Question: Increase, Decrease, or No Effect on Cash (use the dropdown menu to select an answer) Item 1. Cash sales. 2. Receiving a taxes-due notice from

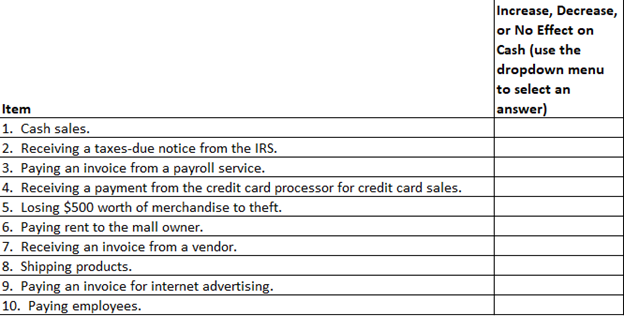

Increase, Decrease, or No Effect on Cash (use the dropdown menu to select an answer) Item 1. Cash sales. 2. Receiving a taxes-due notice from the IRS. 3. Paying an invoice from a payroll service. 4. Receiving a payment from the credit card processor for credit card sales. 5. Losing $500 worth of merchandise to theft. 6. Paying rent to the mall owner. 7. Receiving an invoice from a vendor. 8. Shipping products. 9. Paying an invoice for internet advertising. 10. Paying employees

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts