Question: Indirect Method Preparing a Statement of Cash Flows The accounting records of Guci Corp. show the following data for the current year. Additional information 1.

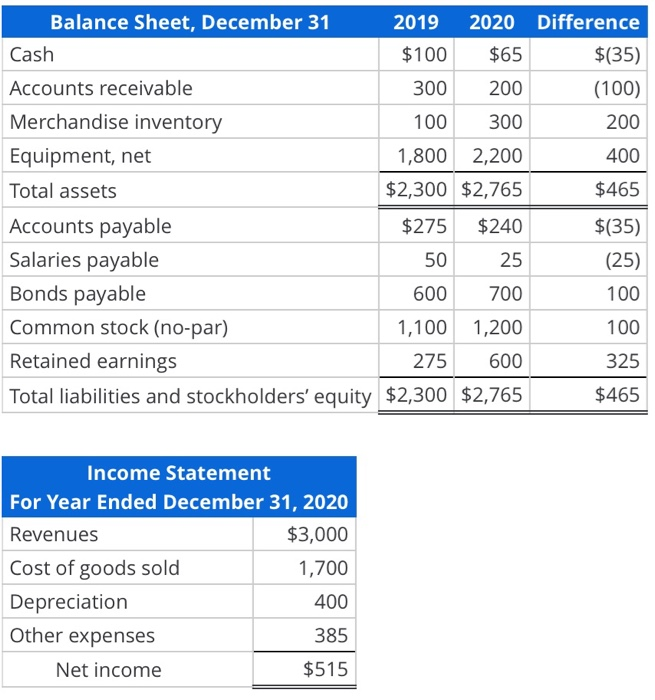

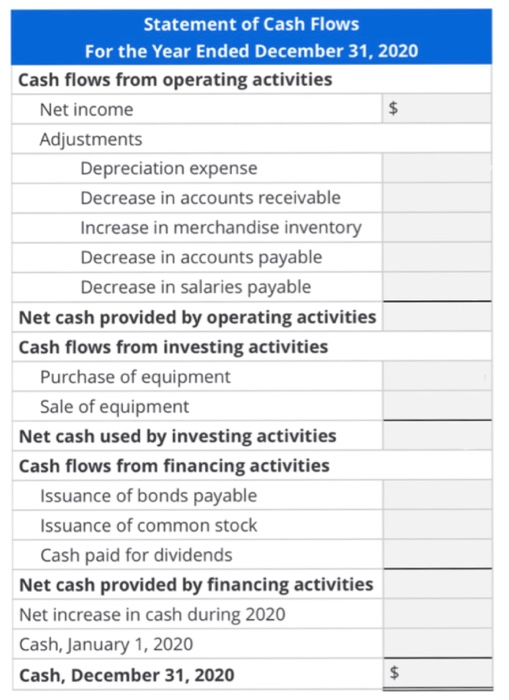

Balance Sheet, December 31 2019 2020 Difference Cash $100 $65 $(35) Accounts receivable 300 200 (100) Merchandise inventory 100 300 200 Equipment, net 1,800 2,200 400 Total assets $2,300 $2,765 $465 Accounts payable $275 $240 $(35) Salaries payable 50 25 (25) Bonds payable 600 700 100 Common stock (no-par) 1,100 1,200 100 Retained earnings 275 600 325 Total liabilities and stockholders' equity $2,300 $2,765 $465 Income Statement For Year Ended December 31, 2020 Revenues $3,000 Cost of goods sold 1,700 Depreciation 400 Other expenses 385 Net income $515 Statement of Cash Flows For the Year Ended December 31, 2020 Cash flows from operating activities Net income $ Adjustments Depreciation expense Decrease in accounts receivable Increase in merchandise inventory Decrease in accounts payable Decrease in salaries payable Net cash provided by operating activities Cash flows from investing activities Purchase of equipment Sale of equipment Net cash used by investing activities Cash flows from financing activities Issuance of bonds payable Issuance of common stock Cash paid for dividends Net cash provided by financing activities Net increase in cash during 2020 Cash, January 1, 2020 Cash, December 31, 2020 $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts