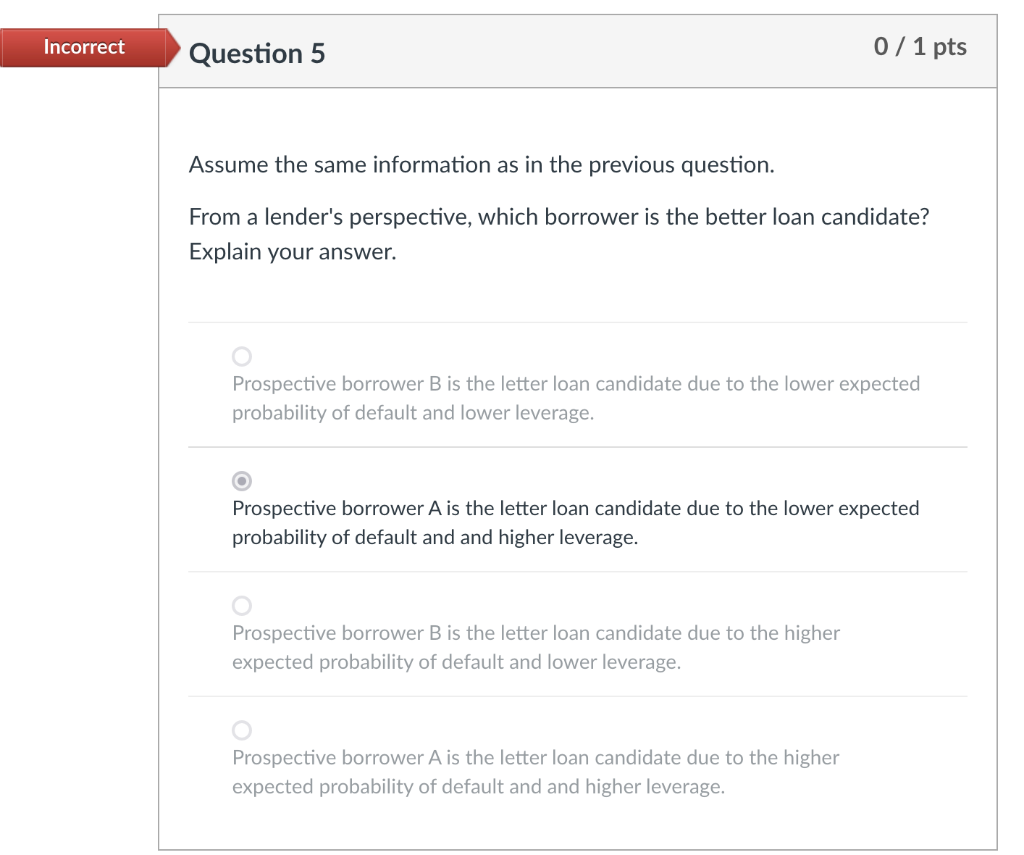

Question: Incorrect Question 5 Assume the same information as in the previous question. From a lender's perspective, which borrower is the better loan candidate? Explain your

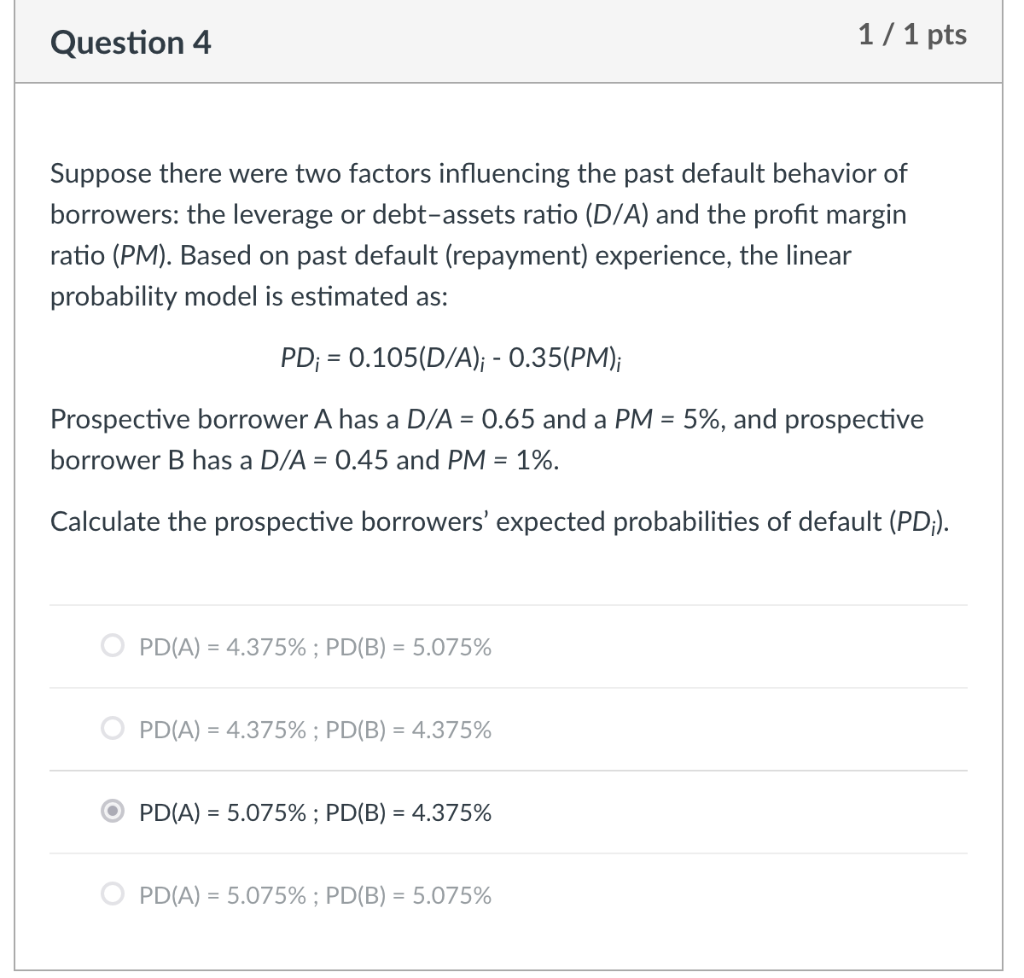

Incorrect Question 5 Assume the same information as in the previous question. From a lender's perspective, which borrower is the better loan candidate? Explain your answer. 0/1 pts Prospective borrower B is the letter loan candidate due to the lower expected probability of default and lower leverage. Prospective borrower A is the letter loan candidate due to the lower expected probability of default and and higher leverage. Prospective borrower B is the letter loan candidate due to the higher expected probability of default and lower leverage. Prospective borrower A is the letter loan candidate due to the higher expected probability of default and and higher leverage. Question 4 Suppose there were two factors influencing the past default behavior of borrowers: the leverage or debt-assets ratio (D/A) and the profit margin ratio (PM). Based on past default (repayment) experience, the linear probability model is estimated as: PD; = 0.105(D/A); - 0.35(PM); Prospective borrower A has a D/A = 0.65 and a PM = 5%, and prospective borrower B has a D/A = 0.45 and PM = 1%. Calculate the prospective borrowers' expected probabilities of default (PD;). PD(A) = 4.375%; PD(B) = 5.075% PD(A) = 4.375%; PD (B) = 4.375% PD(A) = 5.075% ; PD(B) = 4.375% 1/1 pts PD(A) = 5.075%; PD(B) = 5.075%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts