Question: Indicate how the year-end adjustments below affect the operating, investing, and financing activities on the statement of cash flows for a company with a December

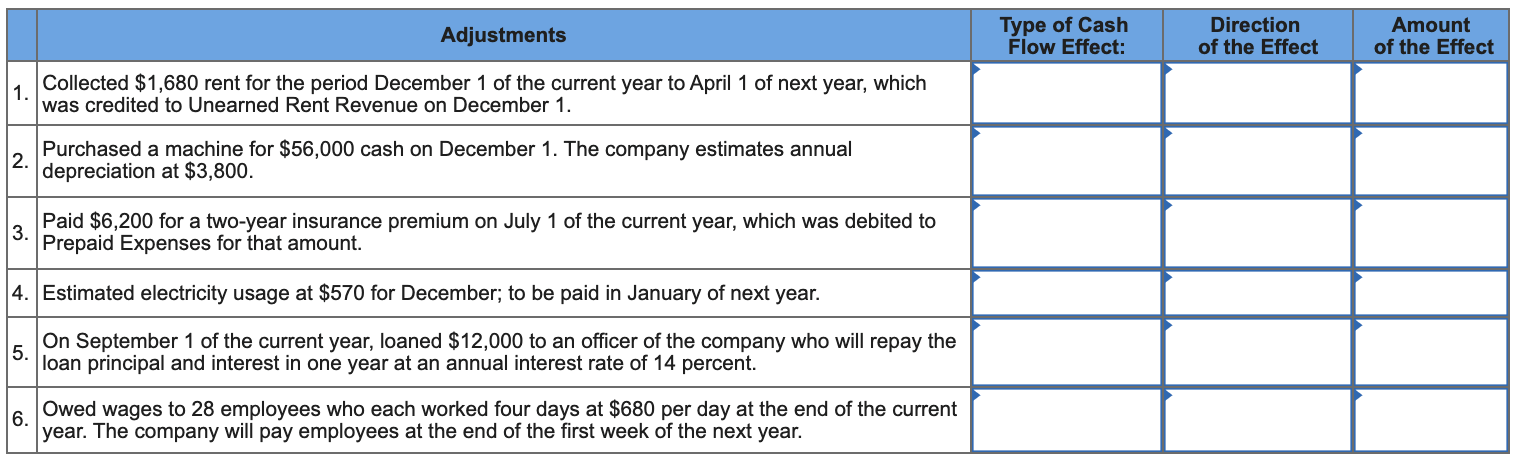

Indicate how the year-end adjustments below affect the operating, investing, and financing activities on the statement of cash flows for a company with a December 31 year-end. Include + or to indicate the direction of the effect of each along with the amount of the effect on cash. (If the transaction has no effect on operating, investing, and financing activities then select "None". Select "N/A" if there is no effect on the direction. Leave no cells blank. Enter "0" wherever required.)

Adjustments Type of Cash Flow Effect: Direction of the Effect Amount of the Effect 1. Collected $1,680 rent for the period December 1 of the current year to April 1 of next year, which was credited to Unearned Rent Revenue on December 1. 2. Purchased a machine for $56,000 cash on December 1. The company estimates annual depreciation at $3,800. 3. Paid $6,200 for a two-year insurance premium on July 1 of the current year, which was debited to Prepaid Expenses for that amount. 4. Estimated electricity usage at $570 for December; to be paid in January of next year. 5. On September 1 of the current year, loaned $12,000 to an officer of the company who will repay the loan principal and interest in one year at an annual interest rate of 14 percent. Owed wages to 28 employees who each worked four days at $680 per day at the end of the current 6. year. The company will pay employees at the end of the first week of the next year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts