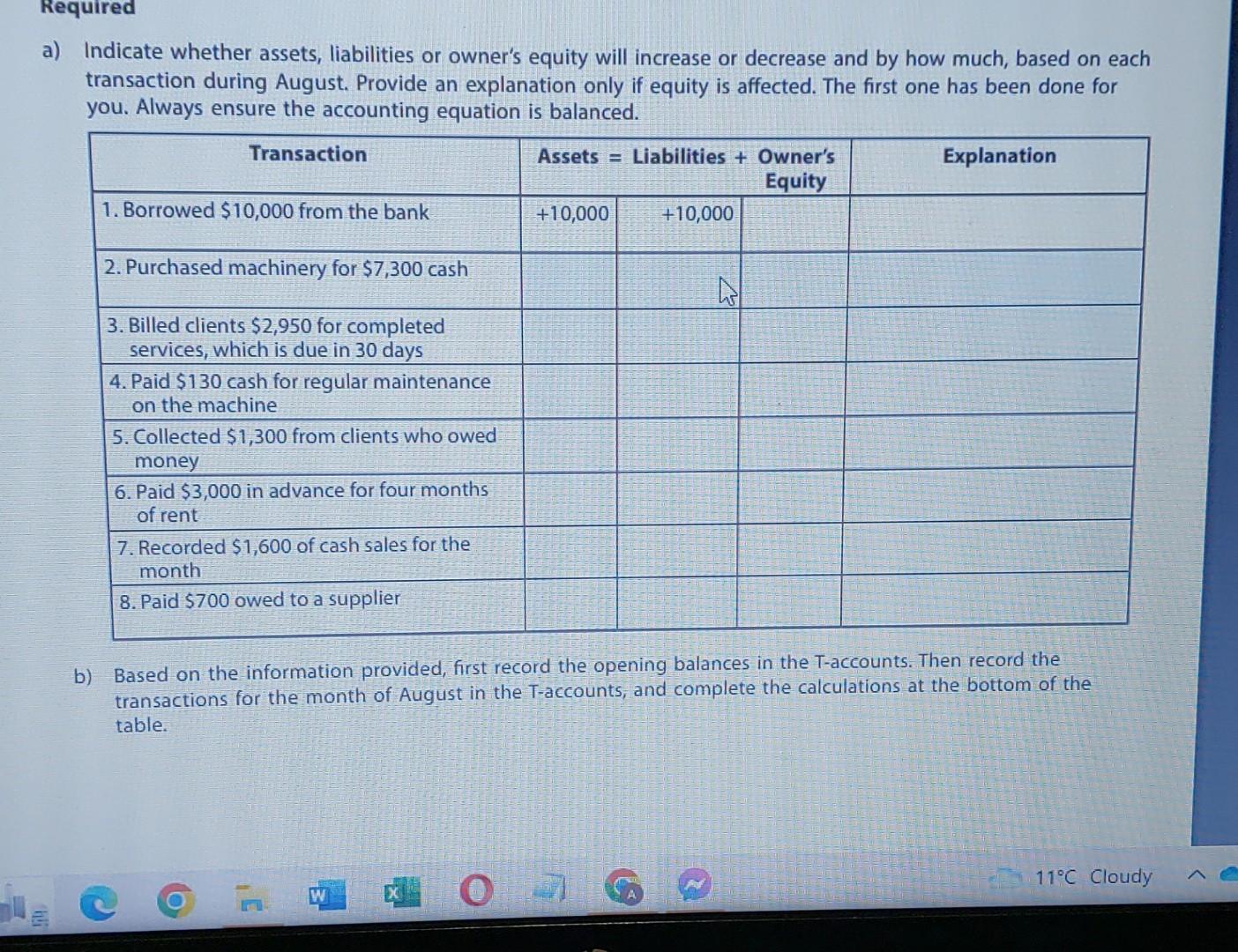

Question: Indicate whether assets, liabilities or owner's equity will increase or decrease and by how much, based on each transaction during August. Provide an explanation only

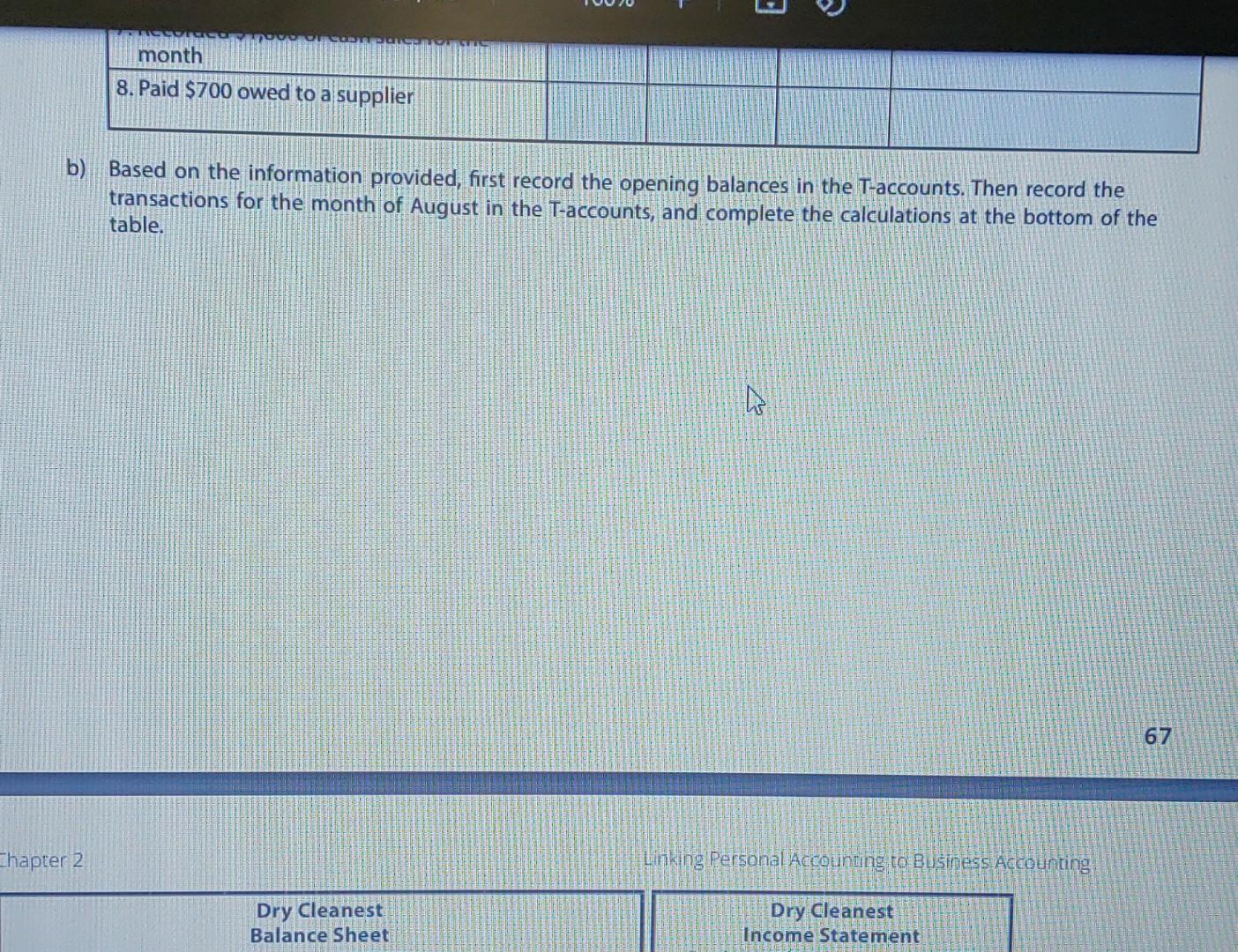

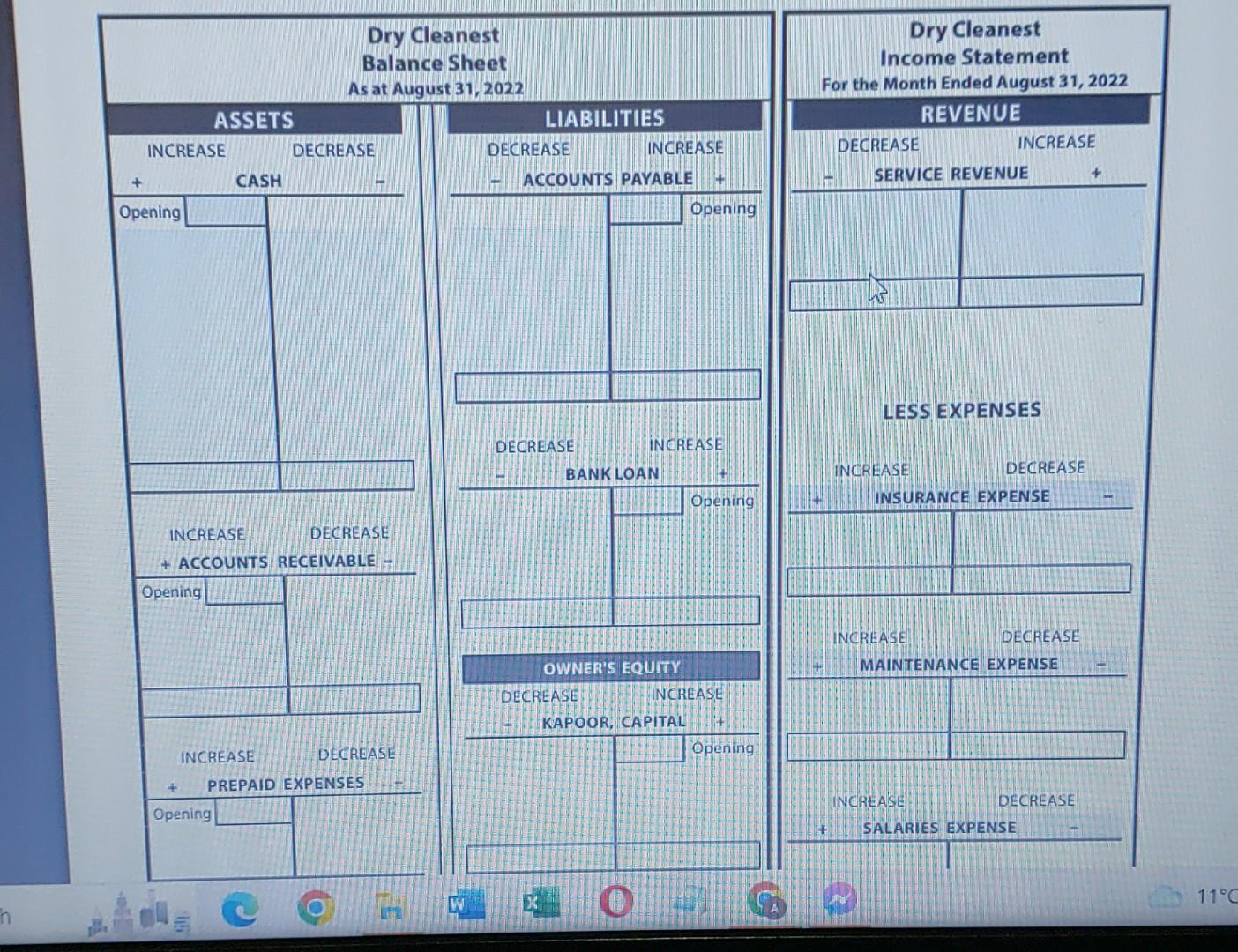

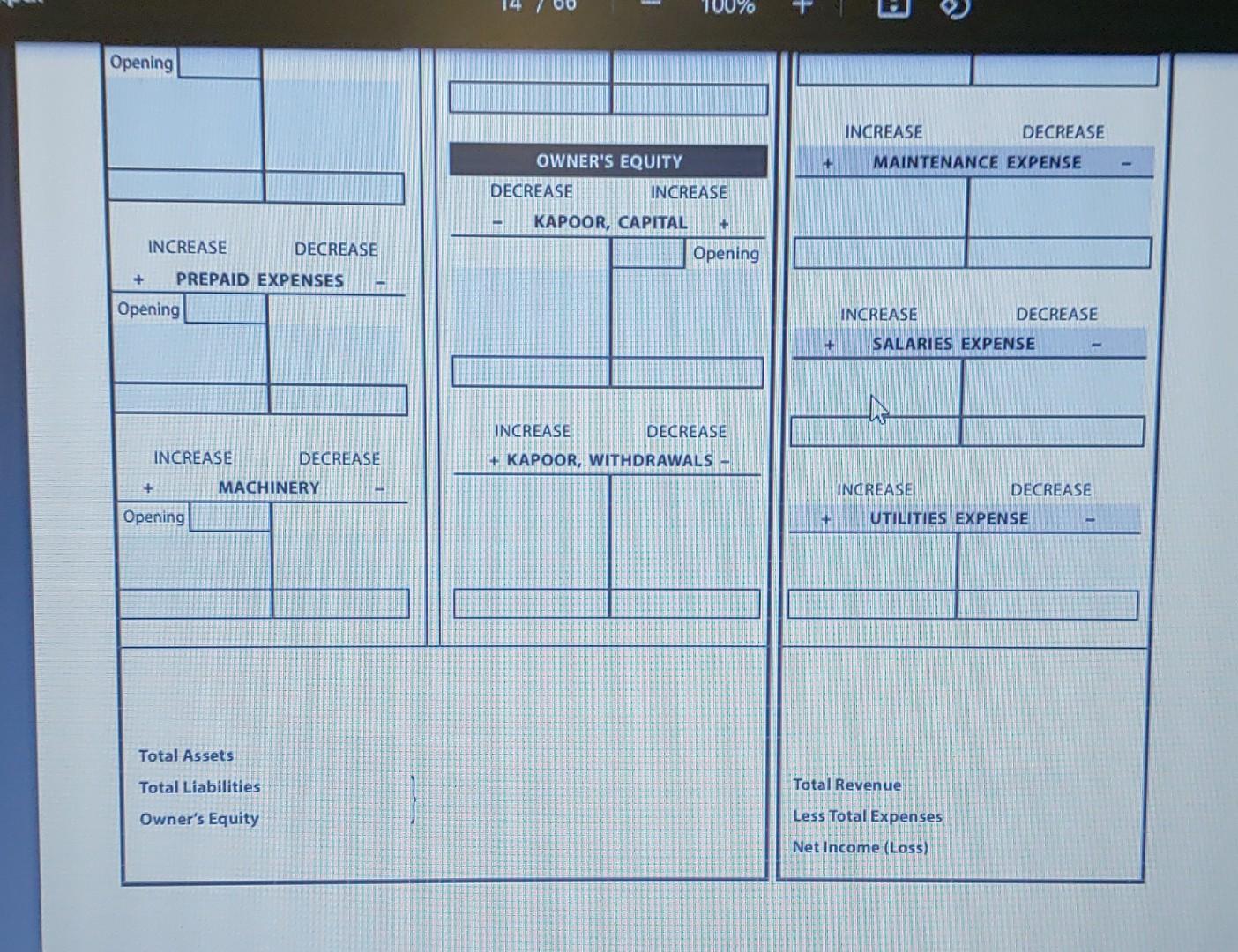

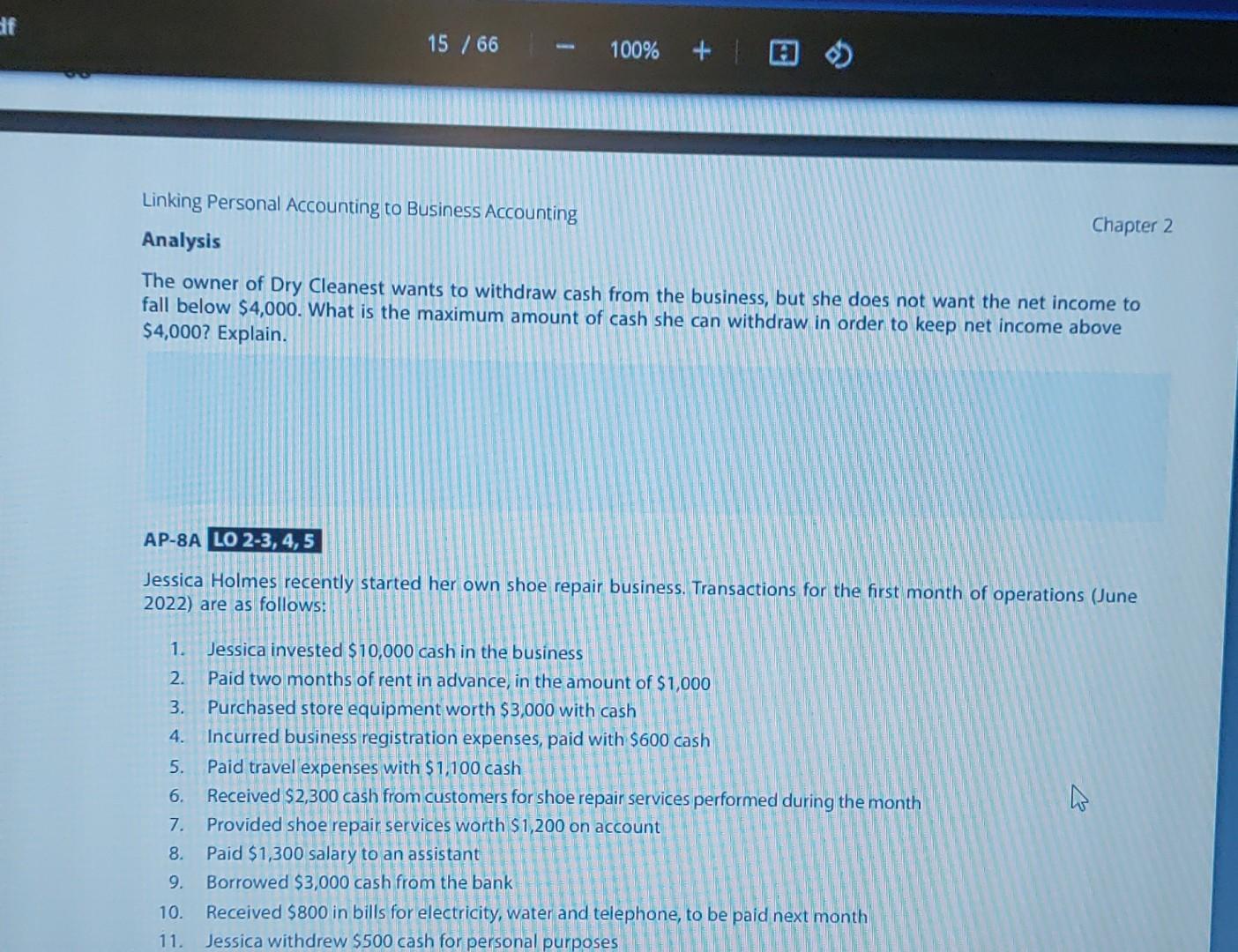

Indicate whether assets, liabilities or owner's equity will increase or decrease and by how much, based on each transaction during August. Provide an explanation only if equity is affected. The first one has been done for you. Always ensure the accounting equation is balanced. b) Based on the information provided, first record the opening balances in the T-accounts. Then record the transactions for the month of August in the T-accounts, and complete the calculations at the bottom of the table. Based on the information provided, first record the opening balances in the T-accounts. Then record the transactions for the month of August in the T-accounts, and complete the calculations at the bottom of the table. Linking Personal Accounting to Business Accounting Analysis Chapter 2 The owner of Dry Cleanest wants to withdraw cash from the business, but she does not want the net income to fall below $4,000. What is the maximum amount of cash she can withdraw in order to keep net income above $4,000 ? Explain. AP-8A LO 2-3, 4,5 Jessica Holmes recently started her own shoe repair business. Transactions for the first month of operations (June 2022) are as follows: 1. Jessica invested $10,000 cash in the business 2. Paid two months of rent in advance, in the amount of $1,000 3. Purchased store equipment worth $3,000 with cash 4. Incurred business registration expenses, paid with $600 cash 5. Paid travel expenses with $1,100 cash 6. Received $2,300 cash from customers for shoe repair services performed during the month 7. Provided shoe repair services worth $1,200 on account 8. Paid $1,300 salary to an assistant 9. Borrowed $3,000 cash from the bank 10. Received $800 in bills for electricity, water and telephone, to be paid next month 11. Jessica withdrew $500 cash for personal purposes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts