Question: income tax expense answer was wrong. how do i calculate the income tax expense and the net income?? thank you The adjusted trial balance of

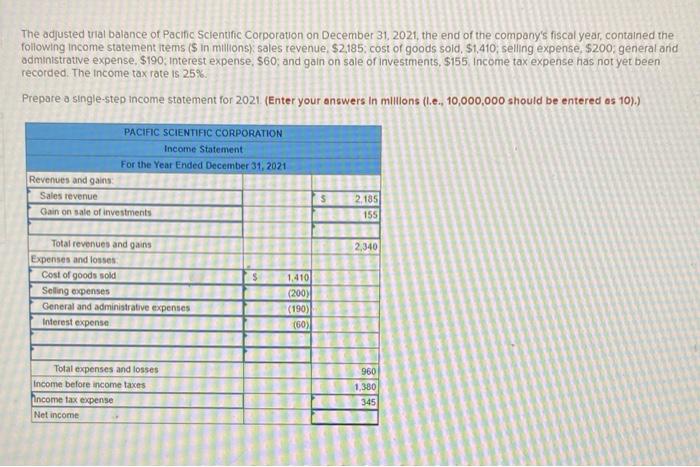

The adjusted trial balance of Pacific Scientific Corporation on December 31, 2021, the end of the company's fiscal year, contained the following income statement items ($ in millionsy sales revenue $2,185, cost of goods sold, S1,410, selling expense, $200 general and administrative expense, $190. Interest expense, S60, and gain on sale of investments, $155. Income tax expense has not yet been recorded. The income tax rate is 25%. Prepare a single-step income statement for 2021. (Enter your answers in millions (le. 10,000,000 should be entered os 10).) PACIFIC SCIENTIFIC CORPORATION Income Statement For the Year Ended December 31, 2021 Revenues and gains Sales revenue Gain on sale of investments 5 2 185 155 2,340 $ Total revenues and gains Expenses and losses Cost of goods sold Selling expenses General and administrative expenses Interest expense 1.410 (200) (190) (60) 960 Total expenses and losses Income before income taxes ncome tax expense Net income 1,380 345

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts