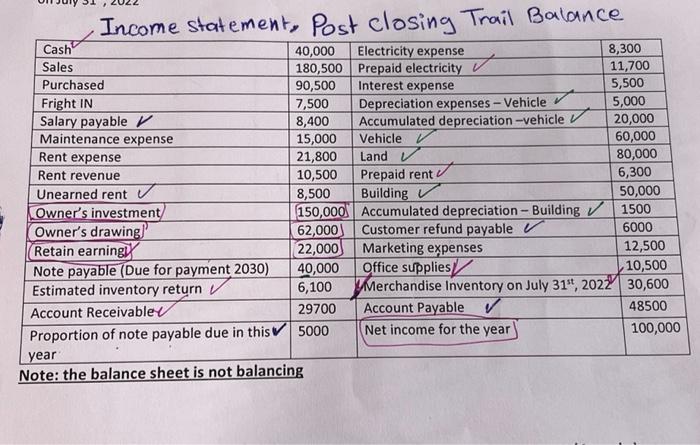

Question: income statement & post closing trail balance Income statement, Post closing Trail Balance Cash 40,000 Electricity expense 8,300 Sales 180,500 Prepaid electricity 11,700 Purchased 90,500

Income statement, Post closing Trail Balance Cash 40,000 Electricity expense 8,300 Sales 180,500 Prepaid electricity 11,700 Purchased 90,500 Interest expense 5,500 Fright IN 7,500 Depreciation expenses - Vehicle 5,000 Salary payable v 8,400 Accumulated depreciation-vehicle 20,000 Maintenance expense 15,000 Vehicle 60,000 Rent expense 21,800 Land 80,000 Rent revenue 10,500 Prepaid rent 6,300 Unearned rent 8,500 Building 50,000 Owner's investment (150,000 Accumulated depreciation - Building 1500 Owner's drawing! 62,000) Customer refund payable v 6000 Retain earningly 22,000) Marketing expenses 12,500 Note payable (Due for payment 2030) 40,000 Office supplies 10,500 Estimated inventory return 6,100 Merchandise Inventory on July 31st, 2022 30,600 Account Receivable 29700 Account Payable 48500 Proportion of note payable due in this 5000 Net income for the year 100,000 year Note: the balance sheet is not balancing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts