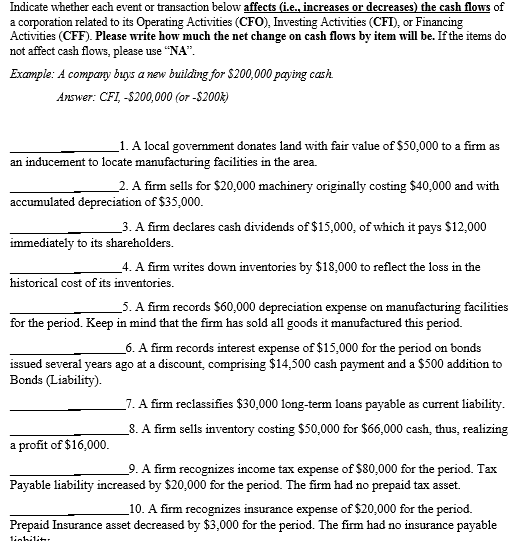

Question: Indicate whether each event or transaction below affects (i.e., increases or decreases) the cash flows of a corporation related to its Operating Activities (CFO), Investing

Indicate whether each event or transaction below affects (i.e., increases or decreases) the cash flows of a corporation related to its Operating Activities (CFO), Investing Activities (CFI), or Financing Activities (CFF). Please write how much the net change on cash flows by item will be. If the items do not affect cash flows, please use "NA Example: A company bugs a new building for S200,000 paying cash. Answer: CFI -$200,000 (or -$200 1. A local government donates land with fair value of S50,000 to a firm as 2. A firm sells for $20,000 machinery originally costing $40,000 and with 3. A firm declares cash dividends of $15,000, of which it pays $12,000 4. A firm writes down inventories by $18,000 to reflect the loss in the 5. A firm records $60,000 depreciation expense on manufacturing facilities an inducement to locate manufacturing facilities in the area. accumulated depreciation of S35,000 immediately to its shareholders. historical cost of its inventories. for the period. Keep in mind that the firm has sold all goods it manufactured this period. 6. A firm records interest expense of $15,000 for the period on bonds issued several years ago at a discount, comprising $14,500 cash payment and a $500 addition to Bonds (Liability). 7. A firm reclassifies $30,000 long-term loans payable as current liability a profit of $16,000 Payable liability increased by $20,000 for the period. The firm had no prepaid tax asset. Prepaid Insurance asset decreased by $3,000 for the period. The firm had no insurance payable 8. A firm sells inventory costing $50,000 for $66,000 cash, thus, realizing 9. A firm recognizes income tax expense of S80,000 for the period. Tax 10. A firm recognizes insurance expense of $20,000 for the period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts