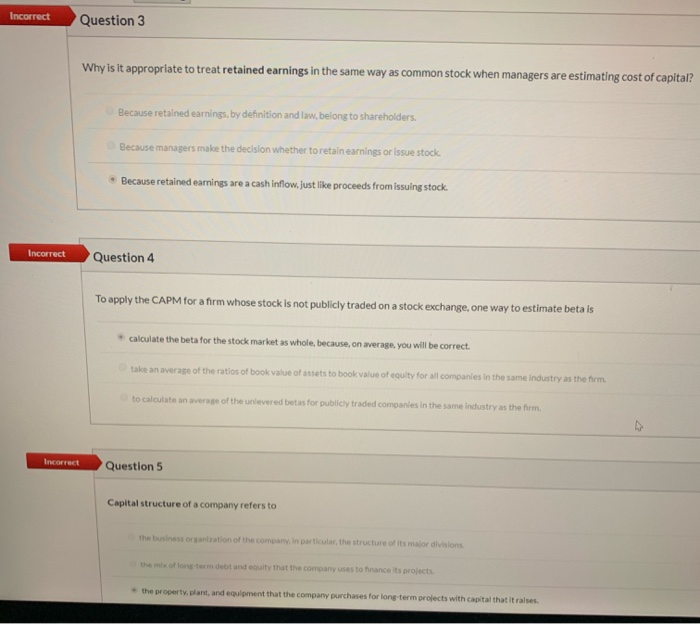

Question: Incorrect Question 3 Why is it appropriate to treat retained earnings in the same way as common stock when managers are estimating cost of capital?

Incorrect Question 3 Why is it appropriate to treat retained earnings in the same way as common stock when managers are estimating cost of capital? Because retained earnings, by defnition and law, belong to shareholders. Because managers make the decision whether to retain earnings or issue stock . Because retained earnings are a cash inflow, just like proceeds from issuing stock Incorrect Question 4 To apply the CAPM for a firm whose stock is not publicly traded on a stock exchange, one way to estimate beta is calculate the beta for the stock market as whole, because, on average, you will be correct. take an average of the ratio of book value of assets to book value of equity for all companies in the same industry as the form to calculate an average of the unlevered betas for publicly traded companies in the same industry as the form Incorrect Question 5 Capital structure of a company refers to the mix of long term debt and equity that the company uses to finance its projects the property, plant, and equipment that the company purchases for long-term projects with capital that it raises

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts