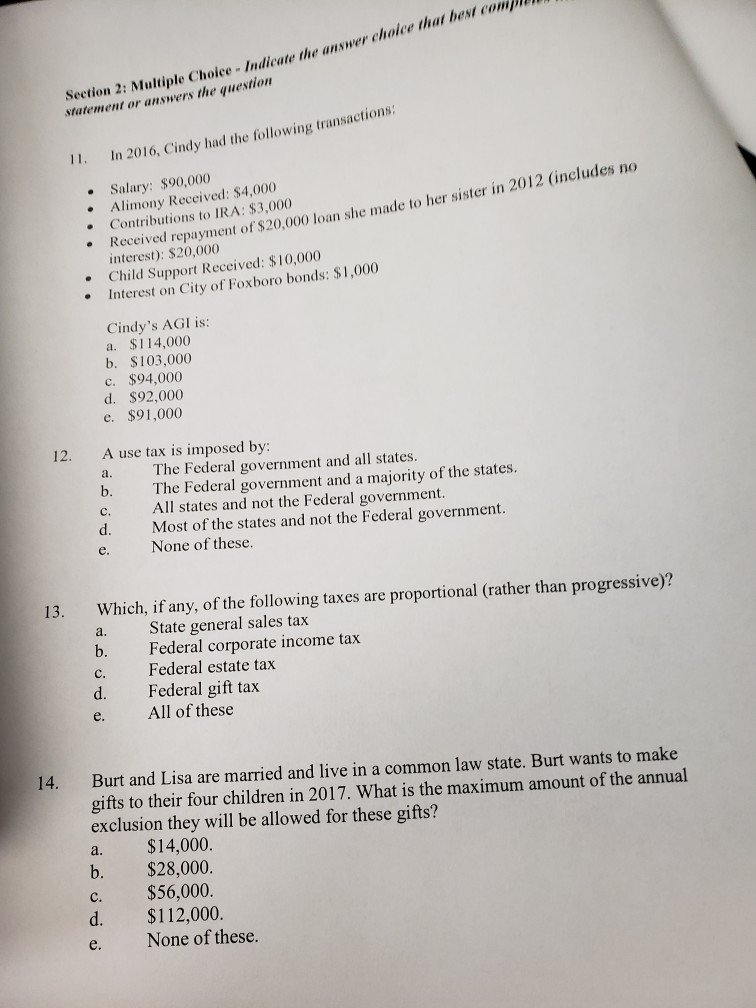

Question: indicate the answer eiple Choice Indicate the answer chakce that best com answers the question ent or 11. In 2016, Cindy had the following transactions:

indicate the answer

eiple Choice Indicate the answer chakce that best com answers the question ent or 11. In 2016, Cindy had the following transactions: Salary: $90,000 Received repayment of $20,000 loan she made to her sister in 2012 (includes no .Child Support Received: $10,000 Alimony Received: $4,000 Contributions to IRA: $3,000 Interest on City of Foxboro bonds: $1,000 Cindy's AGI is: a. $114,000 b. $103,000 c. $94,000 d. $92,000 e. $91,000 A use tax is imposed by: a. The Federal government and all states. b. The Federal government and a majority of the states. c. All states and not the Federal government. d. Most of the states and not the Federal government e. None of these. 12. 13. Which, if any, of the following taxes are proportional (rather than progressive)? a. State general sales tax b. c. Federal corporate income tax Federal estate tax d. Federal gift tax e. All of these 14. Burt and Lisa are married and live in a common law state. Burt wants to make gifts to their four children in 2017. What is the maximum amount of the annual exclusion they will be allowed for these gifts? a. $14,000. b. $28,000. c. $56,000. d. $112,000 e. None of these

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts