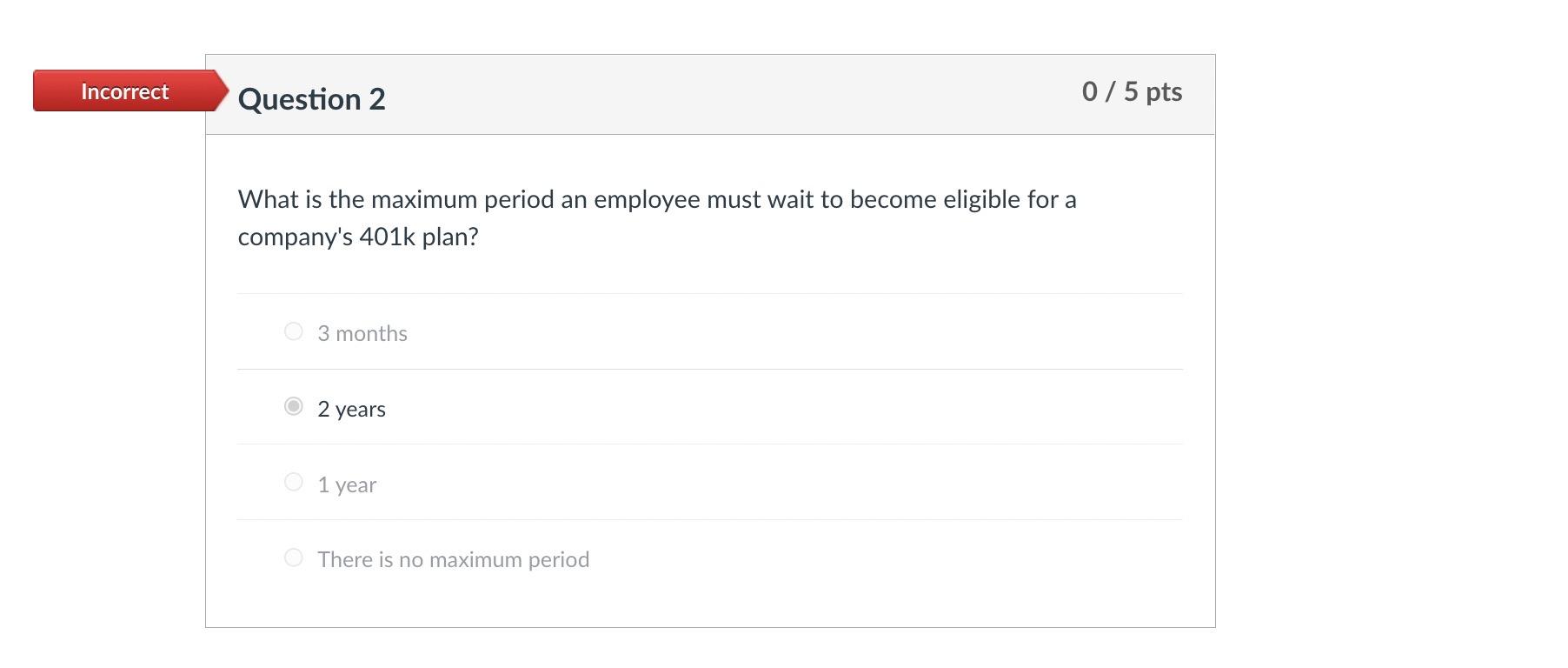

Question: Incorrect Question 2 0 / 5 pts What is the maximum period an employee must wait to become eligible for a company's 401k plan? 3

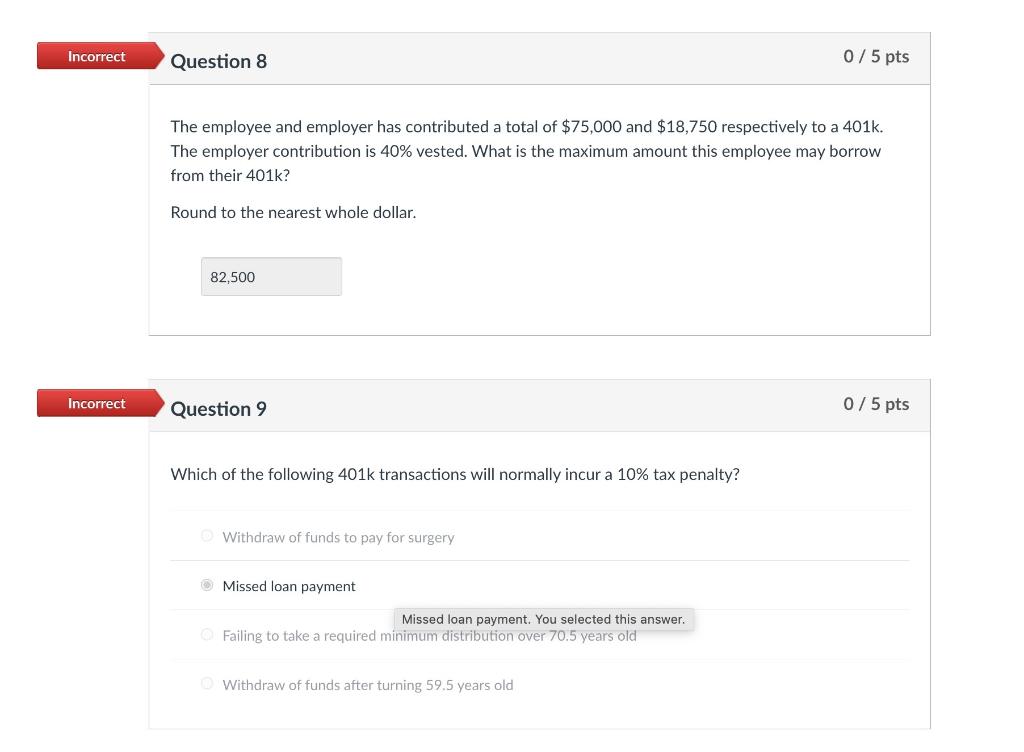

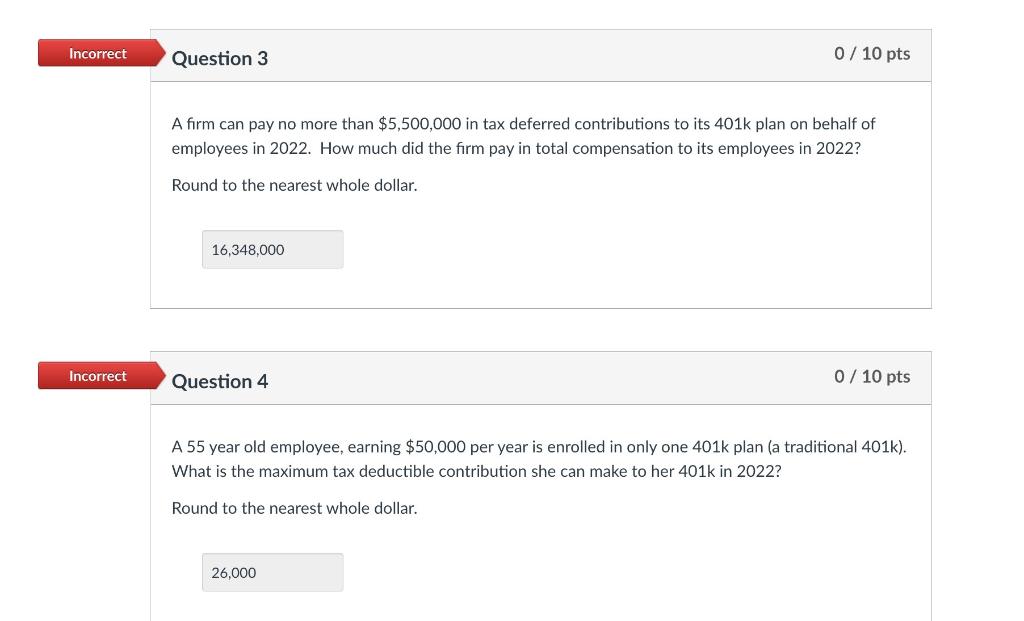

Incorrect Question 2 0 / 5 pts What is the maximum period an employee must wait to become eligible for a company's 401k plan? 3 months 2 years 1 year There is no maximum period Incorrect Question 8 0/5 pts The employee and employer has contributed a total of $75,000 and $18,750 respectively to a 401k. The employer contribution is 40% vested. What is the maximum amount this employee may borrow from their 401k? Round to the nearest whole dollar. 82,500 Incorrect Question 9 0/5 pts Which of the following 401k transactions will normally incur a 10% tax penalty? Withdraw of funds to pay for surgery Missed loan payment Missed loan payment. You selected this answer. Failing to take a required minimum distribution over 70.5 years old Withdraw of funds after turning 59.5 years old Incorrect Question 3 0 / 10 pts A firm can pay no more than $5,500,000 in tax deferred contributions to its 401k plan on behalf of employees in 2022. How much did the firm pay in total compensation to its employees in 2022? Round to the nearest whole dollar. 16,348.000 Incorrect Question 4 0/10 pts A 55 year old employee, earning $50,000 per year is enrolled in only one 401k plan (a traditional 401k). What is the maximum tax deductible contribution she can make to her 401k in 2022? Round to the nearest whole dollar. 26,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts