Question: Incredibles is considering buying a new computer system and network at a cost of R150 000 and the system is expected to have four years

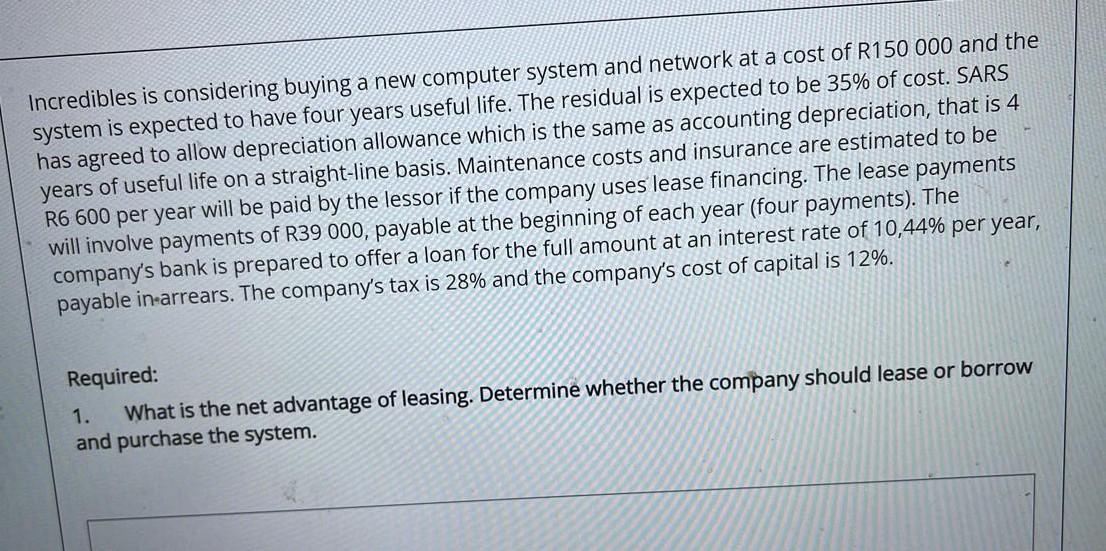

Incredibles is considering buying a new computer system and network at a cost of R150 000 and the system is expected to have four years useful life. The residual is expected to be 35% of cost. SARS has agreed to allow depreciation allowance which is the same as accounting depreciation, that is 4 years of useful life on a straight-line basis. Maintenance costs and insurance are estimated to be R6 600 per year will be paid by the lessor if the company uses lease financing. The lease payments will involve payments of R39 000, payable at the beginning of each year (four payments). The company's bank is prepared to offer a loan for the full amount at an interest rate of 10,44% per year, payable in arrears. The company's tax is 28% and the company's cost of capital is 12%. Required: 1. What is the net advantage of leasing. Determine whether the company should lease or borrow and purchase the system

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts