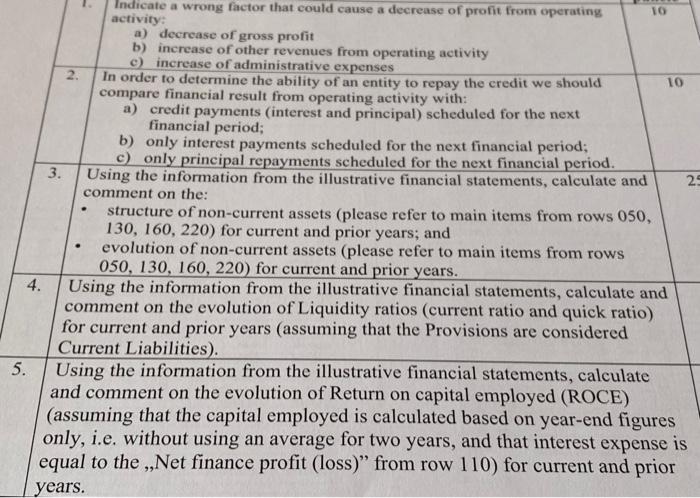

Question: Indicate a wrong factor that could cause a decrease of profit from operating activity: a) decrease of gross profit b) increase of other revenues from

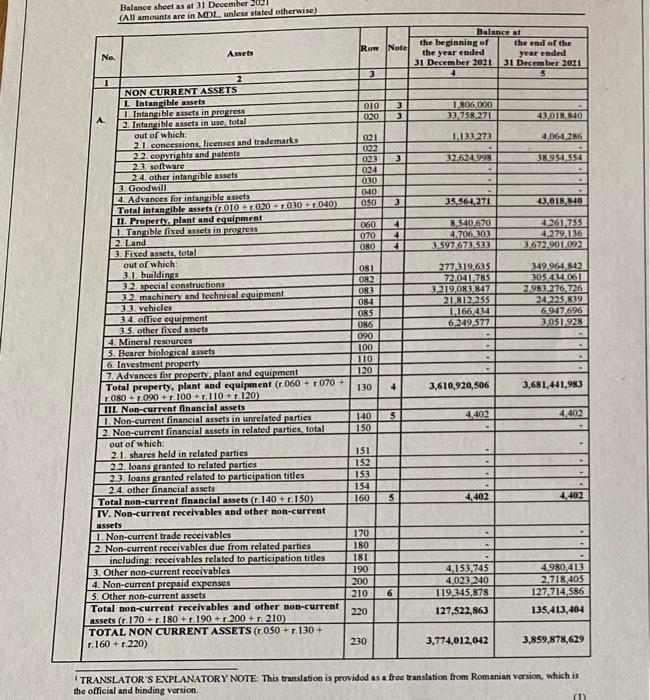

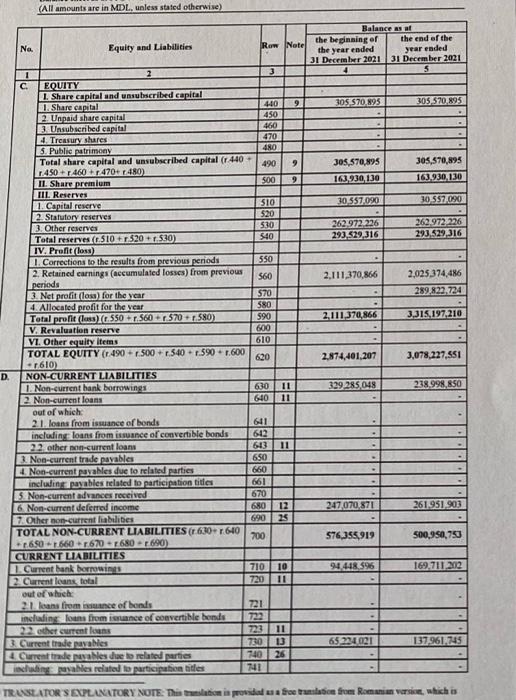

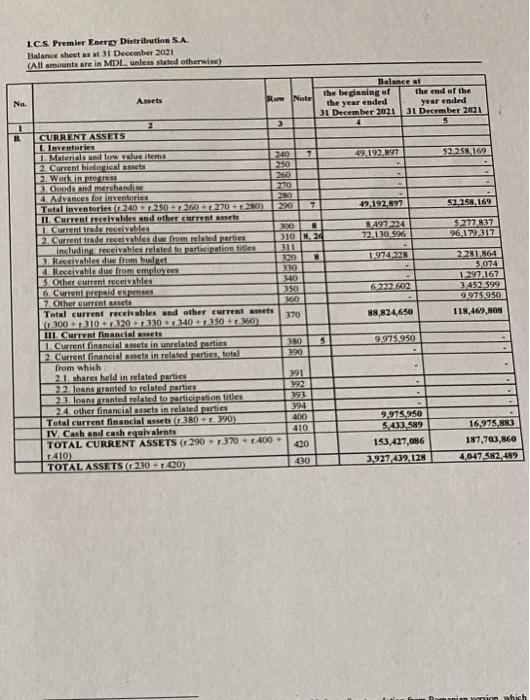

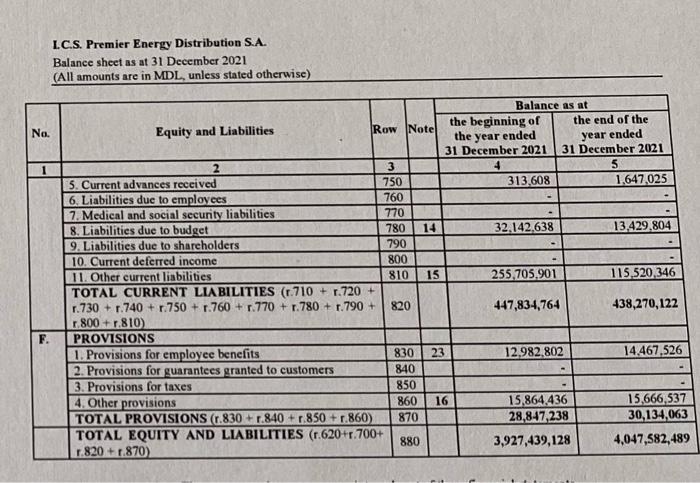

Indicate a wrong factor that could cause a decrease of profit from operating activity: a) decrease of gross profit b) increase of other revenues from operating activity c) increase of administrative expenses 2. In order to determine the ability of an entity to repay the credit we should compare financial result from operating activity with: a) credit payments (interest and principal) scheduled for the next financial period; b) only interest payments scheduled for the next financial period; c) only principal repayments scheduled for the next financial period. 3. Using the information from the illustrative financial statements, calculate and comment on the: - structure of non-current assets (please refer to main items from rows 050 , 130,160,220 ) for current and prior years; and - evolution of non-current assets (please refer to main items from rows 050,130,160,220 ) for current and prior years. 4. Using the information from the illustrative financial statements, calculate and comment on the evolution of Liquidity ratios (current ratio and quick ratio) for current and prior years (assuming that the Provisions are considered Current Liabilities). Using the information from the illustrative financial statements, calculate and comment on the evolution of Return on capital employed (ROCE) (assuming that the capital employed is calculated based on year-end figures only, i.e. without using an average for two years, and that interest expense is equal to the ,Net finance profit (loss)" from row 110 ) for current and prior years. ITR the of (All amounts are in MDL. unless stated otherwise) L.C. Premier Energy Distribution S.A. Balance sheet as at 31 December 2021 (All amounture in MDL- unless stated athervise) I.C.S. Premier Energy Distribution S.A. Balance sheet as at 31 Deeember 2021 (All amounts are in MDL, unless stated otherwise) Indicate a wrong factor that could cause a decrease of profit from operating activity: a) decrease of gross profit b) increase of other revenues from operating activity c) increase of administrative expenses 2. In order to determine the ability of an entity to repay the credit we should compare financial result from operating activity with: a) credit payments (interest and principal) scheduled for the next financial period; b) only interest payments scheduled for the next financial period; c) only principal repayments scheduled for the next financial period. 3. Using the information from the illustrative financial statements, calculate and comment on the: - structure of non-current assets (please refer to main items from rows 050 , 130,160,220 ) for current and prior years; and - evolution of non-current assets (please refer to main items from rows 050,130,160,220 ) for current and prior years. 4. Using the information from the illustrative financial statements, calculate and comment on the evolution of Liquidity ratios (current ratio and quick ratio) for current and prior years (assuming that the Provisions are considered Current Liabilities). Using the information from the illustrative financial statements, calculate and comment on the evolution of Return on capital employed (ROCE) (assuming that the capital employed is calculated based on year-end figures only, i.e. without using an average for two years, and that interest expense is equal to the ,Net finance profit (loss)" from row 110 ) for current and prior years. ITR the of (All amounts are in MDL. unless stated otherwise) L.C. Premier Energy Distribution S.A. Balance sheet as at 31 December 2021 (All amounture in MDL- unless stated athervise) I.C.S. Premier Energy Distribution S.A. Balance sheet as at 31 Deeember 2021 (All amounts are in MDL, unless stated otherwise)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts