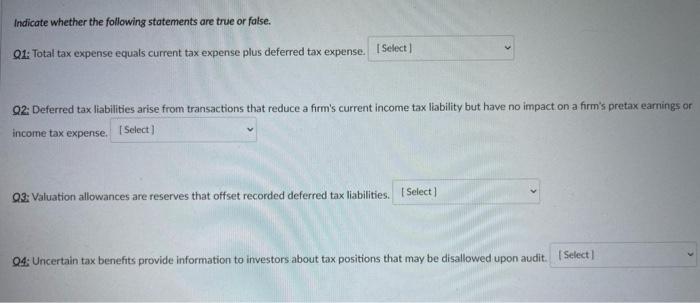

Question: Indicate whether the following statements are true or false. 01: Total tax expense equals current tax expense plus deferred tax expense. Select Q2: Deferred tax

Indicate whether the following statements are true or false. 01: Total tax expense equals current tax expense plus deferred tax expense. Select Q2: Deferred tax liabilities arise from transactions that reduce a firm's current income tax liability but have no impact on a firm's pretax earnings or income tax expense Select Q.2: Valuation allowances are reserves that offset recorded deferred tax liabilities. Select 04: Uncertain tax benefits provide information to investors about tax positions that may be disallowed upon audit. Select

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock