Question: Indicate whether the statement is true or false. 1. The sales factor has become the current method of allocation instead of the 3 factors of

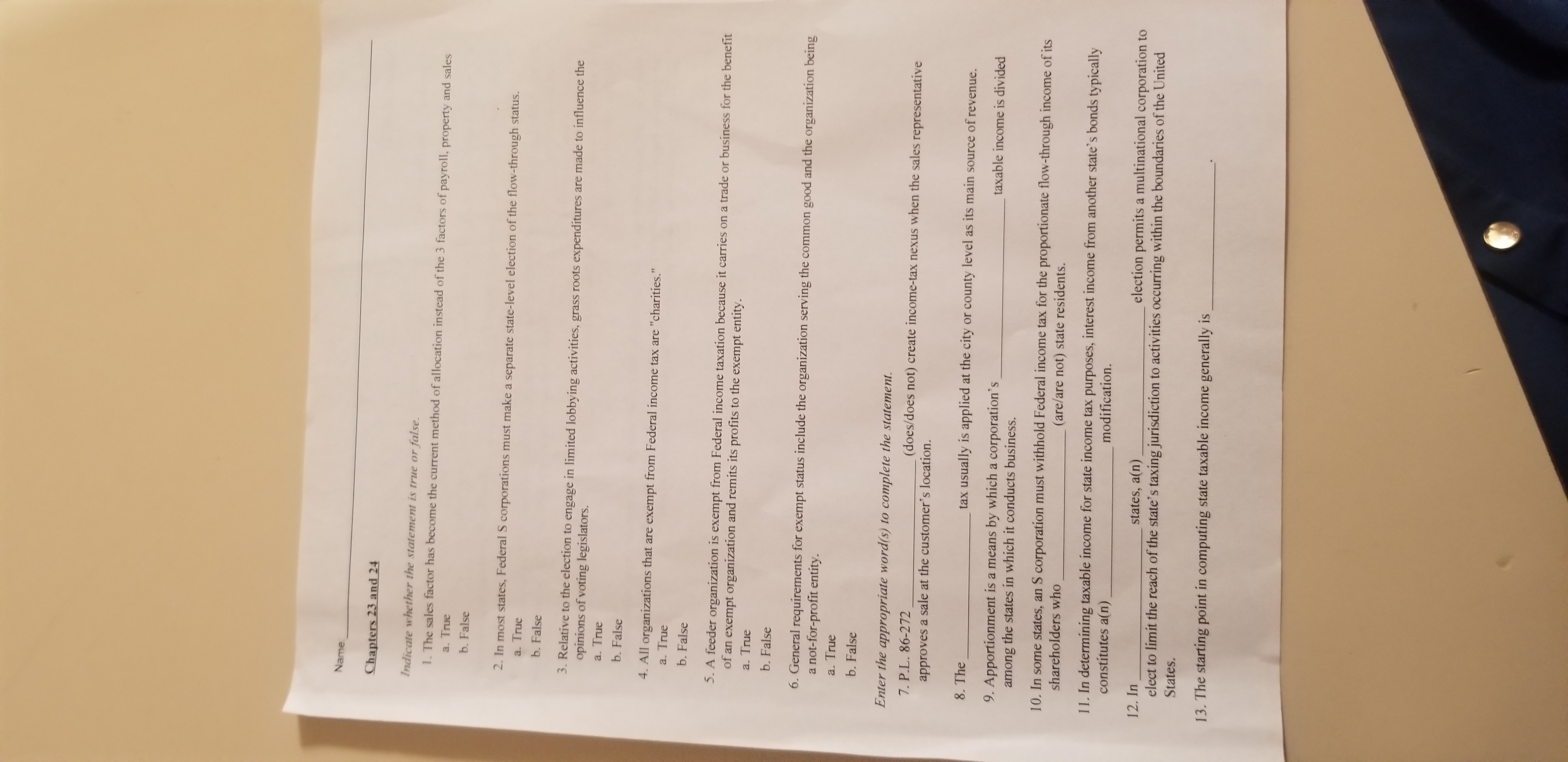

Indicate whether the statement is true or false. 1. The sales factor has become the current method of allocation instead of the 3 factors of payroll, property and sales a. True b. False 2. In most states, Federal S corporations must make a separate state-level election of the flow-through status. a. True b. False 3. Relative to the election to engage in limited lobbying activities, grass roots expenditures are made to influence the opinions of voting legislators. a. True b. False 4. All organizations that are exempt from Federal income tax are "charities." a. True b. False 5. A feeder organization is exempt from Federal income taxation because it carries on a trade or business for the benefit of an exempt organization and remits its profits to the exempt entity. a. True b. False 6. General requirements for exempt status include the organization serving the common good and the organization being a not-for-profit entity. a. True b. False Enter the appropriate word(s) to complete the statement. 7. P.L. 86-272 (does/does not) create income-tax nexus when the sales representative approves a sale at the customer's location. 8. The tax usually is applied at the city or county level as its main source of revenue. 9. Apportionment is a means by which a corporation's among the states in which it conducts business. taxable income is divided 10. In some states, an S corporation must withhold Federal income tax for the proportionate flow-through income of its shareholders who (are/are not) state residents. 11. In determining taxable income for state income tax purposes, interest income from another state's bonds typically constitutes a(n modification. 12. In states, a(n) election permits a multinational corporation to elect to limit the reach of the state's taxing jurisdiction to activities occurring within the boundaries of the United States. 3. The starting point in computing state taxable income generally is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts