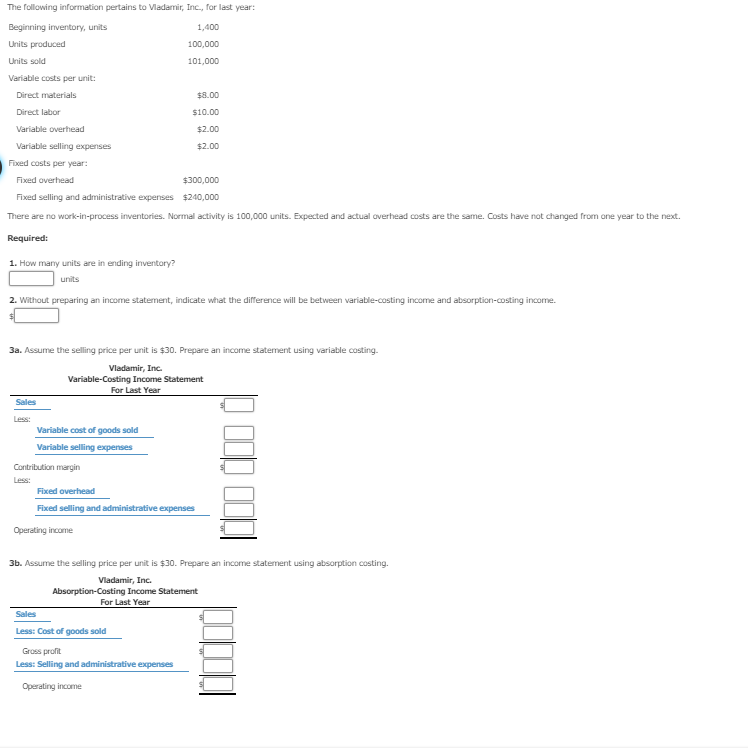

Question: Income Statements, Variable and Absorption Costing. Please show all work! Thank you The following information pertains to VMadamir, Inc., for last year: Beginning irnventory, units

Income Statements, Variable and Absorption Costing. Please show all work! Thank you

Income Statements, Variable and Absorption Costing. Please show all work! Thank you

The following information pertains to VMadamir, Inc., for last year: Beginning irnventory, units Units produced Units sold Variable costs per unit: 1,400 100,000 101,000 Direct materials Direct labor Variable overhead Variable selling expenses $8.00 $10.00 $2.00 $2.00 Fixed costs per year Fixed averhead $300,000 Fixed selling and administrative expenses $240,000 There are no work-in-process inventories. Normal activity is 100,000 units. Expected and actual overhead costs are the same. Costs have not changed from one year to the next. 1. How mary units are in ending inventory? units 2. Without preparing an income statement, indicate what the difference will be between variable-costing income and absorption-costing income. 3a. Assume the selling price per unit is $30. Prepare an income statement using variable costing. Vladamir, Inc Variable-Costing Income Statement For Last Year Sales Less: Variable cost of goods sold Variable selling expenses Contribution margin Less: Fixed overhead Fixed selling and administrative Operating income 3b. Assume the selling price per unit is $30. Prepare an income statement using absorption costing. ladamir, Inc. For Last Year Sales Less: Cost of goods sold Gross pront Less: Selling and administrative expenses Operating income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts