Question: Indicate the answer choice that best completes the statement or answers the question. 42. Young-Eagle files her 2020 Form 1040 on March 1, 2021. The

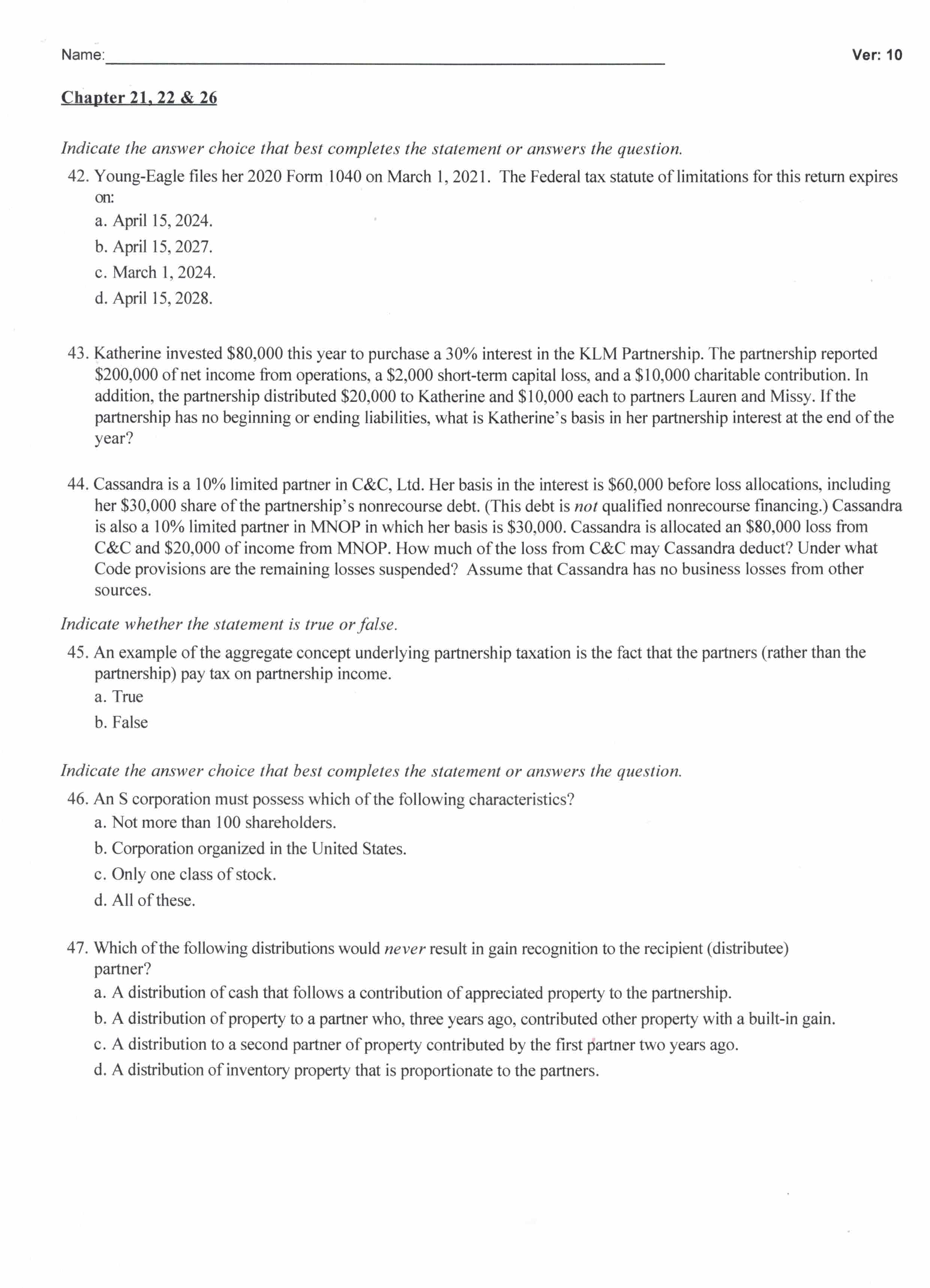

Indicate the answer choice that best completes the statement or answers the question. 42. Young-Eagle files her 2020 Form 1040 on March 1, 2021. The Federal tax statute of limitations for this return expires on: a. April 15, 2024. b. April 15, 2027. c. March 1, 2024. d. April 15, 2028. 43. Katherine invested $80,000 this year to purchase a 30% interest in the KLM Partnership. The partnership reported $200,000 of net income from operations, a $2,000 short-term capital loss, and a $10,000 charitable contribution. In addition, the partnership distributed $20,000 to Katherine and $10,000 each to partners Lauren and Missy. If the partnership has no beginning or ending liabilities, what is Katherine's basis in her partnership interest at the end of the year? 44. Cassandra is a 10% limited partner in C\&C, Ltd. Her basis in the interest is $60,000 before loss allocations, including her $30,000 share of the partnership's nonrecourse debt. (This debt is not qualified nonrecourse financing.) Cassandra is also a 10% limited partner in MNOP in which her basis is $30,000. Cassandra is allocated an $80,000 loss from C&C and $20,000 of income from MNOP. How much of the loss from C&C may Cassandra deduct? Under what Code provisions are the remaining losses suspended? Assume that Cassandra has no business losses from other sources. Indicate whether the statement is true or false. 45. An example of the aggregate concept underlying partnership taxation is the fact that the partners (rather than the partnership) pay tax on partnership income. a. True b. False Indicate the answer choice that best completes the statement or answers the question. 46. An S corporation must possess which of the following characteristics? a. Not more than 100 shareholders. b. Corporation organized in the United States. c. Only one class of stock. d. All of these. 47. Which of the following distributions would never result in gain recognition to the recipient (distributee) partner? a. A distribution of cash that follows a contribution of appreciated property to the partnership. b. A distribution of property to a partner who, three years ago, contributed other property with a built-in gain. c. A distribution to a second partner of property contributed by the first partner two years ago. d. A distribution of inventory property that is proportionate to the partners

Step by Step Solution

There are 3 Steps involved in it

Sure lets go through each question 42 Federal Tax Statute of Limitations The statute of limitations ... View full answer

Get step-by-step solutions from verified subject matter experts