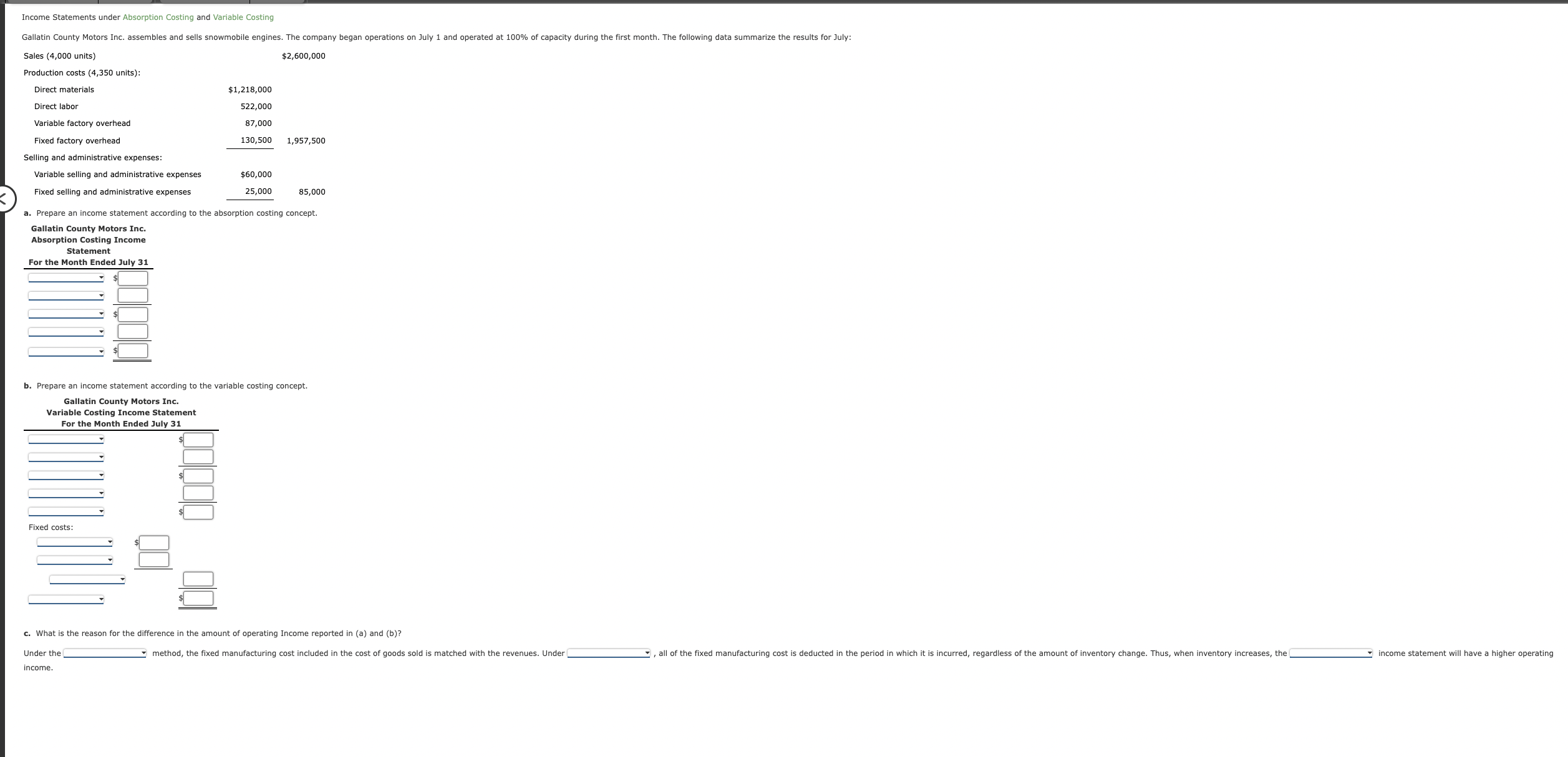

Question: Income Statements under Absorption Costing and Variable Costing a . Prepare an income statement according to the absorption costing concept. Gallatin county Motors Inc. Absorption

Income Statements under Absorption Costing and Variable Costing

a Prepare an income statement according to the absorption costing concept.

Gallatin county Motors Inc.

Absorption Costing Income

statement

For the Month Ended July

b Prepare an income statement according to the variable costing concept.

Gallatin County Motors Inc.

Variable Costing Income Statement

For the Month Ended July

Fixed costs:

c What is the reason for the difference in the amount of operating Income reported in a and b

Under the method, the fixed manufacturing cost included in the cost of goods sold is matched with the revenues. Under

income.

: all of the fixed manufacturing cost is deducted in the period in which it is incurred, regardless of the amount of inventory change. Thus, when inventory increases, the

income statement will have a higher operating

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock