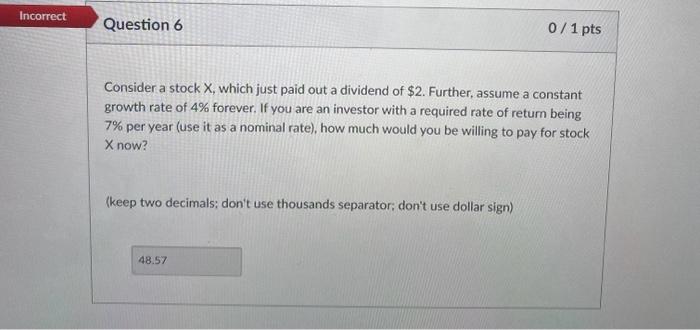

Question: Incorrect Question 6 0/1 pts Consider a stock X, which just paid out a dividend of $2. Further, assume a constant growth rate of 4%

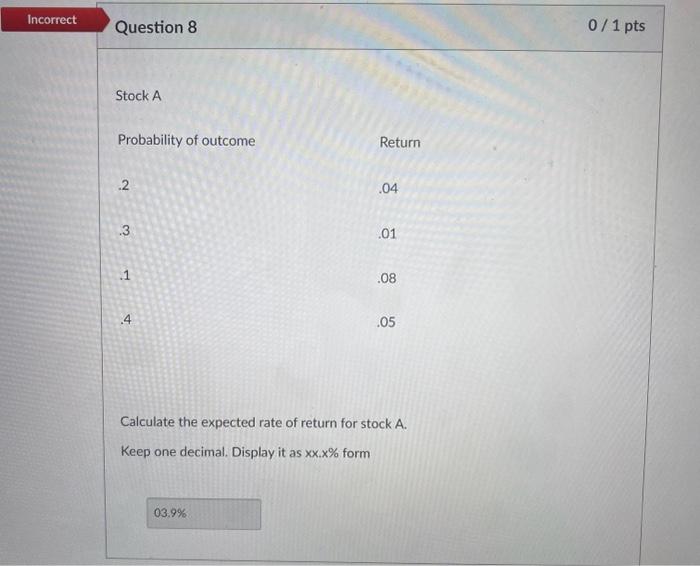

Incorrect Question 6 0/1 pts Consider a stock X, which just paid out a dividend of $2. Further, assume a constant growth rate of 4% forever. If you are an investor with a required rate of return being 7% per year (use it as a nominal rate), how much would you be willing to pay for stock X now? (keep two decimals; don't use thousands separator; don't use dollar sign) Incorrect Question 8 0/1 pts Stock A Probability of outcome .2 .3 1 .4 Return .04 .01 .08 .05 Calculate the expected rate of return for stock A. Keep one decimal. Display it as xx.x% form

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts