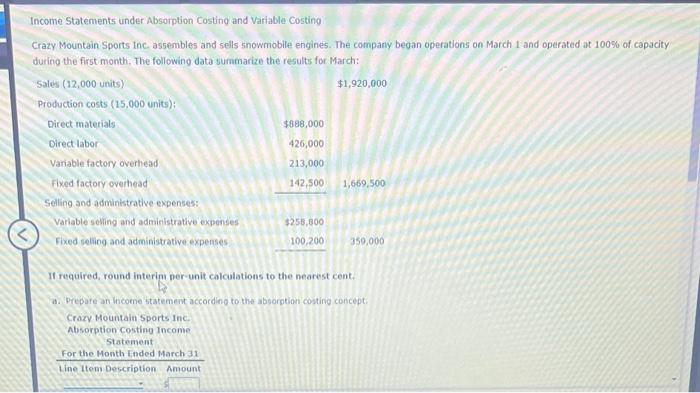

Question: Income Statements under Absorption Costing and Variable Costing Crazy Mountain Sports Inc. assembles and sells snowmobile engines. The company began operations on March 1 and

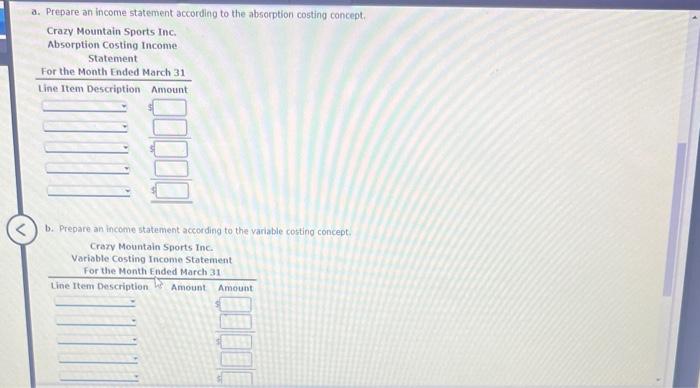

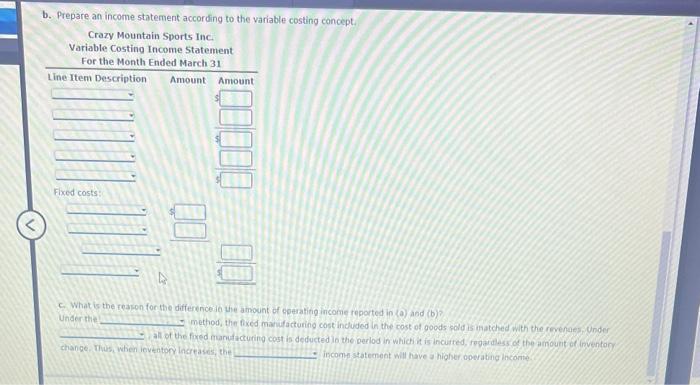

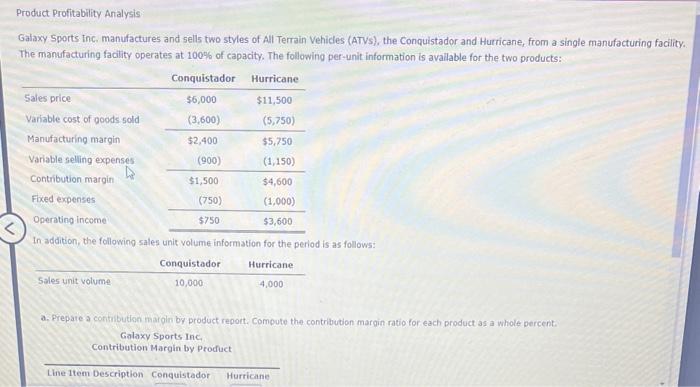

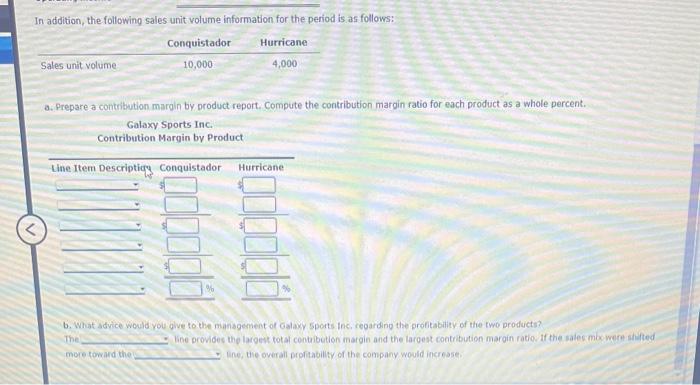

Income Statements under Absorption Costing and Variable Costing Crazy Mountain Sports Inc. assembles and sells snowmobile engines. The company began operations on March 1 and operated at 100% of capacity during the first month. The following data summarize the results for March: If required, round interim ner-unit calculations to the nearest cent. a. Prepare an income statement according to the absorption costing concept. Crazy Mountain Sports Inc. Ahiorntiou foutan vo...... b. Prepare an income statement according to the variable costing concept: b. Prepare an income statement according to the variable costing concept. Crazy Mountain Sports Inc. Variable Costing Income statement For the Montl, Ewdad waci. i. c. What is the reason for the differenceic the amount of cperating income reported in (a) and (b)? Under the method, the fixed manufacturing cost induded in the cost of goods sold is thatched with the ravenaes. Undes. all of the fixed erareizcturing cost is deducted lo the berlod in which in is incuited, fegardass of the amourit of (rvengton change. Thus, when inventor lacreases, the incompl statement will have a higher operating inconte Galaxy Sports inc. manufactures and sells two styles of All Terrain Vehicles (ATVs), the Conquistador and Hurricane, from a single manufacturing facility. The manufacturing facility operates at 100% of capacity. The following per-unit information is available for the two products: In addition, the following sales unit volume information for the period is as follows: a. Prepare a contibution maxglin by product report. Comoute the contribution maroin ratio for each product as a whole percent: Galaxy Sports Inc. Contribution Margin by Product In addition, the following sales unit volume information for the period is as follows: a. Prepare a contribution margin by product report. Compute the contribution margin ratio for each product as a whole percent. Galaxy Sports Inc. Contribution Margin by Product b. What advice would you give to the managenent of Galaxy 5 ports inc, regarding the grofitability of the two products? The lioe orovides the largent total contibution margin and the largest contribution margin ratio. If the satec mbe were itifted more toward the Ine, the overall profitabillty of the company would incresse

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts