Question: Indicate the pension - related amounts that would be reported on the income statement for Pharoah Company for the year 2 0 2 5 .

Indicate the pensionrelated amounts that would be reported on the income statement for Pharoah Company for the year

PHAROAH COMPANY

Income Statement Partial

For the Year Ended December c

The parts of this question must be completed in order. This part will be available when you complete the part above.

c

The parts of this question must be completed in order. This part will be available when you complete the part above. Account Titles and Explanation

Debit

Credit

Pension AssetLiability

Other Comprehensive Income PSC

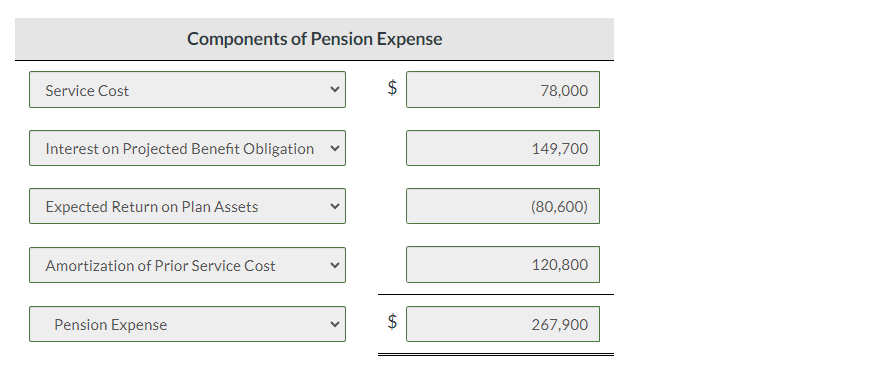

Other Comprehensive Income GL Components of Pension Expense

$

Interest on Projected Benefit Obligation

Expected Return on Plan Assets

Amortization of Prior Service Cost

$Pension Expense, Journal Entries, Statement Presentation Ferreri Company received the following selected information from its pension plan trustee concerning the operation of the companys defined benefit pension plan for the year ended December

January December

Projected benefit obligation $ $

Marketrelated and fair value of plan assets

Accumulated benefit obligation

Accumulated OCI GLNet gain

The service cost component of pension expense for employee services rendered in the current year amounted to $ and the amortization of prior service cost was $ The companys actual funding contributions of the plan in amounted to $ The expected return on plan assets and the actual rate were both ; the interestdiscount settlement rate was Accumulated other comprehensive income PSC had a balance of $ on January Assume no benefits paid in

Instructions

Determine the amounts of the components of pension expense that should be recognized by the company in

Prepare the journal entry to record pension expense and the employers contribution to the pension plan in

Indicate the pensionrelated amounts that would be reported on the income stateme Account Titles and Explanation

Debit

Credit

Pension AssetLiability

Other Comprehensive Income PSC

Other Comprehensive Income GL Indicate the pensionrelated amounts that would be reported on the income statement for Pharoah Company for the year

PHAROAH COMPANY

Income Statement Partial

For the Year Ended December c

The parts of this question must be completed in order. This part will be available when you complete the part above.

c

The parts of this question must be completed in order. This part will be available when you complete the part above.nt and the balance sheet for Ferreri Company for the year

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock