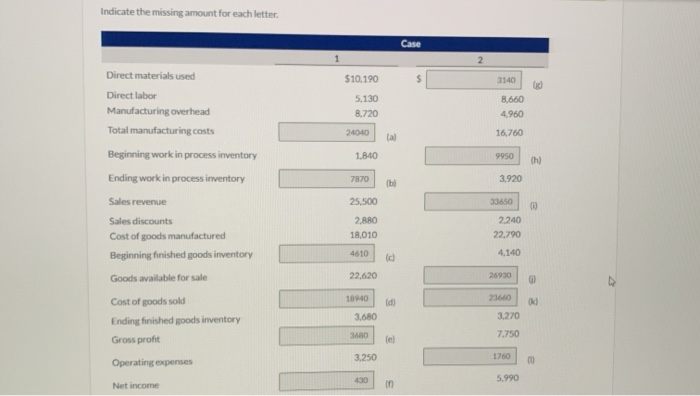

Question: Indicate the missing amount for each letter. Case 1 2 $10.190 $ 3140 5,130 8,720 8.660 4.960 16,760 24040 (a) 1.840 9950 (h) 7870 (b)

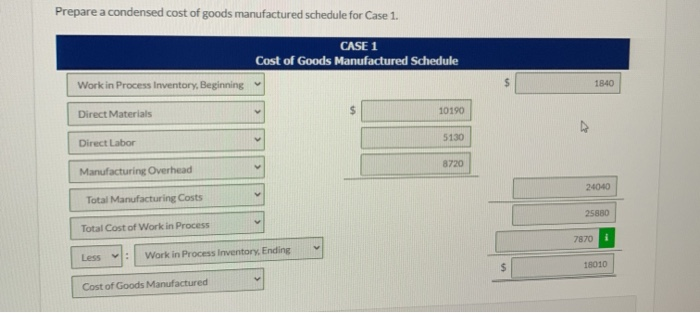

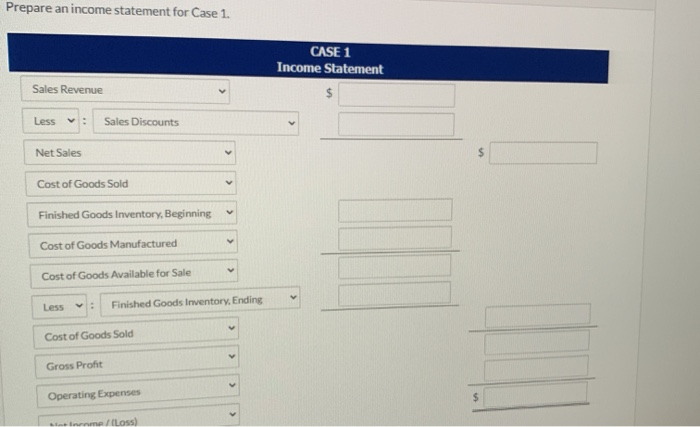

Indicate the missing amount for each letter. Case 1 2 $10.190 $ 3140 5,130 8,720 8.660 4.960 16,760 24040 (a) 1.840 9950 (h) 7870 (b) 3,920 25,500 33650 Direct materials used Direct labor Manufacturing overhead Total manufacturing costs Beginning work in process inventory Ending work in process inventory Sales revenue Sales discounts Cost of goods manufactured Beginning finished goods inventory Goods available for sale Cost of goods sold Ending finished goods inventory Gross profit 2,880 18.010 2.240 22,790 4610 4,140 . 22,620 26930 18940 23660 (d) 3.680 3.270 3680 lel 7.750 3.250 1760 Operating expenses 00 430 5.990 Net income in Prepare a condensed cost of goods manufactured schedule for Case 1. CASE 1 Cost of Goods Manufactured Schedule Work in Process Inventory, Beginning $ 1840 10190 Direct Materials 5130 Direct Labor 8720 Manufacturing Overhead 24040 Total Manufacturing Costs 25880 Total Cost of Work in Process 7870 Less Work in Process Inventory, Ending $ 18010 Cost of Goods Manufactured Prepare an income statement for Case 1. CASE 1 Income Statement Sales Revenue Less : Sales Discounts Net Sales Cost of Goods Sold Finished Goods Inventory, Beginning V Cost of Goods Manufactured Cost of Goods Available for Sale Less Finished Goods Inventory, Ending Cost of Goods Sold Gross Profit Operating Expenses me /(Loss)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts