Question: Income statement data for Winthrop Company for two recent years ended December 31, are as follows: Current Year Previous Year Sales $546,100 $430,000 Cost

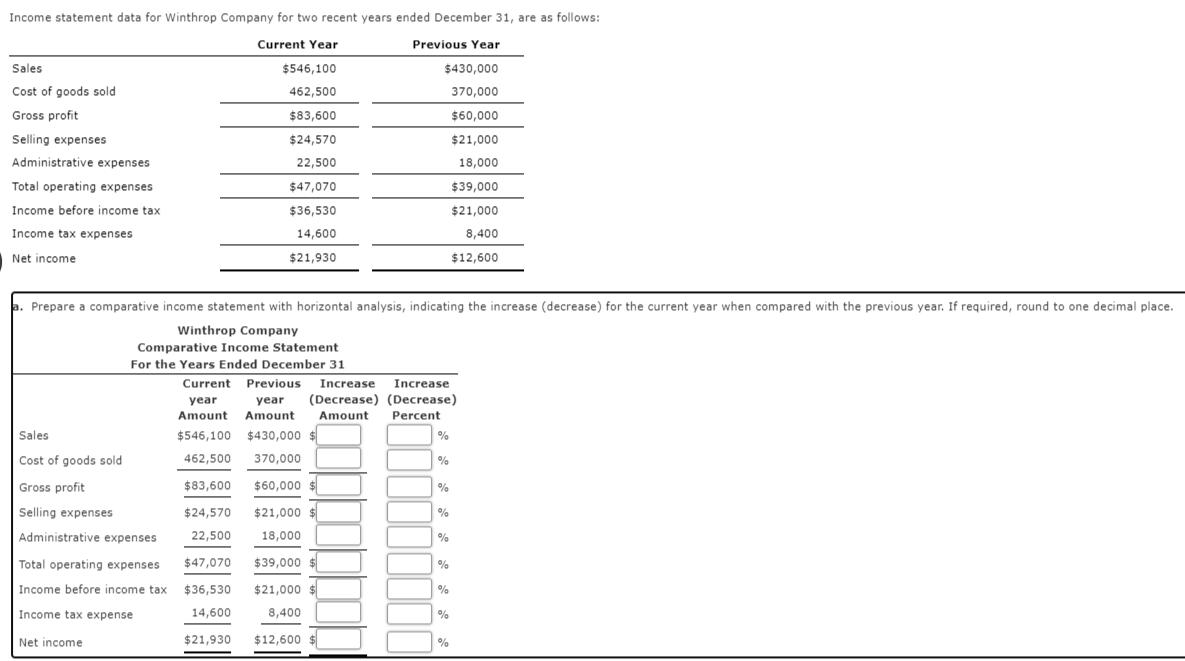

Income statement data for Winthrop Company for two recent years ended December 31, are as follows: Current Year Previous Year Sales $546,100 $430,000 Cost of goods sold 462,500 370,000 Gross profit $83,600 $60,000 Selling expenses $24,570 $21,000 Administrative expenses 22,500 18,000 Total operating expenses $47,070 $39,000 Income before income tax $36,530 $21,000 Income tax expenses 14,600 8,400 Net income $21,930 $12,600 p. Prepare a comparative income statement with horizontal analysis, indicating the increase (decrease) for the current year when compared with the previous year. If required, round to one decimal place. Winthrop Company Comparative Income Statement For the Years Ended December 31 Current Previous Increase Increase year ear (Decrease) (Decrease) Amount Amount Amount Percent Sales $546,100 $430,000 $ % Cost of goods sold 462,500 370,000 Gross profit $83,600 $60,000 % Selling expenses $24,570 $21,000 $ Administrative expenses 22,500 18,000 % Total operating expenses $47,070 $39,000 $ % Income before income tax $36,530 $21,000 $ % Income tax expense 14,600 8,400 % Net income $21,930 $12,600 %

Step by Step Solution

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Answer Winthrop Company Comparative Income Statement ... View full answer

Get step-by-step solutions from verified subject matter experts