Question: Indicate whether the statement is true or false. Katelyn is divorced and maintains a household in which she and her daughter, Crissa, live. Crissa, age

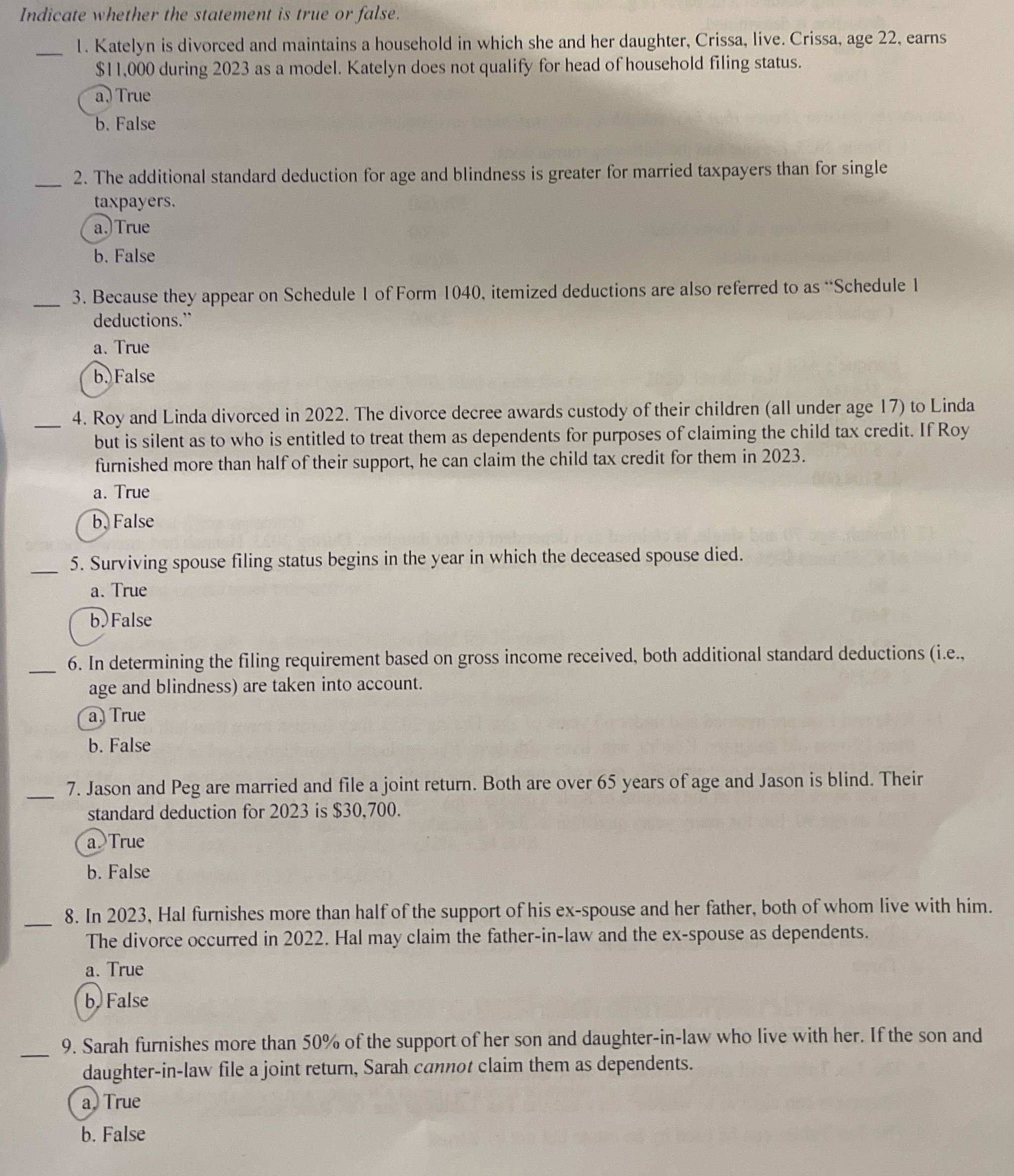

Indicate whether the statement is true or false.

Katelyn is divorced and maintains a household in which she and her daughter, Crissa, live. Crissa, age earns $ during as a model. Katelyn does not qualify for head of household filing status.

a True

b False

The additional standard deduction for age and blindness is greater for married taxpayers than for single

taxpayers.

a True

b False

Because they appear on Schedule I of Form itemized deductions are also referred to as "Schedule Deductions."

a True

b False

Roy and Linda divorced in The divorce decree awards custody of their children all under age to Linda but is silent as to who is entitled to treat them as dependents for purposes of claiming the child tax credit. If Roy furnished more than half of their support, he can claim the child tax credit for them in

a True

b False

Surviving spouse filing status begins in the year in which the deceased spouse died.

a True

b False

In determining the filing requirement based on gross income received, both additional standard deductions ie age and blindness are taken into account.

a True

b False

Jason and Peg are married and file a joint return. Both are over years of age and Jason is blind. Their

standard deduction for is $

a True

b False

In Hal furnishes more than half of the support of his exspouse and her father, both of whom live with him. The divorce occurred in Hal may claim the fatherinlaw and the exspouse as dependents.

a True

b False

Sarah furnishes more than of the support of her son and daughterinlaw who live with her. If the son and

daughterinlaw file a joint return, Sarah cannot claim them as dependents.

a True

b False

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock