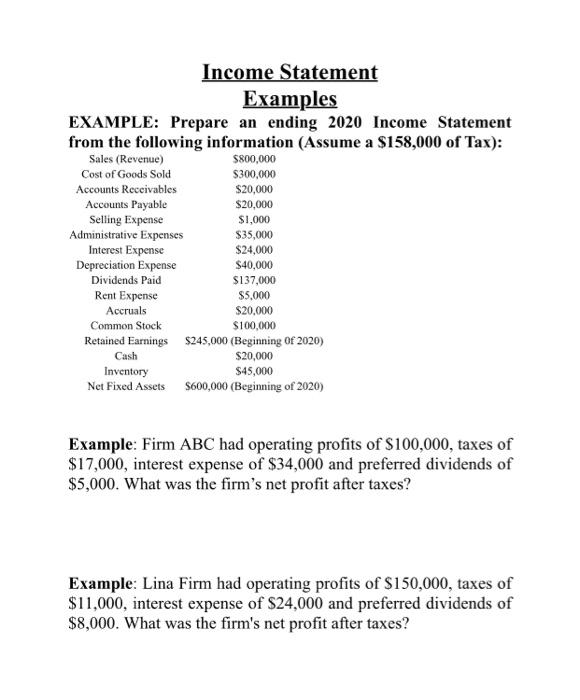

Question: Income Statement Examples EXAMPLE: Prepare an ending 2020 Income Statement from the following information (Assume a $158,000 of Tax): Sales (Revenue) $800,000 Cost of Goods

Income Statement Examples EXAMPLE: Prepare an ending 2020 Income Statement from the following information (Assume a $158,000 of Tax): Sales (Revenue) $800,000 Cost of Goods Sold $300,000 Accounts Receivables $20,000 Accounts Payable $20,000 Selling Expense $1,000 Administrative Expenses $35,000 Interest Expense $24,000 Depreciation Expense $40,000 Dividends Paid $137,000 Rent Expense $5,000 Accruals $20,000 Common Stock $100,000 Retained Earnings $245,000 (Beginning of 2020) Cash $20,000 Inventory $45,000 Net Fixed Assets $600,000 (Beginning of 2020) Example: Firm ABC had operating profits of $100,000, taxes of $17,000, interest expense of $34,000 and preferred dividends of $5,000. What was the firm's net profit after taxes? Example: Lina Firm had operating profits of $150,000, taxes of $11,000, interest expense of $24,000 and preferred dividends of $8,000. What was the firm's net profit after taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts