Question: incorrect answer straight report against your answer....10 down votes XYZ Corporation is considering relaxing its present credit policy and is in the process of evaluating

incorrect answer straight report against your answer....10 down votes

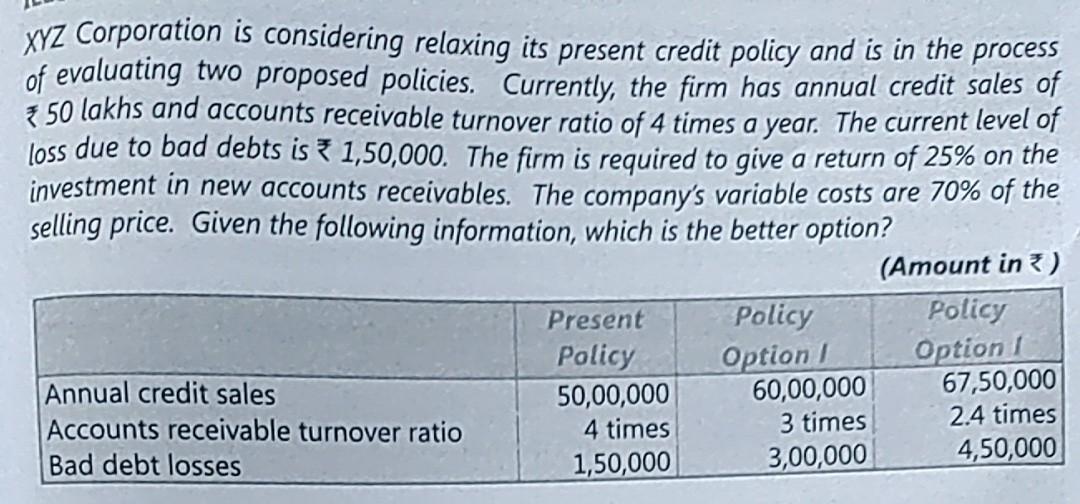

XYZ Corporation is considering relaxing its present credit policy and is in the process of evaluating two proposed policies. Currently , the firm has annual credit sales of 50 lakhs and accounts receivable turnover ratio of 4 times a year. The current level of loss due to bad debts is * 1,50,000. The firm is required to give a return of 25% on the investment in new accounts receivables. The company's variable costs are 70% of the selling price. Given the following information, which is the better option? (Amount in ) Policy Policy Policy Option Option1 Annual credit sales 50,00,000 60,00,000 67,50,000 Accounts receivable turnover ratio 4 times 3 times 2.4 times Bad debt losses 1,50,000 3,00,000 4,50,000 Present

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts