Question: Indicate whether each statement is true or false. Absorption costing and variable costing are both accepted GAAP methods. Many companies link manager bonuses to income

Indicate whether each statement is true or false.

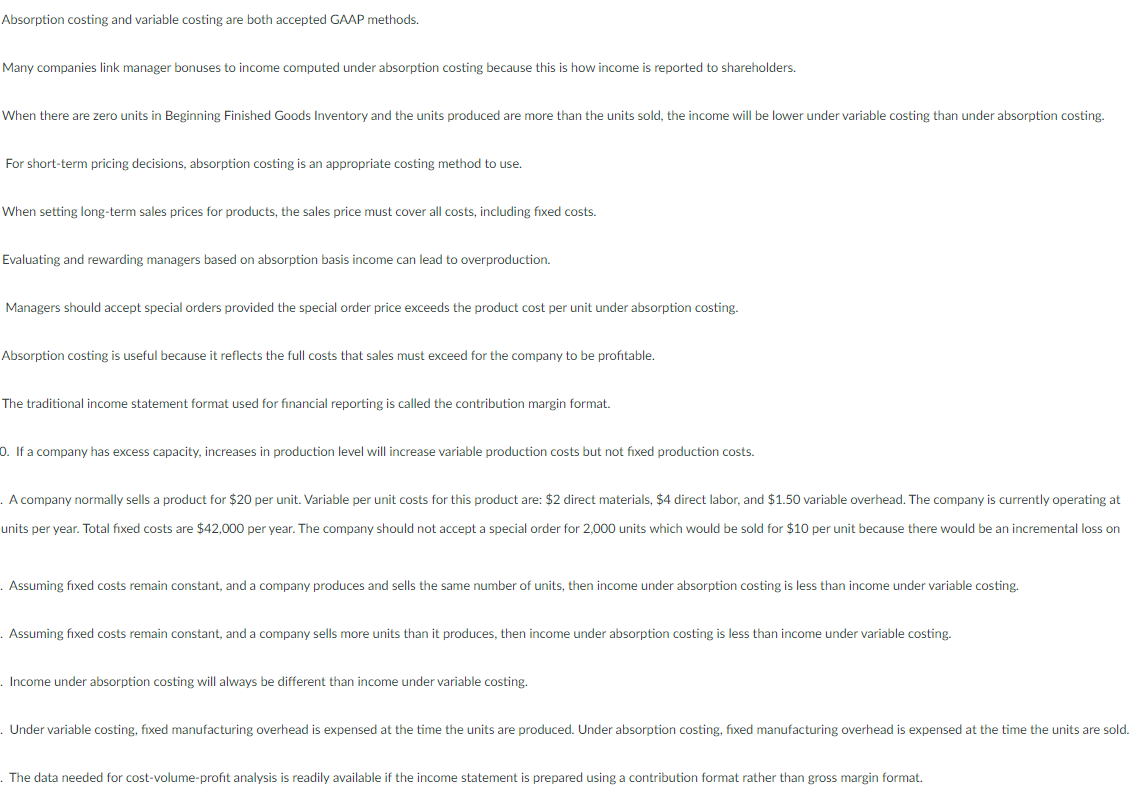

Absorption costing and variable costing are both accepted GAAP methods. Many companies link manager bonuses to income computed under absorption costing because this is how income is reported to shareholders. When there are zero units in Beginning Finished Goods Inventory and the units produced are more than the units sold, the income will be lower under variable costing than under absorption costing. For short-term pricing decisions, absorption costing is an appropriate costing method to use. When setting long-term sales prices for products, the sales price must cover all costs, including fixed costs. Evaluating and rewarding managers based on absorption basis income can lead to overproduction. Managers should accept special orders provided the special order price exceeds the product cost per unit under absorption costing. Absorption costing is useful because it reflects the full costs that sales must exceed for the company to be profitable. The traditional income statement format used for financial reporting is called the contribution margin format. 0. If a company has excess capacity, increases in production level will increase variable production costs but not fixed production costs. A company normally sells a product for $20 per unit. Variable per unit costs for this product are: $2 direct materials, $4 direct labor, and $1.50 variable overhead. The company is currently operating at units per year. Total fixed costs are $42,000 per year. The company should not accept a special order for 2,000 units which would be sold for $10 per unit because there would be an incremental loss on Assuming fixed costs remain constant, and a company produces and sells the same number of units, then income under absorption costing is less than income under variable costing. Assuming fixed costs remain constant, and a company sells more units than it produces, then income under absorption costing is less than income under variable costing. Income under absorption costing will always be different than income under variable costing. Under variable costing, fixed manufacturing overhead is expensed at the time the units are produced. Under absorption costing, fixed manufacturing overhead is expensed at the time the units are sold. The data needed for cost-volume-profit analysis is readily available if the income statement prepared using a contribution format rather than gross margin format

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts