Question: Indicate which is the most appropriate form or schedulels) for each of the following items. Unless otherwise indicated in the problem, assume the taxpayer is

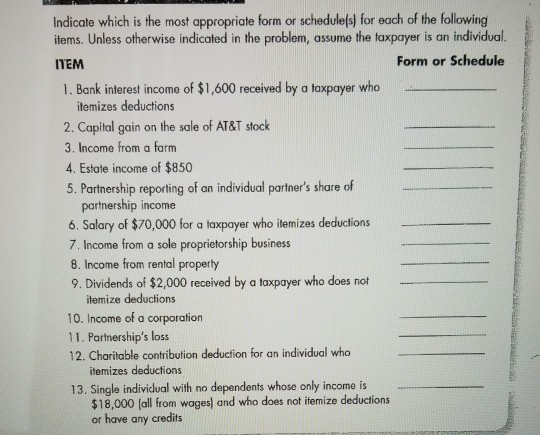

Indicate which is the most appropriate form or schedulels) for each of the following items. Unless otherwise indicated in the problem, assume the taxpayer is an individual. ITEM Form or Schedule 1. Bank interest income of $1,600 received by a taxpayer who itemizes deductions 2. Capital gain on the sale of AT&T stock 3. Income from a farm 4. Estate income of $850 5. Partnership reporting of an individual partner's share of partnership income 6. Salary of $70,000 for a taxpayer who itemizes deductions 7. Income from a sole proprietorship busines 8. Income from rental property 9. Dividends of $2,000 received by a taxpayer who does not itemize deductions 10. Income of a corporation 11. Partnership's loss 12. Charitable contribution deduction for an individual who itemizes deductions 13. Single individual with no dependents whose only income is $18,000 (all from wages) and who does not itemize deductions or have any credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts