Question: income Tax I Critical Thinking / Problem Solving Assessment Below is the information that was used to prepare the attached Schedule A for Michael and

income Tax I

Critical ThinkingProblem Solving

Assessment

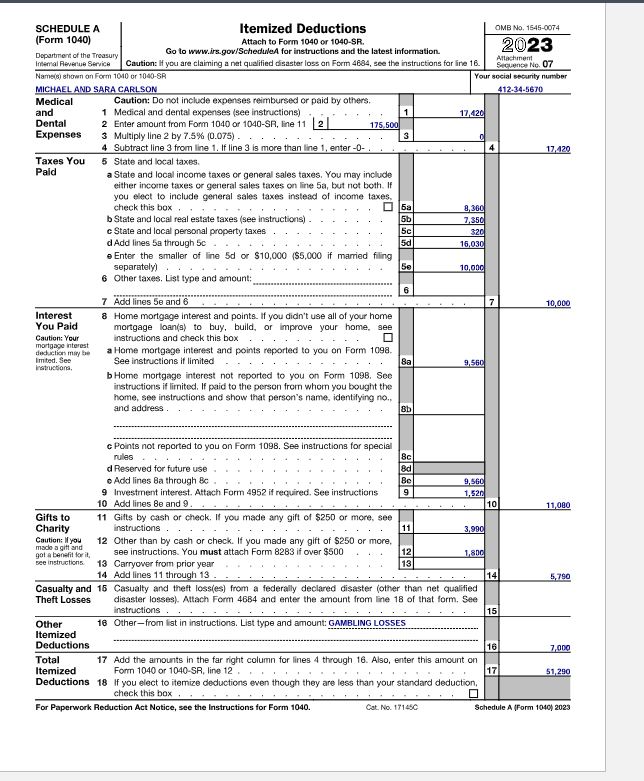

Below is the information that was used to prepare the attached Schedule A for Michael and Sara

Carlson. However, when the accountant was preparing the Schedule A he made some errors. After

reviewing the information, find the errors, note the correct treatment, and prepare a corrected

Schedule A

INCOME

Wages Michael $

Wages Sara

Dividend Income

Gambling Winnings

Adjusted Gross Income $

DEDUCTIONS

Medical Expenses

Hospital Bills $

Doctor Bills

Prescriptions

Vitamins

Health Club Fee

Vet Expenses for Dog

Insurance Reimbursements

This is how the accountant calculated the medical expenses.

Hospital Bills $

Doctor Bills

Prescriptions

Vitamins

Vet Expenses for Dog

Insurance Reimbursements

Total $

Taxes

WI withholding Michael $

WI withholding Sara

Prior Year WI Refund $

Property Taxes Main Home

Property Taxes Cabin in the Woods

Property Taxes Disney Condo

Car Registration not based on value

Interest

Mortgage Interest Main Home

Mortgage Interest Cabin in the Woods

Mortgage Interest Disney Condo

Interest on Investment Loan

Interest on Car Loan

Interest on Credit Card

Interest on Student Loan

Charitable Contributions

Documented contributions to Church $

Documented Contributions to Boy Scouts

Contribution to Republican Party

Contribution to Go Fund Me for friend

Goodwill donation FMV

Goodwill donation cost

Other Deductions

Gambling Losses $

Required

Complete the attached grid identifying the error, why it is an error, and the correct

treatment. There are errors.

Complete a corrected Schedule A

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock