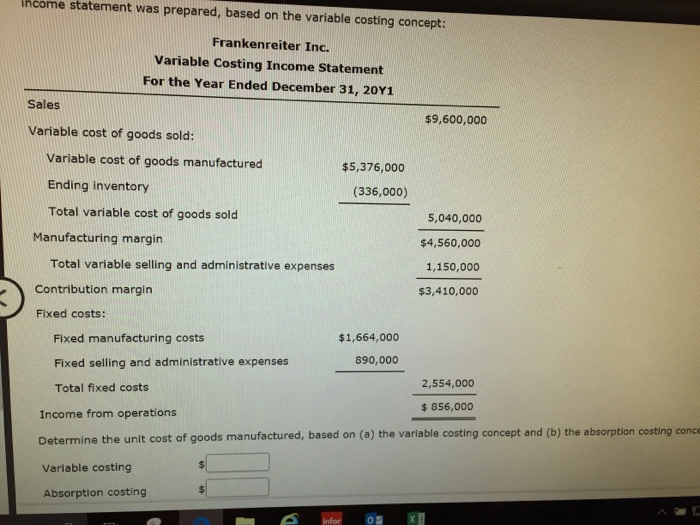

Question: Income statement was prepared, based on the variable costing concept: Frankenreiter Inc. Variable Costing Income Statement For the Year Ended December 31, 20Y1 Sales $9,600,000

Income statement was prepared, based on the variable costing concept: Frankenreiter Inc. Variable Costing Income Statement For the Year Ended December 31, 20Y1 Sales $9,600,000 Variable cost of goods sold: Variable cost of goods manufactured Ending inventory Total variable cost of goods sold $5,376,000 (336,000) 5,040,000 $4,560,000 1,150,000 $3,410,000 Manufacturing margin Total variable selling and administrative expenses Contribution margin Fixed costs: Fixed manufacturing costs $1,664,000 Fixed selling and administrative expenses 890,000 2,554,000 Total fixed costs Income from operations Determine the unit cost of goods manufactured, based on (a) the variable costing concept and (b) the absorption costing conce Variable costing Absorption costing 856,000 Income statement was prepared, based on the variable costing concept: Frankenreiter Inc. Variable Costing Income Statement For the Year Ended December 31, 20Y1 Sales $9,600,000 Variable cost of goods sold: Variable cost of goods manufactured Ending inventory Total variable cost of goods sold $5,376,000 (336,000) 5,040,000 $4,560,000 1,150,000 $3,410,000 Manufacturing margin Total variable selling and administrative expenses Contribution margin Fixed costs: Fixed manufacturing costs $1,664,000 Fixed selling and administrative expenses 890,000 2,554,000 Total fixed costs Income from operations Determine the unit cost of goods manufactured, based on (a) the variable costing concept and (b) the absorption costing conce Variable costing Absorption costing 856,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts