Question: Individual Assignment - Mini Cases / Problems This assessment is centred on the topics Cost Classification & Inventory Valuation which are covered in Units 2

Individual Assignment Mini CasesProblems

This assessment is centred on the topics "Cost Classification" & "Inventory Valuation" which are covered in

Units & & speaks to the following objectives:

Course Objectives:

Distinguish between manufacturing & nonmanufacturing overhead product versus period costs

Classify costs as prime costs or conversion costs

Use the correct inventory to determine the cost of goods manufactured and cost of goods sold.

Prepare a statement of cost of goods manufactured, clearly showing total manufacturing costs & total

manufacturing costs to account for.

Prepare an income statement for a manufacturing entity, clearly showing Cost of Goods Sold. Question

marks

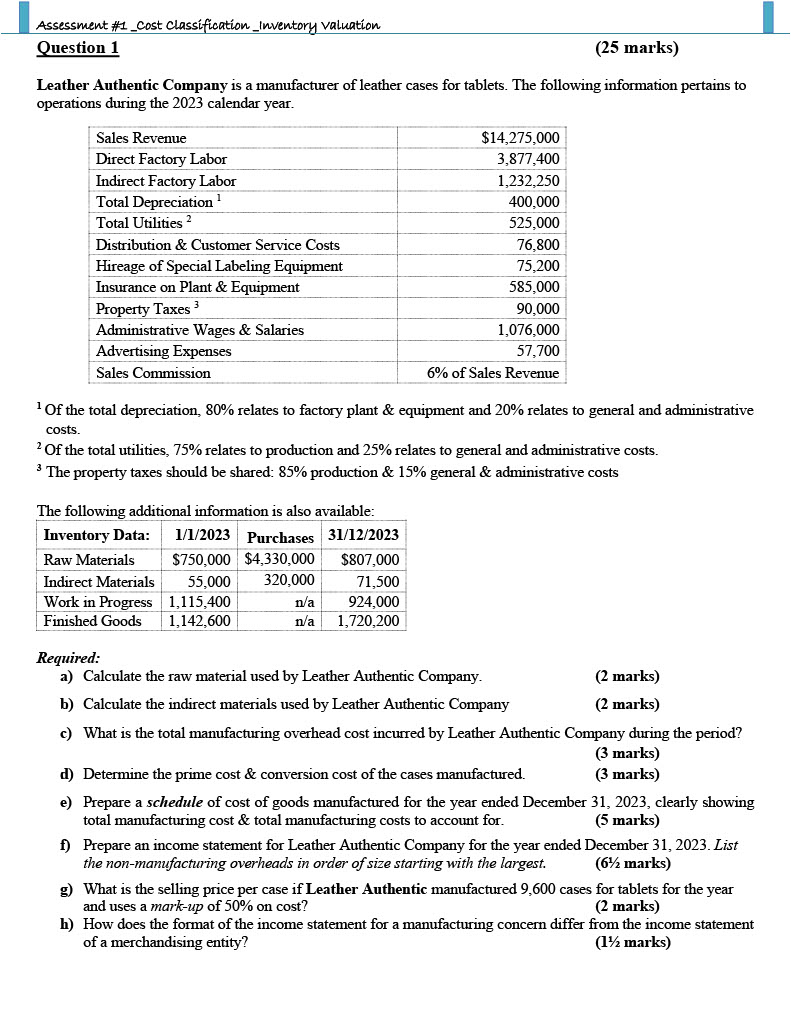

Leather Authentic Company is a manufacturer of leather cases for tablets. The following information pertains to

operations during the calendar year.

Of the total depreciation, relates to factory plant & equipment and relates to general and administrative

costs.

Of the total utilities, relates to production and relates to general and administrative costs.

The property taxes should be shared: production & general & administrative costs

The following additional information is also available:

Required:

a Calculate the raw material used by Leather Authentic Company.

marks

b Calculate the indirect materials used by Leather Authentic Company

marks

c What is the total manufacturing overhead cost incurred by Leather Authentic Company during the period?

d Determine the prime cost & conversion cost of the cases manufactured.

e Prepare a schedule of cost of goods manufactured for the year ended December clearly showing

total manufacturing cost & total manufacturing costs to account for.

marks

f Prepare an income statement for Leather Authentic Company for the year ended December List

the nonmanufacturing overheads in order of size starting with the largest.

marks

g What is the selling price per case if Leather Authentic manufactured cases for tablets for the year

and uses a markup of on cost

h How does the format of the income statement for a manufacturing concern differ from the income statement

of a merchandising entity?

Calculate unit factory cost and selling price, given the markup applied by the entity.

Explain the difference between the income statements of a merchandiser & a manufacturer

Given a set of transactions of a merchandiser for a specified period, prepare an inventory record to

determine the value of ending inventory & cost of goods sold.

Demonstrate how sales returns & purchases returns are treated in the inventory record and how they impact

the income statement.

Prepare an income statement for a merchandising entity.

Use journal entries to demonstrate the difference between a perpetual & a periodic inventory system using

purchases, freightin & sale of inventory transactions.

Explain the differences between a product cost and a period cost.

This assessment will account for of your overall mark. You are required to show ALL supporting workings

where necessary and state any assumptions made.

You are required to submit this assignment by Thursday, October by : pm EC Time : pm

Jamaica Time; : pm Belize Time.

Specifications:

MS Word or Excel Document Version

Font Size

Pdf documents will not be graded

GRADING:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock