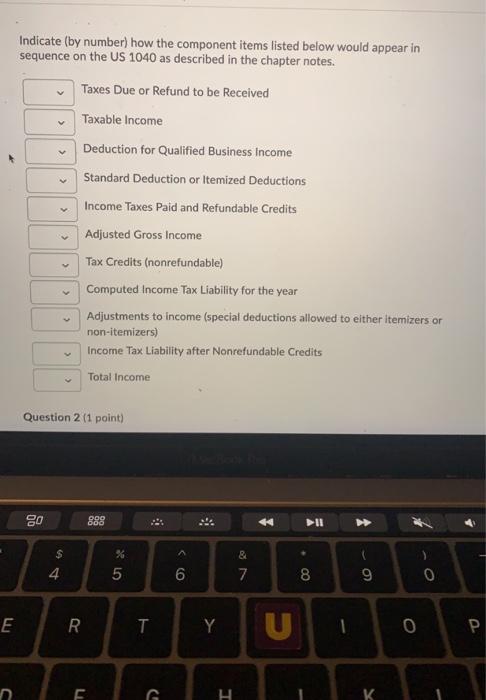

Question: > Indicate (by number) how the component items listed below would appear in sequence on the US 1040 as described in the chapter notes. Taxes

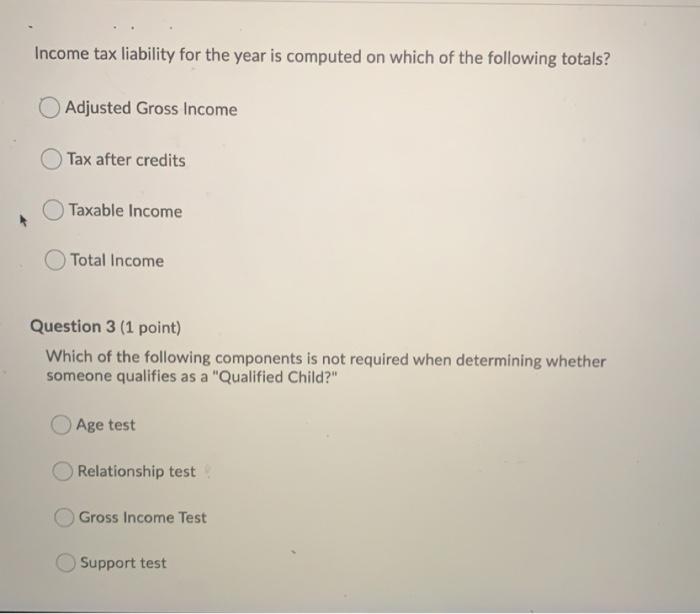

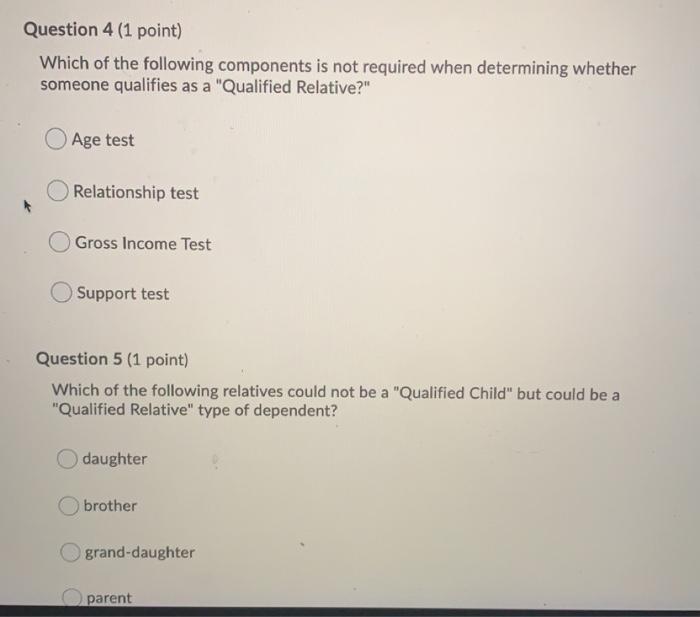

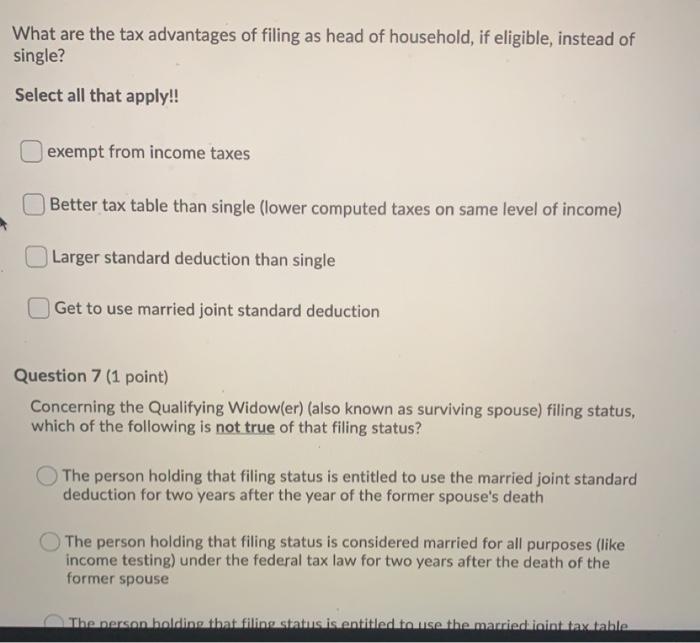

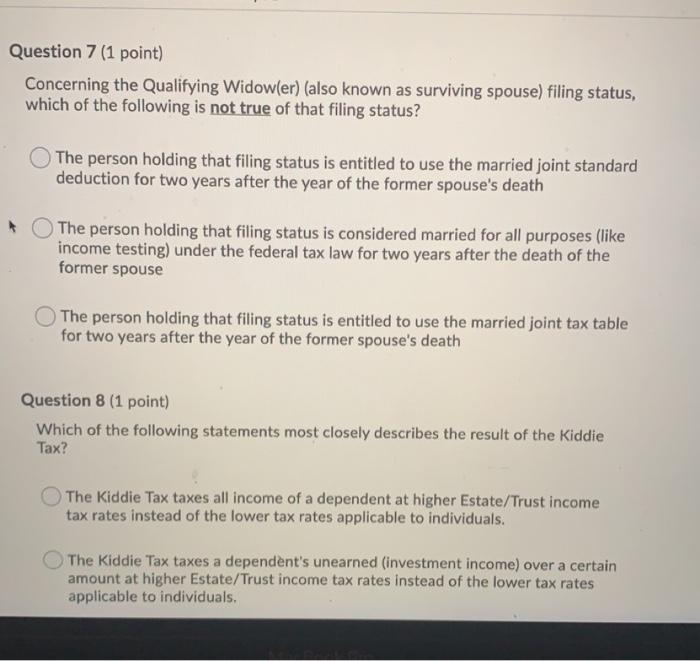

> Indicate (by number) how the component items listed below would appear in sequence on the US 1040 as described in the chapter notes. Taxes Due or Refund to be Received Taxable income Deduction for Qualified Business Income Standard Deduction or Itemized Deductions Income Taxes Paid and Refundable Credits Adjusted Gross Income Tax Credits (nonrefundable) Computed Income Tax Liability for the year Adjustments to income (special deductions allowed to either itemizers or non-itemizers) Income Tax Liability after Nonrefundable Credits Total Income > > Question 2 (1 point) 80 888 > $ 4 % 5 & 7 ) 0 6 8 9 R. T Y U 0 P. D. E G H K Income tax liability for the year is computed on which of the following totals? Adjusted Gross Income Tax after credits Taxable income Total Income Question 3 (1 point) Which of the following components is not required when determining whether someone qualifies as a "Qualified Child?" Age test Relationship test Gross Income Test Support test Question 4 (1 point) Which of the following components is not required when determining whether someone qualifies as a "Qualified Relative?" Age test Relationship test Gross Income Test Support test Question 5 (1 point) Which of the following relatives could not be a "Qualified Child" but could be a "Qualified Relative" type of dependent? daughter brother grand-daughter parent What are the tax advantages of filing as head of household, if eligible, instead of single? Select all that apply!! exempt from income taxes Better tax table than single (lower computed taxes on same level of income) Larger standard deduction than single Get to use married joint standard deduction Question 7 (1 point) Concerning the Qualifying Widow(er) (also known as surviving spouse) filing status, which of the following is not true of that filing status? The person holding that filing status is entitled to use the married joint standard deduction for two years after the year of the former spouse's death The person holding that filing status is considered married for all purposes (like income testing) under the federal tax law for two years after the death of the former spouse The person holding that filling status is entitled to use the married inintataxatable Question 7 (1 point) Concerning the Qualifying Widow(er) (also known as surviving spouse) filing status, which of the following is not true of that filing status? The person holding that filing status is entitled to use the married joint standard deduction for two years after the year of the former spouse's death The person holding that filing status is considered married for all purposes (like income testing) under the federal tax law for two years after the death of the former spouse The person holding that filing status is entitled to use the married joint tax table for two years after the year of the former spouse's death Question 8 (1 point) Which of the following statements most closely describes the result of the Kiddie Tax? The Kiddie Tax taxes all income of a dependent at higher Estate/Trust income tax rates instead of the lower tax rates applicable to individuals. The Kiddie Tax taxes a dependent's unearned (investment income) over a certain amount at higher Estate/Trust income tax rates instead of the lower tax rates applicable to individuals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts