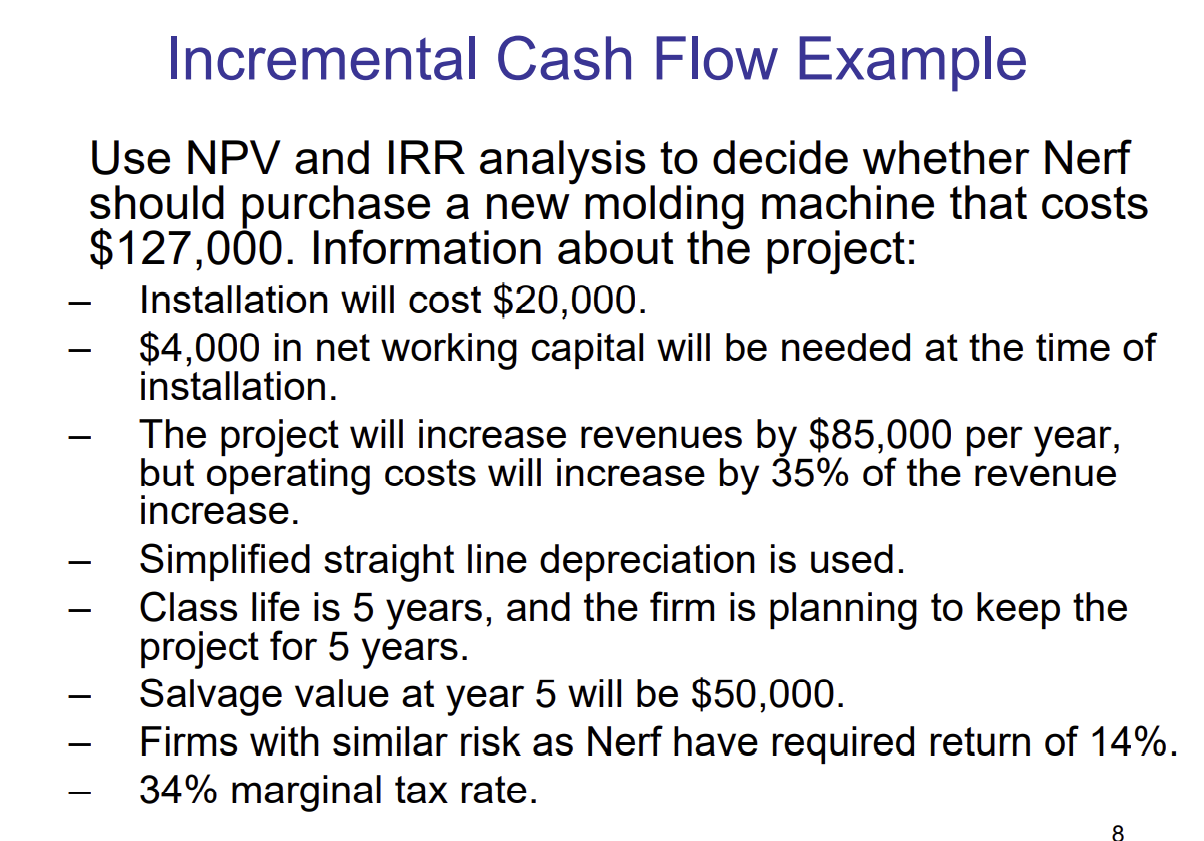

Question: Incremental Cash Flow Example Use NPV and IRR analysis to decide whether Nerf should purchase a new molding machine that costs $127,000. Information about

\

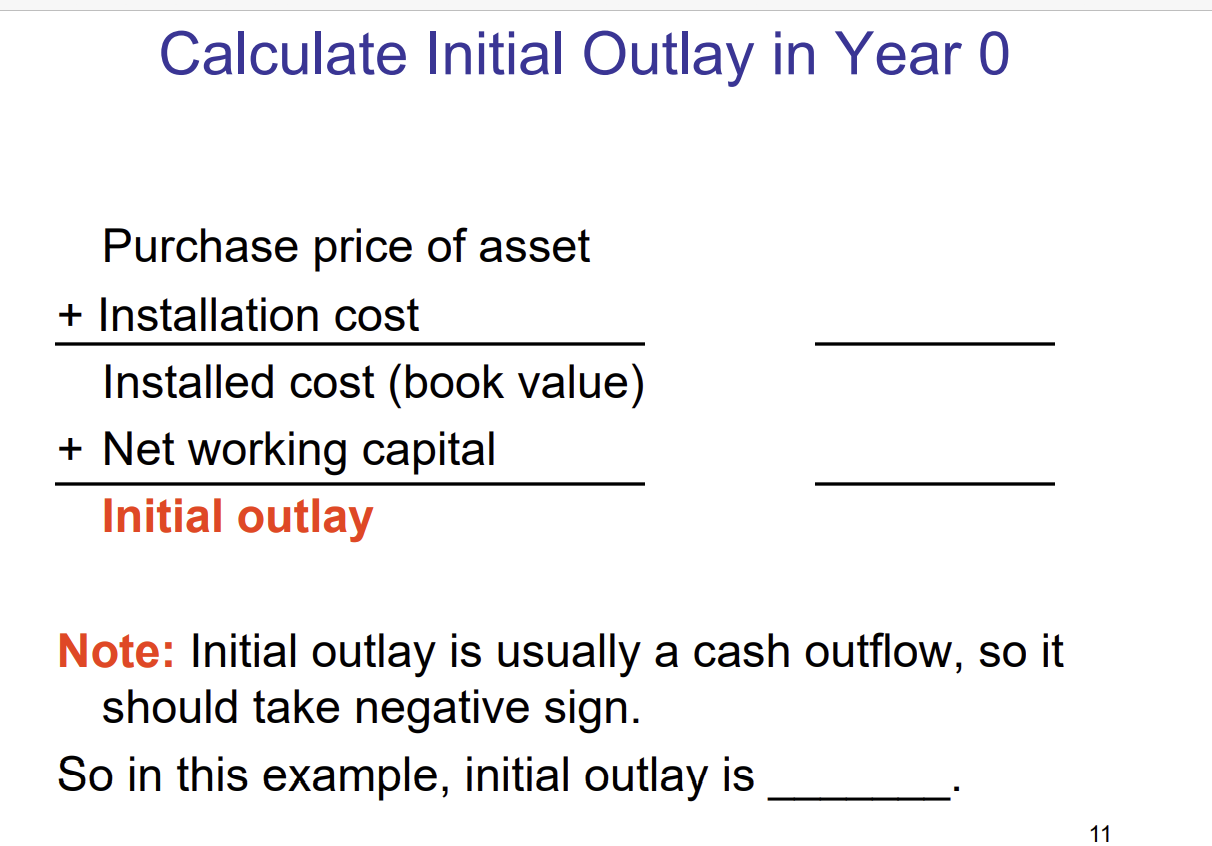

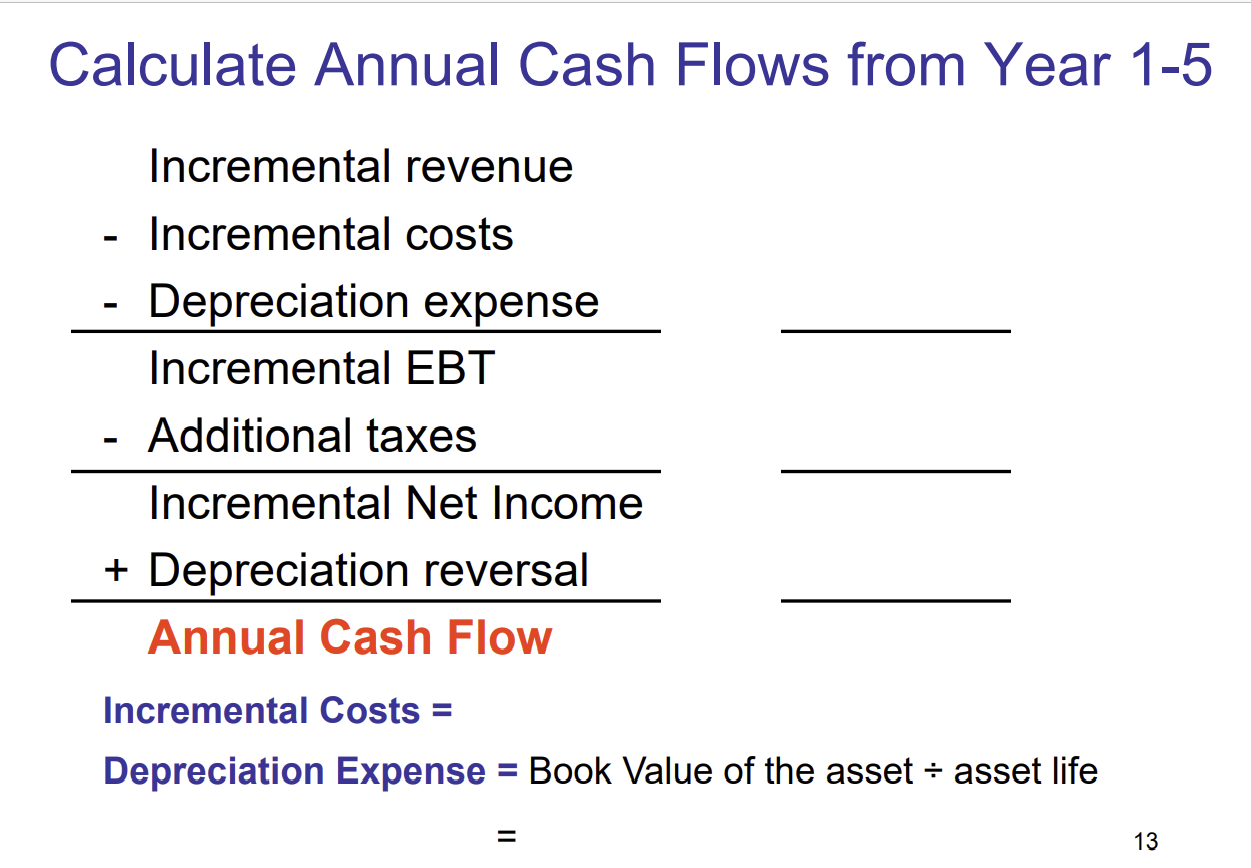

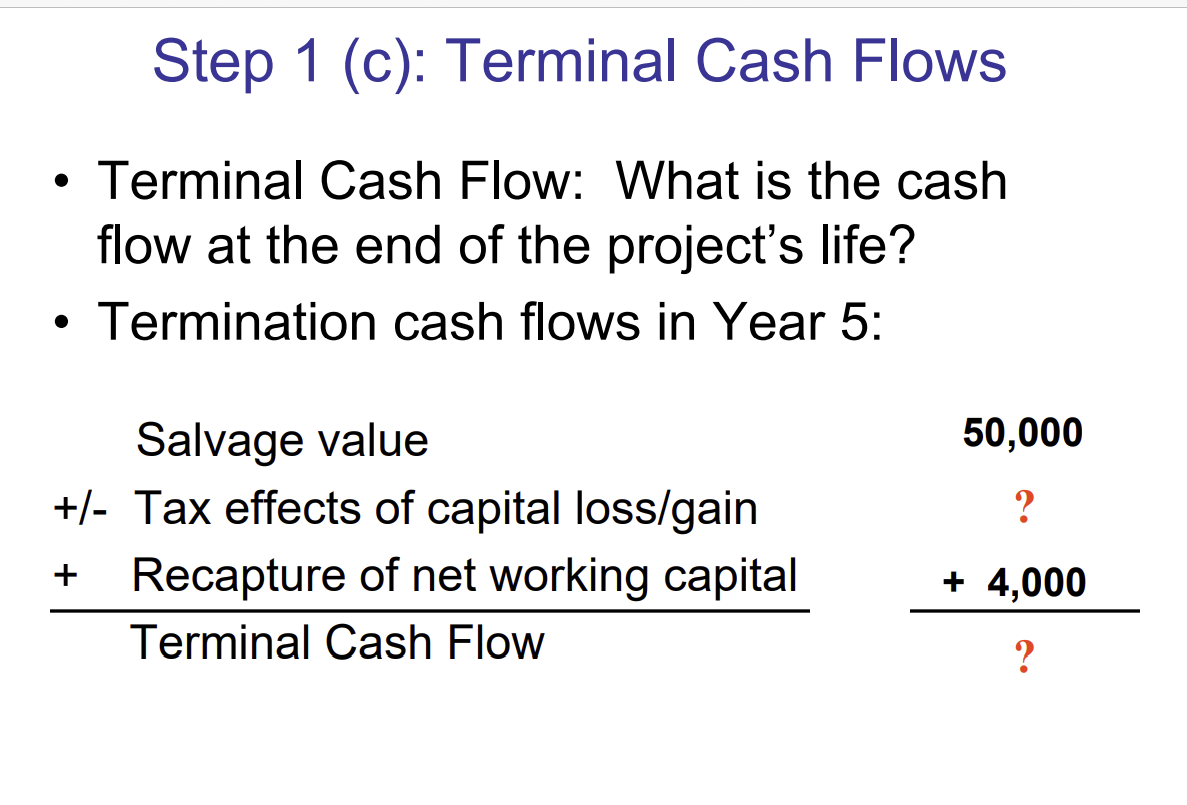

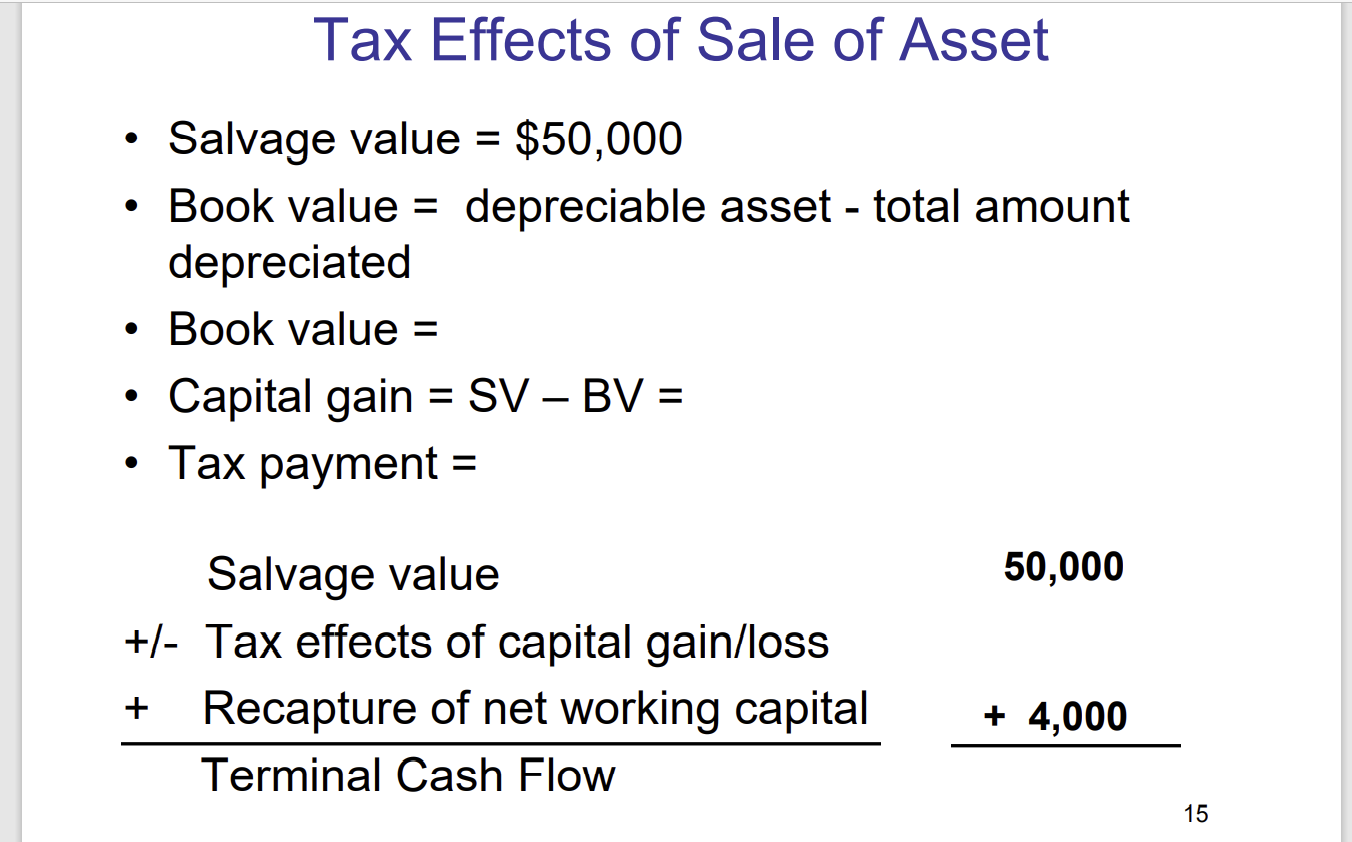

Incremental Cash Flow Example Use NPV and IRR analysis to decide whether Nerf should purchase a new molding machine that costs $127,000. Information about the project: - Installation will cost $20,000. - $4,000 in net working capital will be needed at the time of installation. - The project will increase revenues by $85,000 per year, but operating costs will increase by 35% of the revenue increase. - Simplified straight line depreciation is used. - Class life is 5 years, and the firm is planning to keep the project for 5 years. - Salvage value at year 5 will be $50,000. - Firms with similar risk as Nerf have required return of 14%. - 34% marginal tax rate. Calculate Initial Outlay in Year 0 Note: Initial outlay is usually a cash outflow, so it should take negative sign. So in this example, initial outlay is Coloulsta Annionl Coch Floinie from Voor 1-5 Step 1 (c): Terminal Cash Flows - Terminal Cash Flow: What is the cash flow at the end of the project's life? - Termination cash flows in Year 5: Tax Effects of Sale of Asset - Salvage value =$50,000 - Book value = depreciable asset total amount depreciated - Book value = - Capital gain = SV BV = - Tax payment = Salvage value 50,000 +/- Tax effects of capital gain/loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts