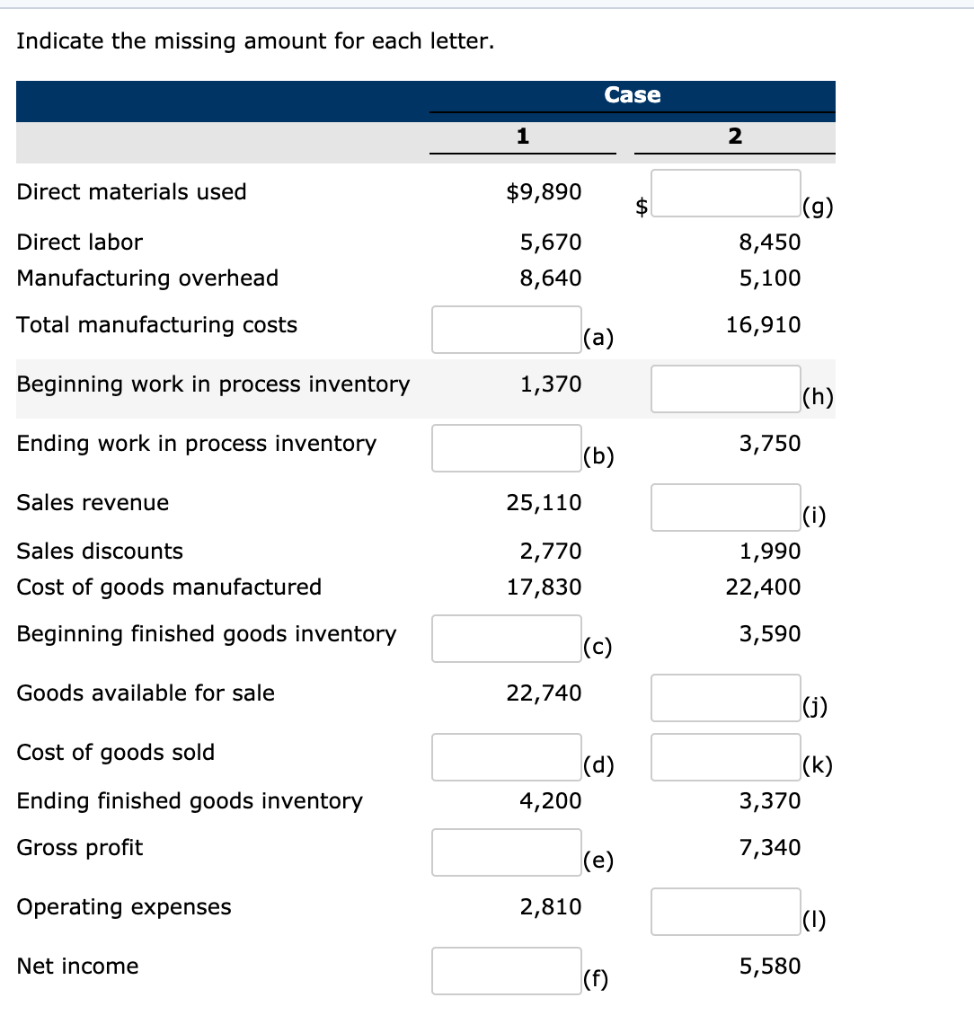

Question: Indicate the missing amount for each letter. Case 2 $9,890 Direct materials used $ (g) Direct labor 5,670 8,450 Manufacturing overhead 8,640 5,100 Total manufacturing

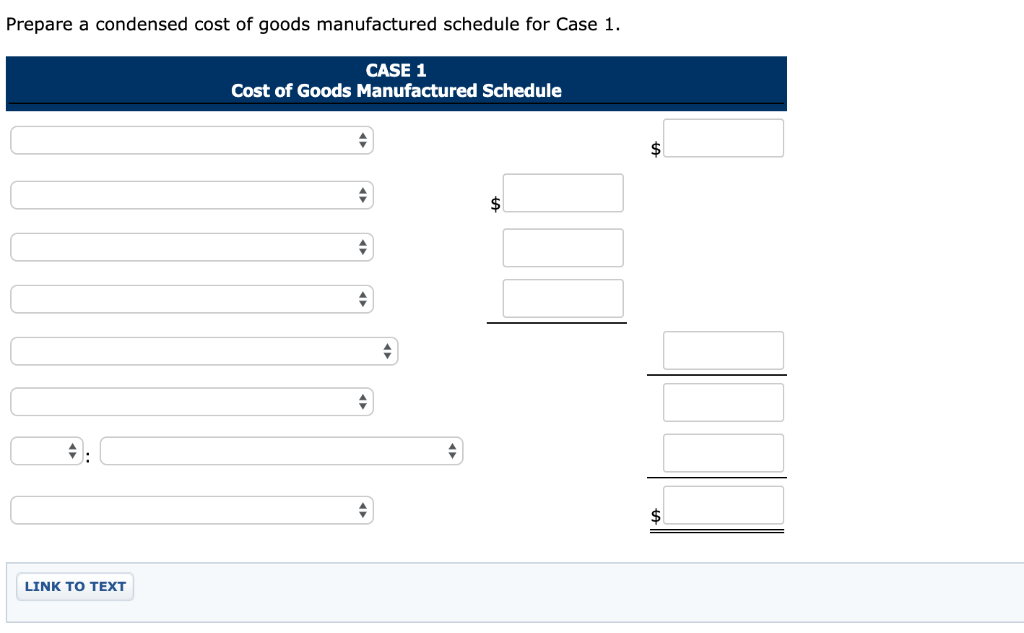

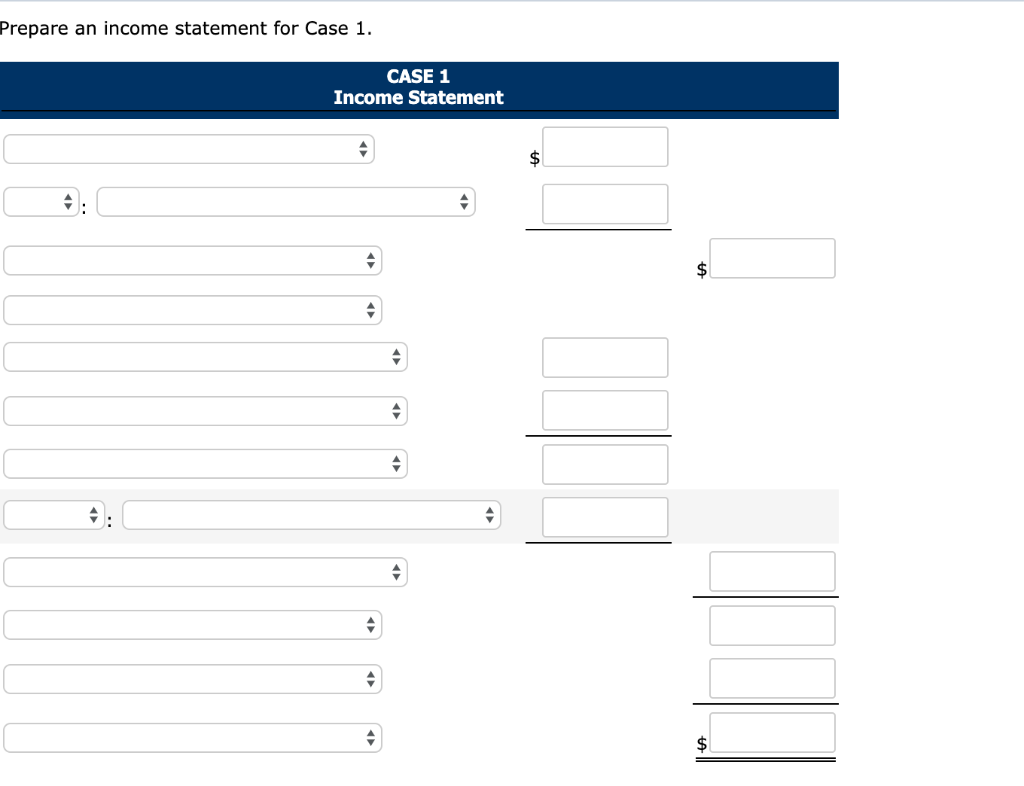

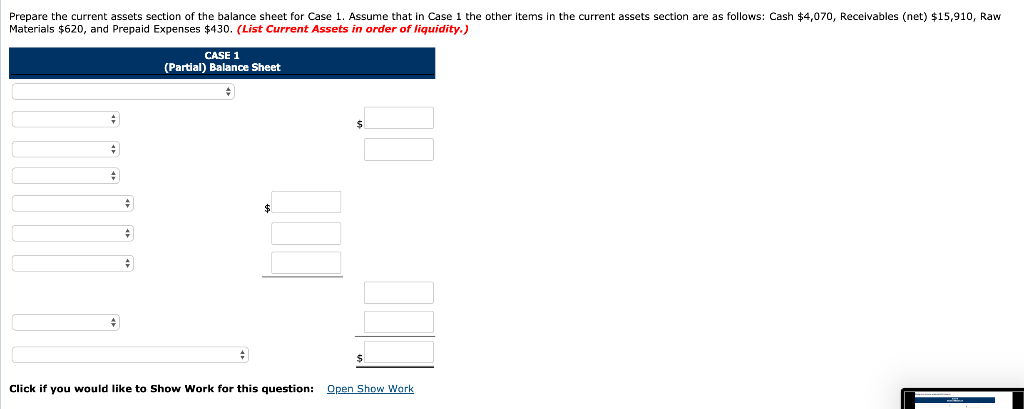

Indicate the missing amount for each letter. Case 2 $9,890 Direct materials used $ (g) Direct labor 5,670 8,450 Manufacturing overhead 8,640 5,100 Total manufacturing costs 16,910 (a) Beginning work in process inventory 1,370 |(h) Ending work in process inventory 3,750 (b) Sales revenue 25,110 |(i) Sales discounts 2,770 1,990 17,830 22,400 Cost of goods manufactured Beginning finished goods inventory 3,590 (c) Goods available for sale 22,740 |(j) Cost of goods sold |(d) |(k) Ending finished goods inventory 4,200 3,370 Gross profit 7,340 |(e) Operating expenses 2,810 (1) Net income 5,580 (f) Prepare a condensed cost of goods manufactured schedule for Case 1 CASE 1 Cost of Goods Manufactured Schedule $ $ LINK TO TEXT Prepare an income statement for Case 1 CASE 1 Income Statement $ $ Prepare the current assets section of the balance sheet for Case 1. Assume that in Case 1 the other items Materials $620, and Prepaid Expenses $430. (List Current Assets in order of liquidity.) the current assets section are as follows: Cash $4,070, Receivables (net) $15,910, Raw (Partia) Blance Sheet Open Show Work Click you would like to Show Work for this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts