Question: incorrect shown. A-D needed with new numbers given. The Colvin 2018 income statement and balance sheet follows. B Click the icon to view the assets

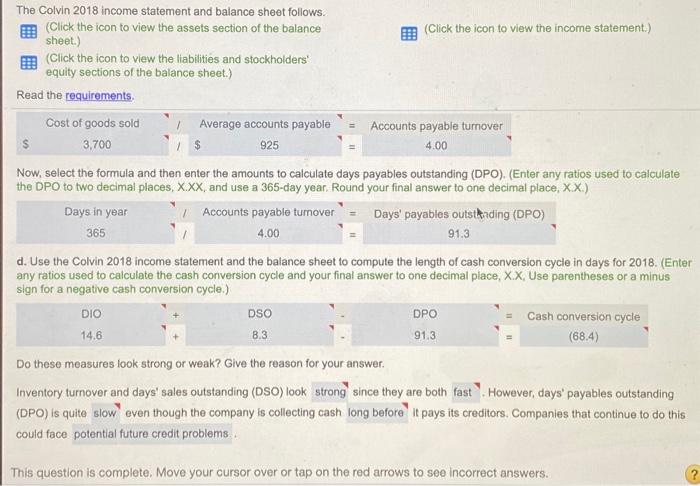

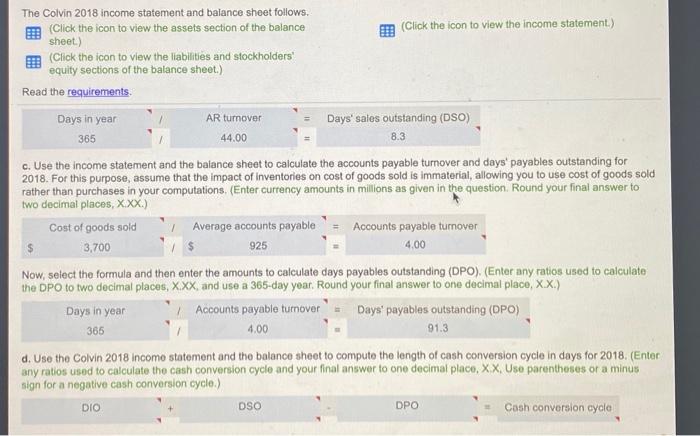

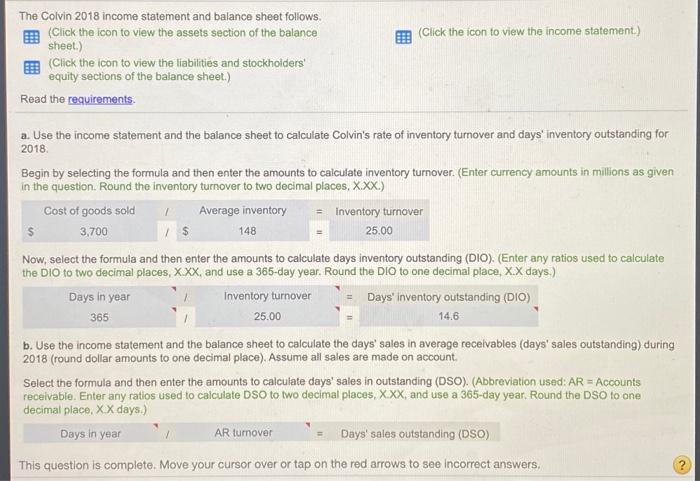

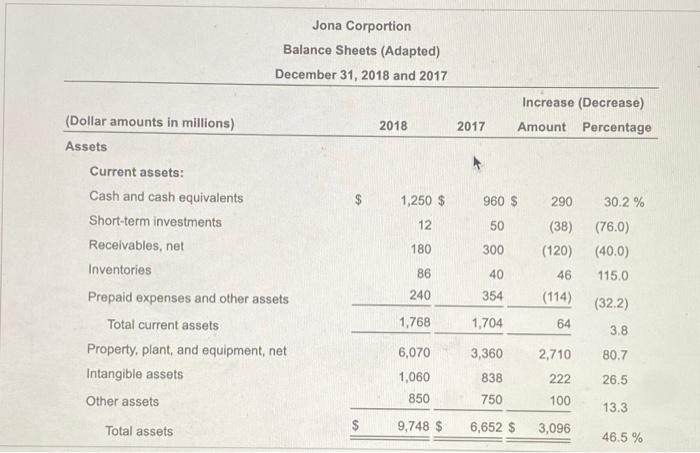

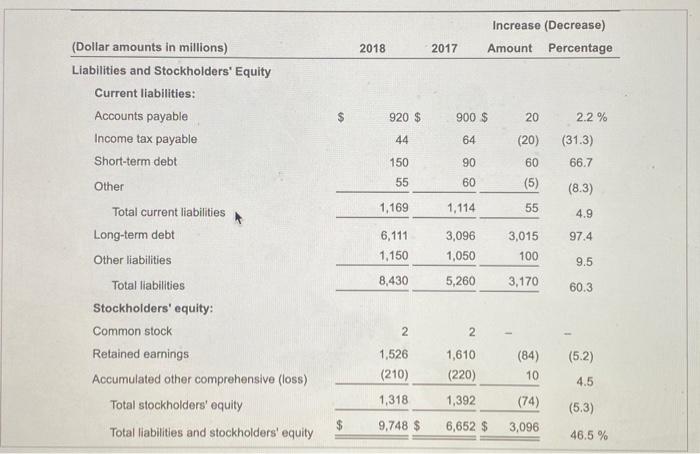

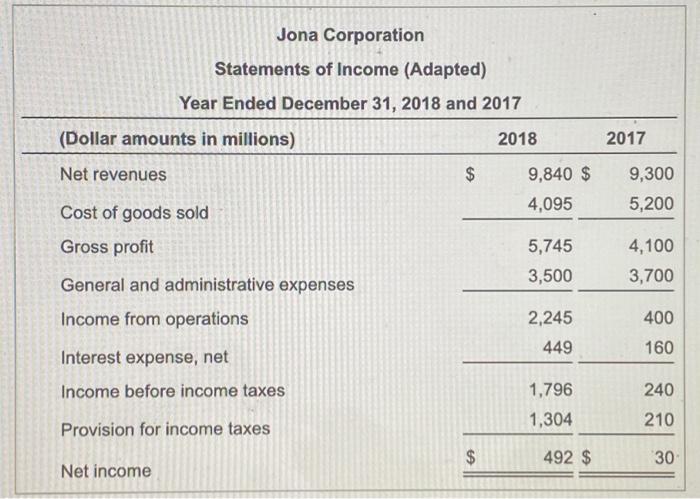

The Colvin 2018 income statement and balance sheet follows. B Click the icon to view the assets section of the balance (Click the icon to view the income statement.) sheet.) (Click the icon to view the liabilities and stockholders' equity sections of the balance sheet.) Read the requirements Cost of goods sold Average accounts payable Accounts payable tumover $ 3,700 1$ 925 4.00 Now, select the formula and then enter the amounts to calculate days payables outstanding (DPO). (Enter any ratlos used to calculate the DPO to two decimal places, X.XX, and use a 365-day year. Round your final answer to one decimal place, XX.) Days in year Accounts payable tumover Days' payables outstanding (DPO) 4.00 91.3 d. Use the Colvin 2018 income statement and the balance sheet to compute the length of cash conversion cycle in days for 2018. (Enter any ratios used to calculate the cash conversion cycle and your final answer to one decimal place, X.X Use parentheses or a minus sign for a negative cash conversion cycle.) DIO DSO DPO Cash conversion cycle 14.6 91.3 (68.4) Do these measures look strong or weak? Give the reason for your answer. Inventory turnover and days' sales outstanding (DSO) look strong since they are both fast". However, days' payables outstanding (DPO) is quite slow even though the company is collecting cash long before it pays its creditors. Companies that continue to do this could face potential future credit problems 365 8.3 This question is complete. Move your cursor over or tap on the red arrows to see incorrect answers. 8.3 The Colvin 2018 income statement and balance sheet follows. (Click the icon to view the assets section of the balance (Click the icon to view the income statement.) sheet.) (Click the icon to view the liabilities and stockholders equity sections of the balance sheet.) Read the requirements Days in year AR tumover Days' sales outstanding (DSO) 365 44.00 c. Use the income statement and the balance sheet to calculate the accounts payable turnover and days' payables outstanding for 2018. For this purpose, assume that the impact of inventories on cost of goods sold is immaterial, allowing you to use cost of goods sold rather than purchases in your computations. (Enter currency amounts in millions as given in the question. Round your final answer to two decimal places, X.XX.) Cost of goods sold Average accounts payable" = Accounts payable turnover 3,700 925 4.00 Now, select the formula and then enter the amounts to calculate days payables outstanding (DPO). (Enter any ratios used to calculate the DPO to two decimal places, XXX, and use a 365-day year. Round your final answer to one decimal place, X.X.) Days in year Accounts payable tumover = Days' payables outstanding (DPO) 365 4,00 91.3 d. Use the Colvin 2018 Incomo statement and the balance sheet to compute the length of cash conversion cycle in days for 2018. (Enter any ratlos used to calculate the cash conversion cycle and your final answer to one decimal place, XX. Use parentheses or a minus sign for a negative cash conversion cycle.) DIO DSO DPO Cash conversion cycle 2 (Click the icon to view the income statement.) The Colvin 2018 income statement and balance sheet follows (Click the icon to view the assets section of the balance sheet.) Click the icon to view the liabilities and stockholders' equity sections of the balance sheet.) Read the requirements / $ 148 a. Use the income statement and the balance sheet to calculate Colvin's rate of inventory turnover and days' inventory outstanding for 2018 Begin by selecting the formula and then enter the amounts to calculate inventory turnover. (Enter currency amounts in millions as given in the question. Round the inventory turnover to two decimal places, X.XX.) Cost of goods sold Average inventory = Inventory turnover $ 3,700 25.00 Now, select the formula and then enter the amounts to calculate days inventory outstanding (DIO). (Enter any ratios used to calculate the Dio to two decimal places, X.XX, and use a 365-day year. Round the DIO to one decimal place, X.X days.) Days in year Inventory turnover Days' inventory outstanding (D10) 365 25.00 14,6 b. Use the income statement and the balance sheet to calculate the days' sales in average receivables (days' sales outstanding) during 2018 (round dollar amounts to one decimal place). Assume all sales are made on account Select the formula and then enter the amounts to calculate days' sales in outstanding (DSO). (Abbreviation used: AR = Accounts receivable. Enter any ratios used to calculate DSO to two decimal places, XXX, and use a 365-day year, Round the DSO to one decimal place, XX days.) Days in year AR turnover Days' sales outstanding (DSO) This question is complete. Move your cursor over or tap on the red arrows to see incorrect answers. Jona Corportion Balance Sheets (Adapted) December 31, 2018 and 2017 (Dollar amounts in millions) Increase (Decrease) Amount Percentage 2018 2017 Assets 1,250 $ 960 $ 290 30.2 % 12 50 (38) (120) 180 300 Current assets: Cash and cash equivalents Short-term investments Receivables, net Inventories Prepaid expenses and other assets Total current assets Property, plant, and equipment, net Intangible assets (76.0) (40.0) 115.0 86 46 40 354 240 (114) (32.2) 1,768 1,704 64 3.8 3,360 2,710 80.7 6,070 1,060 850 838 222 26.5 Other assets 750 100 13.3 Total assets $ 9,748 $ 6,652 $ 3,096 46.5% Increase (Decrease) Amount Percentage 2018 2017 (Dollar amounts in millions) Liabilities and Stockholders' Equity Current liabilities: Accounts payable Income tax payable Short-term debt 920 $ 900 $ 20 2.2 % 44 64 (20) (31.3) 66.7 150 90 60 Other 55 60 (5) (8.3) 1,169 1,114 55 4.9 Total current liabilities Long-term debt 97.4 6,111 1,150 3,096 1,050 3,015 100 Other liabilities 9.5 8,430 5,260 3,170 60.3 2 2 Total liabilities Stockholders' equity: Common stock Retained earnings Accumulated other comprehensive (loss) Total stockholders' equity Total liabilities and stockholders' equity (5.2) 1,526 (210) 1,610 (220) (84) 10 4.5 1,318 1,392 (74) (5.3) 9.748 $ 6,652 $ 3,096 46.5% Jona Corporation Statements of Income (Adapted) Year Ended December 31, 2018 and 2017 (Dollar amounts in millions) 2018 2017 Net revenues $ 9,840 $ 4,095 9,300 5,200 Cost of goods sold Gross profit 5,745 3,500 4,100 3,700 General and administrative expenses Income from operations 400 2,245 449 160 Interest expense, net Income before income taxes 1,796 240 1,304 210 Provision for income taxes $ 492 $ 30 Net income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts