Question: Individual Assignment 2 Instructions to students: This assignment should be completed in handwritten form individually and neatly in A4 single line paper using blue or

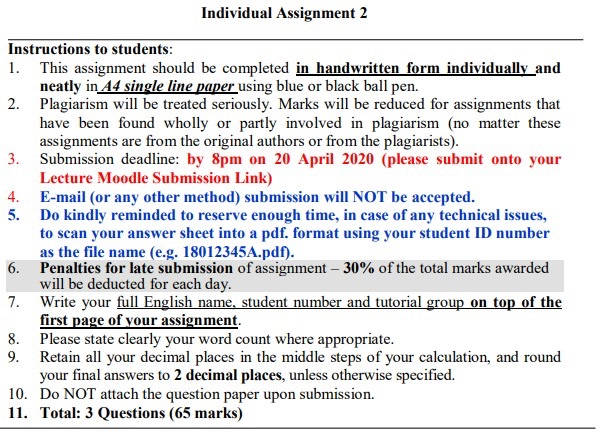

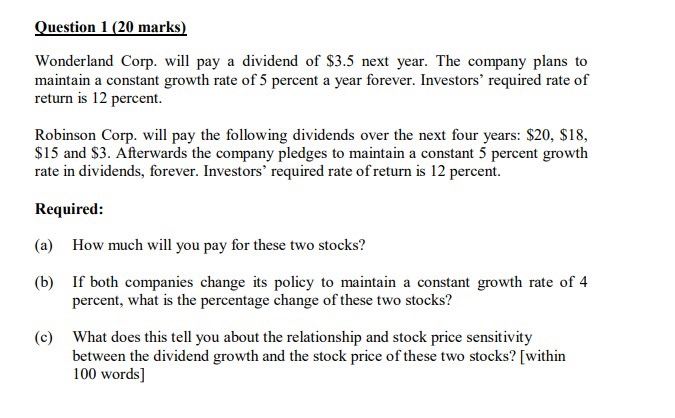

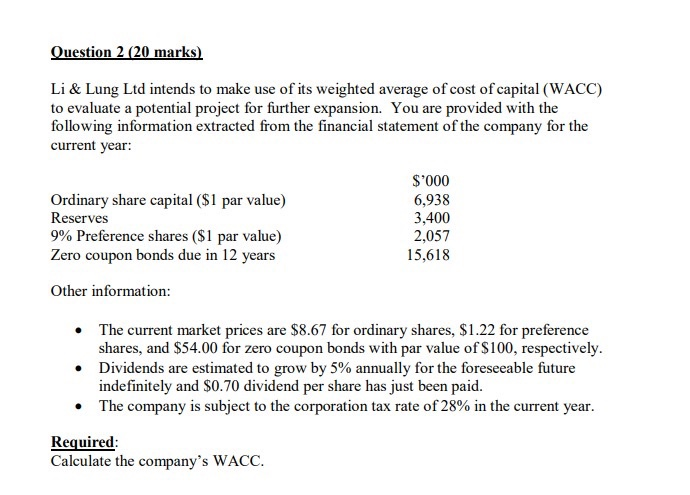

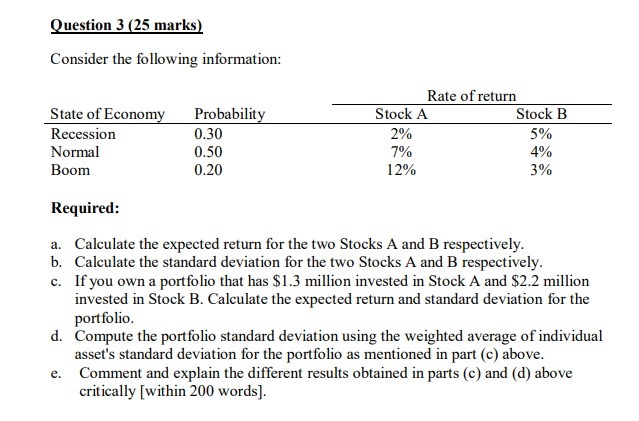

Individual Assignment 2 Instructions to students: This assignment should be completed in handwritten form individually and neatly in A4 single line paper using blue or black ball pen. 2. Plagiarism will be treated seriously. Marks will be reduced for assignments that have been found wholly or partly involved in plagiarism (no matter these assignments are from the original authors or from the plagiarists). 3. Submission deadline: by 8pm on 20 April 2020 (please submit onto your Lecture Moodle Submission Link) E-mail (or any other method) submission will NOT be accepted. 5. Do kindly reminded to reserve enough time, in case of any technical issues, to scan your answer sheet into a pdf. format using your student ID number as the file name (e.g. 18012345A.pdf). Penalties for late submission of assignment - 30% of the total marks awarded will be deducted for each day. 7. Write your full English name, student number and tutorial group on top of the first page of your assignment. 8. Please state clearly your word count where appropriate. Retain all your decimal places in the middle steps of your calculation, and round your final answers to 2 decimal places, unless otherwise specified. 10. Do NOT attach the question paper upon submission. 11. Total: 3 Questions (65 marks) Question 1 (20 marks) Wonderland Corp. will pay a dividend of $3.5 next year. The company plans to maintain a constant growth rate of 5 percent a year forever. Investors' required rate of return is 12 percent. Robinson Corp. will pay the following dividends over the next four years: $20, $18, $15 and $3. Afterwards the company pledges to maintain a constant 5 percent growth rate in dividends, forever. Investors' required rate of return is 12 percent. Required: (a) How much will you pay for these two stocks? (b) If both companies change its policy to maintain a constant growth rate of 4 percent, what is the percentage change of these two stocks? (c) What does this tell you about the relationship and stock price sensitivity between the dividend growth and the stock price of these two stocks? [within 100 words ] Question 2 (20 marks) Li & Lung Ltd intends to make use of its weighted average of cost of capital (WACC) to evaluate a potential project for further expansion. You are provided with the following information extracted from the financial statement of the company for the current year: Ordinary share capital ($1 par value) Reserves 9% Preference shares ($1 par value) Zero coupon bonds due in 12 years $'000 6,938 3,400 2,057 15,618 Other information: The current market prices are $8.67 for ordinary shares, $1.22 for preference shares, and $54.00 for zero coupon bonds with par value of $100, respectively. Dividends are estimated to grow by 5% annually for the foreseeable future indefinitely and $0.70 dividend per share has just been paid. The company is subject to the corporation tax rate of 28% in the current year. Required: Calculate the company's WACC. Question 3 (25 marks) Consider the following information: State of Economy Recession Normal Boom Probability 0.30 0.50 0.20 Rate of return Stock A Stock B 2% 5% 7% 4% 12% 3% Required: a. Calculate the expected return for the two Stocks A and B respectively. b. Calculate the standard deviation for the two Stocks A and B respectively. c. If you own a portfolio that has $1.3 million invested in Stock A and $2.2 million invested in Stock B. Calculate the expected return and standard deviation for the portfolio. d. Compute the portfolio standard deviation using the weighted average of individual asset's standard deviation for the portfolio as mentioned in part (c) above. e. Comment and explain the different results obtained in parts (c) and (d) above critically [within 200 words). Individual Assignment 2 Instructions to students: This assignment should be completed in handwritten form individually and neatly in A4 single line paper using blue or black ball pen. 2. Plagiarism will be treated seriously. Marks will be reduced for assignments that have been found wholly or partly involved in plagiarism (no matter these assignments are from the original authors or from the plagiarists). 3. Submission deadline: by 8pm on 20 April 2020 (please submit onto your Lecture Moodle Submission Link) E-mail (or any other method) submission will NOT be accepted. 5. Do kindly reminded to reserve enough time, in case of any technical issues, to scan your answer sheet into a pdf. format using your student ID number as the file name (e.g. 18012345A.pdf). Penalties for late submission of assignment - 30% of the total marks awarded will be deducted for each day. 7. Write your full English name, student number and tutorial group on top of the first page of your assignment. 8. Please state clearly your word count where appropriate. Retain all your decimal places in the middle steps of your calculation, and round your final answers to 2 decimal places, unless otherwise specified. 10. Do NOT attach the question paper upon submission. 11. Total: 3 Questions (65 marks) Question 1 (20 marks) Wonderland Corp. will pay a dividend of $3.5 next year. The company plans to maintain a constant growth rate of 5 percent a year forever. Investors' required rate of return is 12 percent. Robinson Corp. will pay the following dividends over the next four years: $20, $18, $15 and $3. Afterwards the company pledges to maintain a constant 5 percent growth rate in dividends, forever. Investors' required rate of return is 12 percent. Required: (a) How much will you pay for these two stocks? (b) If both companies change its policy to maintain a constant growth rate of 4 percent, what is the percentage change of these two stocks? (c) What does this tell you about the relationship and stock price sensitivity between the dividend growth and the stock price of these two stocks? [within 100 words ] Question 2 (20 marks) Li & Lung Ltd intends to make use of its weighted average of cost of capital (WACC) to evaluate a potential project for further expansion. You are provided with the following information extracted from the financial statement of the company for the current year: Ordinary share capital ($1 par value) Reserves 9% Preference shares ($1 par value) Zero coupon bonds due in 12 years $'000 6,938 3,400 2,057 15,618 Other information: The current market prices are $8.67 for ordinary shares, $1.22 for preference shares, and $54.00 for zero coupon bonds with par value of $100, respectively. Dividends are estimated to grow by 5% annually for the foreseeable future indefinitely and $0.70 dividend per share has just been paid. The company is subject to the corporation tax rate of 28% in the current year. Required: Calculate the company's WACC. Question 3 (25 marks) Consider the following information: State of Economy Recession Normal Boom Probability 0.30 0.50 0.20 Rate of return Stock A Stock B 2% 5% 7% 4% 12% 3% Required: a. Calculate the expected return for the two Stocks A and B respectively. b. Calculate the standard deviation for the two Stocks A and B respectively. c. If you own a portfolio that has $1.3 million invested in Stock A and $2.2 million invested in Stock B. Calculate the expected return and standard deviation for the portfolio. d. Compute the portfolio standard deviation using the weighted average of individual asset's standard deviation for the portfolio as mentioned in part (c) above. e. Comment and explain the different results obtained in parts (c) and (d) above critically [within 200 words)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts