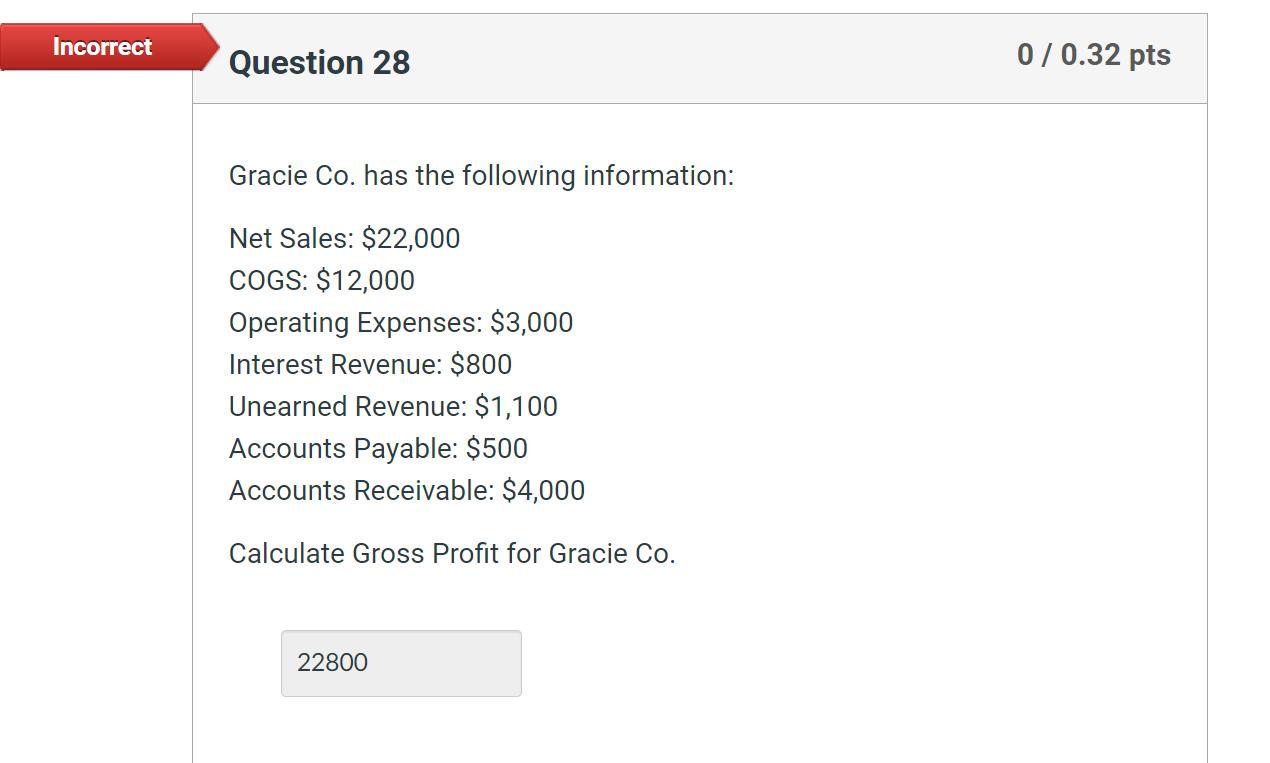

Question: Incorrect Question 28 Gracie Co. has the following information: Net Sales: $22,000 COGS: $12,000 Operating Expenses: $3,000 Interest Revenue: $800 Unearned Revenue: $1,100 Accounts

Incorrect Question 28 Gracie Co. has the following information: Net Sales: $22,000 COGS: $12,000 Operating Expenses: $3,000 Interest Revenue: $800 Unearned Revenue: $1,100 Accounts Payable: $500 Accounts Receivable: $4,000 Calculate Gross Profit for Gracie Co. 22800 0/0.32 pts Incorrect Question 28 Gracie Co. has the following information: Net Sales: $22,000 COGS: $12,000 Operating Expenses: $3,000 Interest Revenue: $800 Unearned Revenue: $1,100 Accounts Payable: $500 Accounts Receivable: $4,000 Calculate Gross Profit for Gracie Co. 22800 0/0.32 pts

Step by Step Solution

3.37 Rating (156 Votes )

There are 3 Steps involved in it

General Guidance The answer provided below has been developed in a clear step by step manner Step ... View full answer

Get step-by-step solutions from verified subject matter experts