Question: Indicate whether the following statements are True or False regarding uncertain tax positions (UTP). a. Disclosures are required for items that are material as

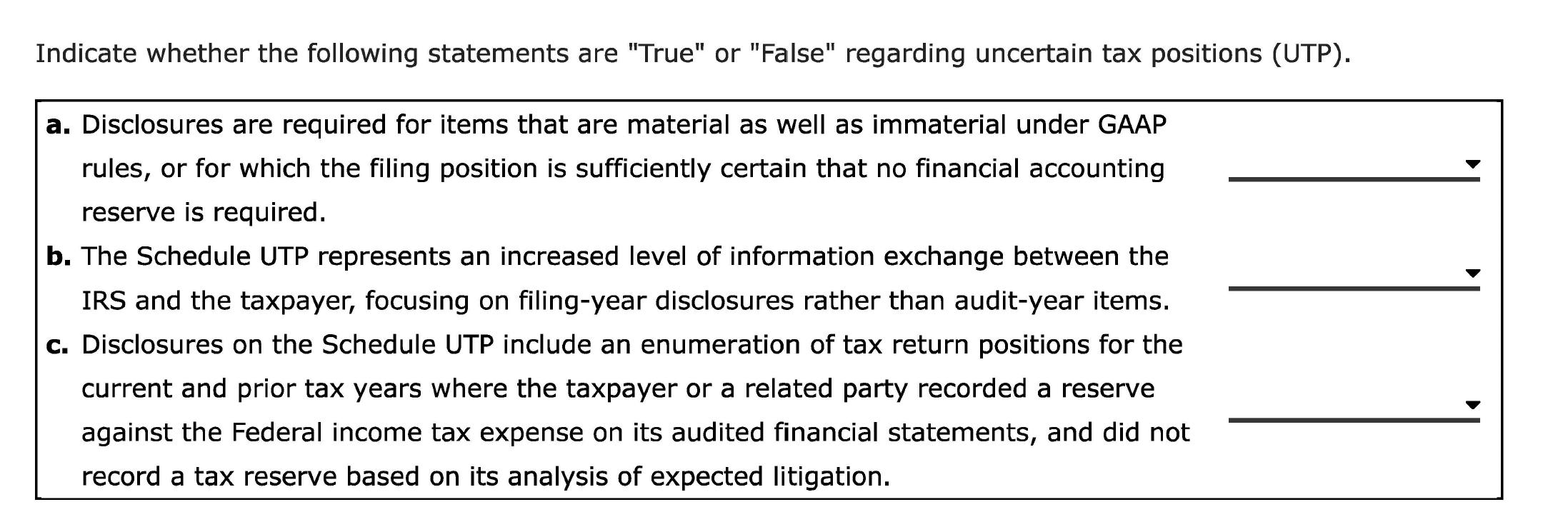

Indicate whether the following statements are "True" or "False" regarding uncertain tax positions (UTP). a. Disclosures are required for items that are material as well as immaterial under GAAP rules, or for which the filing position is sufficiently certain that no financial accounting reserve is required. b. The Schedule UTP represents an increased level of information exchange between the IRS and the taxpayer, focusing on filing-year disclosures rather than audit-year items. c. Disclosures on the Schedule UTP include an enumeration of tax return positions for the current and prior tax years where the taxpayer or a related party recorded a reserve against the Federal income tax expense on its audited financial statements, and did not record a tax reserve based on its analysis of expected litigation.

Step by Step Solution

3.47 Rating (150 Votes )

There are 3 Steps involved in it

a False GAAP requires only to disclose the material information relevant for the user... View full answer

Get step-by-step solutions from verified subject matter experts