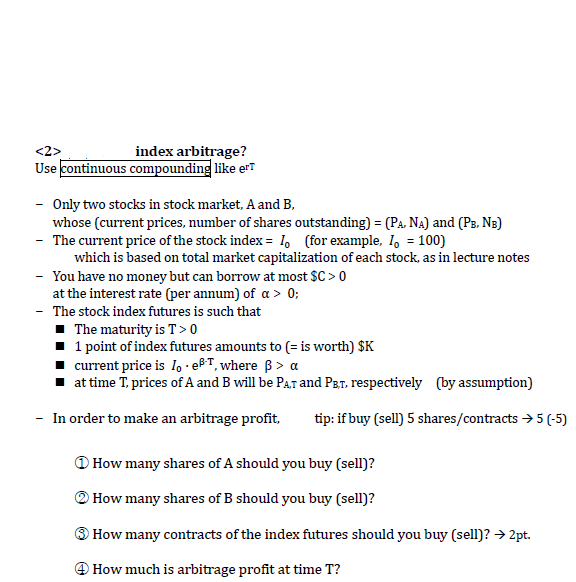

Question: index arbitrage? Use continuous compounding like er Only two stocks in stock market. A and B whose (current prices, number of shares outstanding) = (PA.

index arbitrage? Use continuous compounding like er Only two stocks in stock market. A and B whose (current prices, number of shares outstanding) = (PA. NA) and (Ps. NB) - The current price of the stock index = I0 (for example, Io =100) which is based on total market capitalization of each stock, as in lecture notes - You have no money but can borrow at most $C> 0 at the interest rate (per annum) of a > 0; The stock index futures is such that The maturity is T > 0 1 point of index futures amounts to (= is worth) $K current price is lo eAT.where B > a at time T.prices of A and B will be PAT and PaT. respectively (by assumption) - In order to make an arbitrage profit tip: if buy (sell) 5 shares/contracts >5 (-5) DHow many shares of A should you buy (sell)? many shares of B should you buy (sell)? How How many contracts of the index futures should you buy (sell)? -> 2pt. How much is arbitrage profit at time T? index arbitrage? Use continuous compounding like er Only two stocks in stock market. A and B whose (current prices, number of shares outstanding) = (PA. NA) and (Ps. NB) - The current price of the stock index = I0 (for example, Io =100) which is based on total market capitalization of each stock, as in lecture notes - You have no money but can borrow at most $C> 0 at the interest rate (per annum) of a > 0; The stock index futures is such that The maturity is T > 0 1 point of index futures amounts to (= is worth) $K current price is lo eAT.where B > a at time T.prices of A and B will be PAT and PaT. respectively (by assumption) - In order to make an arbitrage profit tip: if buy (sell) 5 shares/contracts >5 (-5) DHow many shares of A should you buy (sell)? many shares of B should you buy (sell)? How How many contracts of the index futures should you buy (sell)? -> 2pt. How much is arbitrage profit at time T

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts