Question: Incremental operating cash inflows A firm is considering renewing its equipment to meet increased demand for its product. The cost of equipment modification is $1.9

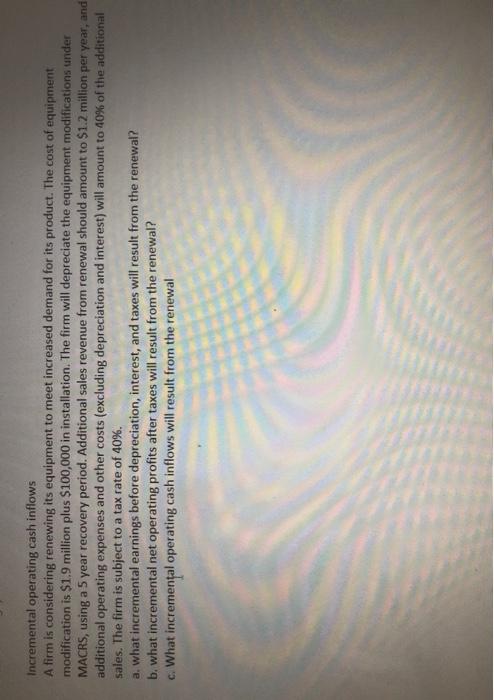

Incremental operating cash inflows A firm is considering renewing its equipment to meet increased demand for its product. The cost of equipment modification is $1.9 million plus $100,000 in installation. The firm will depreciate the equipment modifications under MACRS, using a 5 year recovery period. Additional sales revenue from renewal should amount to $1.2 million per year, and additional operating expenses and other costs (excluding depreciation and interest) will amount to 40% of the additional sales. The firm is subject to a tax rate of 40%. a. what incremental earnings before depreciation, interest, and taxes will result from the renewal? b. what incremental net operating profits after taxes will result from the renewal? c. What incremental operating cash inflows will result from the renewal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts