Question: Indicate whether the following statements are true or false. Q1: Although cash bonus plans are generally not used for tax planning, cash bonuses can be

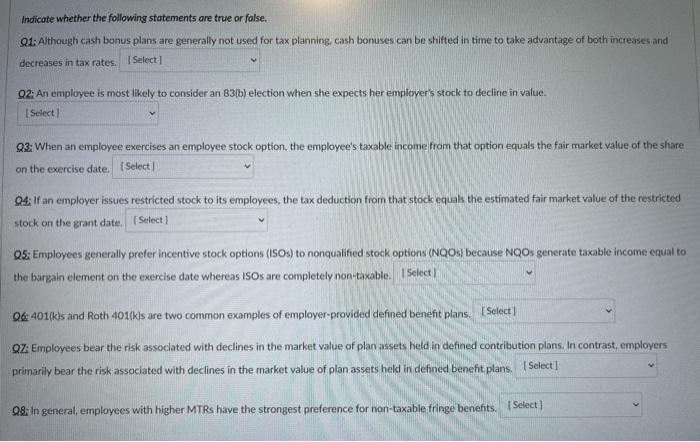

Indicate whether the following statements are true or false. Q1: Although cash bonus plans are generally not used for tax planning, cash bonuses can be shifted in time to take advantage of both increases and decreases in tax rates. Select Q2: An employee is most likely to consider an 83(b) election when she expects her employer's stock to decline in value. Select Q3: When an employee exercises an employee stock option, the employee's taxable income from that option equals the fair market value of the share on the exercise date. Select 04: If an employer issues restricted stock to its employees, the tax deduction from that stock equals the estimated fair market value of the restricted stock on the grant date. Select] Q5: Employees generally prefer incentive stock options (ISOs) to nonqualified stock options (NQOs) because NQOs generate taxable income equal to the bargain element on the exercise date whereas ISOs are completely non-taxable. Select Q6: 401(k)s and Roth 401(kls are two common examples of employer-provided defined benefit plans. Select QZ: Employees bear the risk associated with declines in the market value of plan assets held in defined contribution plans. In contrast, employers primarily bear the risk associated with declines in the market value of plan assets held in defined benefit plans. Select 08: In general, employees with higher MTRs have the strongest preference for non-taxable fringe benefits. Select

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts