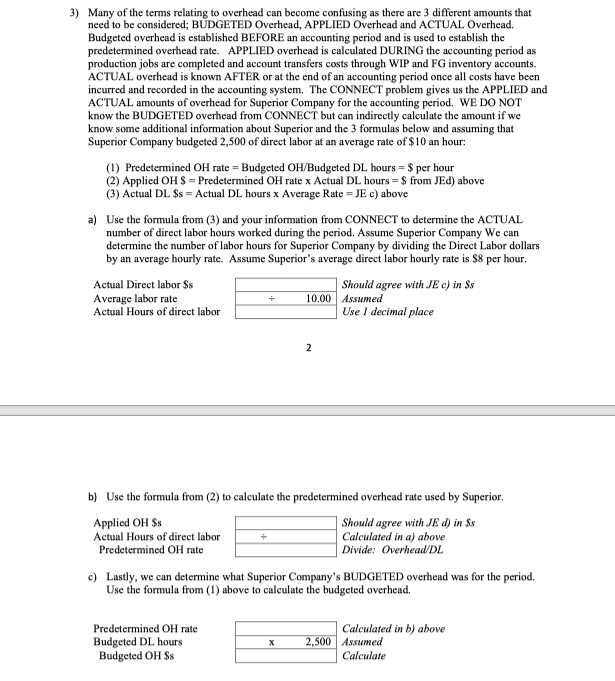

Income Statement COGS Schedule COGM Schedule Prepare an income statement for the year. Superior Company Income Statement 1,050,000 655,000 395,000 Sales Cost of goods sold Gross margin Selling and administrative expenses: Selling expenses Administrative expenses $ 212,000 152,000 364,000 $ 31,000 Net operating income Income Statement COGS Schedule Complete this question by entering your answers in the tabs below. Income Statement COGS Schedule COGM Schedule Prepare a schedule of cost of goods sold. $ Superior Company Schedule of Cost of Goods Sold Beginning finished goods inventory Add: Cost of goods manufactured Cost of goods available for sale Less: Ending finished goods inventory Unadjusted cost of goods sold Less: Overapplied overhead Adjusted cost of goods sold 36,000 714,000 750,000 81,000 669,000 14,000 655,000 $ Income Statement COGM Schedule > Show correct answers Prepare schedules OI COSI O yoous manufactured and cost of yoous sold and an income statement. (Hint: Prepare the income statement and schedule of cost of goods sold first followed by the schedule of cost of goods manufactured.) Complete this question by entering your answers in the tabs below. Income Statement COGS Schedule COGM Schedule Prepare a schedule of cost of goods manufactured. Superior Company Schedule of Cost Goods Manufactured Direct materials: Beginning raw materials inventory $ 53,000 Add: Purchases of raw materials 264,000 Total raw materials available 317,000 Less: Ending raw materials inventory 32,000 Raw materials used in production Direct labor Manufacturing overhead applied to work in process Total manufacturing costs $ 285,000 26,000 369,000 680,000 58,000 738,000 24,000 $ 714,000 Add: Beginning work in process inventory Less: Ending work in process inventory Cost of goods manufactured Show correct answers Prepare schedules OI COSI O yoous manufactured and cost of yoous sold and an income statement. (Hint: Prepare the income statement and schedule of cost of goods sold first followed by the schedule of cost of goods manufactured.) Complete this question by entering your answers in the tabs below. Income Statement COGS Schedule COGM Schedule Prepare a schedule of cost of goods manufactured. Superior Company Schedule of Cost Goods Manufactured Direct materials: Beginning raw materials inventory $ 53,000 Add: Purchases of raw materials 264,000 Total raw materials available 317,000 Less: Ending raw materials inventory 32,000 Raw materials used in production Direct labor Manufacturing overhead applied to work in process Total manufacturing costs $ 285,000 26,000 369,000 680,000 58,000 738,000 24,000 $ 714,000 Add: Beginning work in process inventory Less: Ending work in process inventory Cost of goods manufactured

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts