Question: INDIVIDUAL - Assignment TWO Information in the table below extracted from the latest financial reports of two Boursa Kuwait companies, Kuwait Cement Company and Gulf

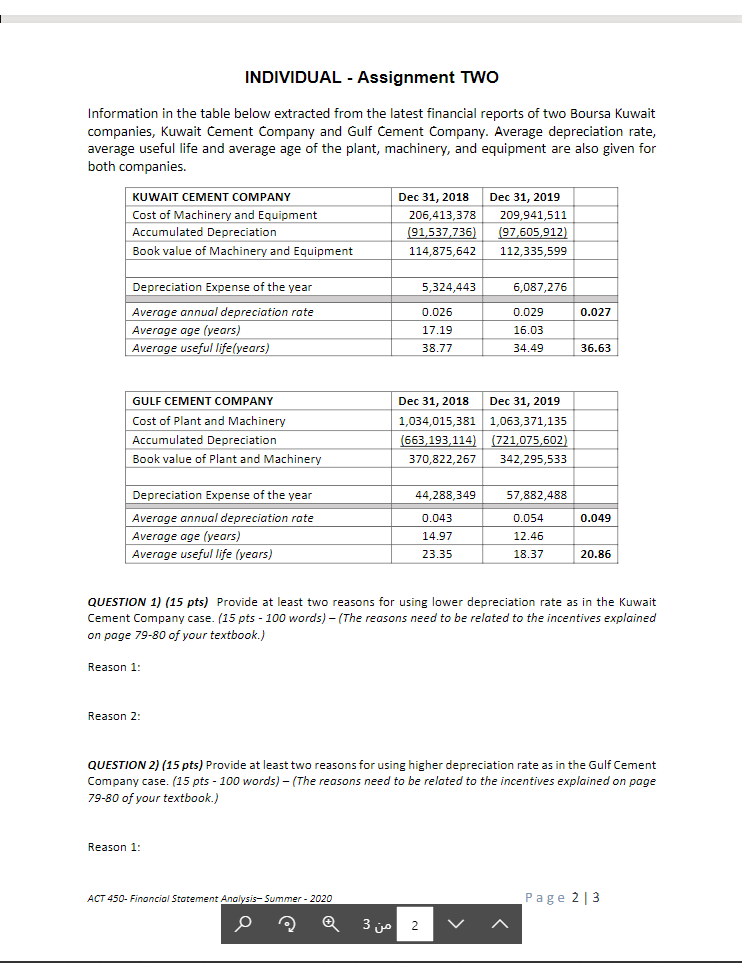

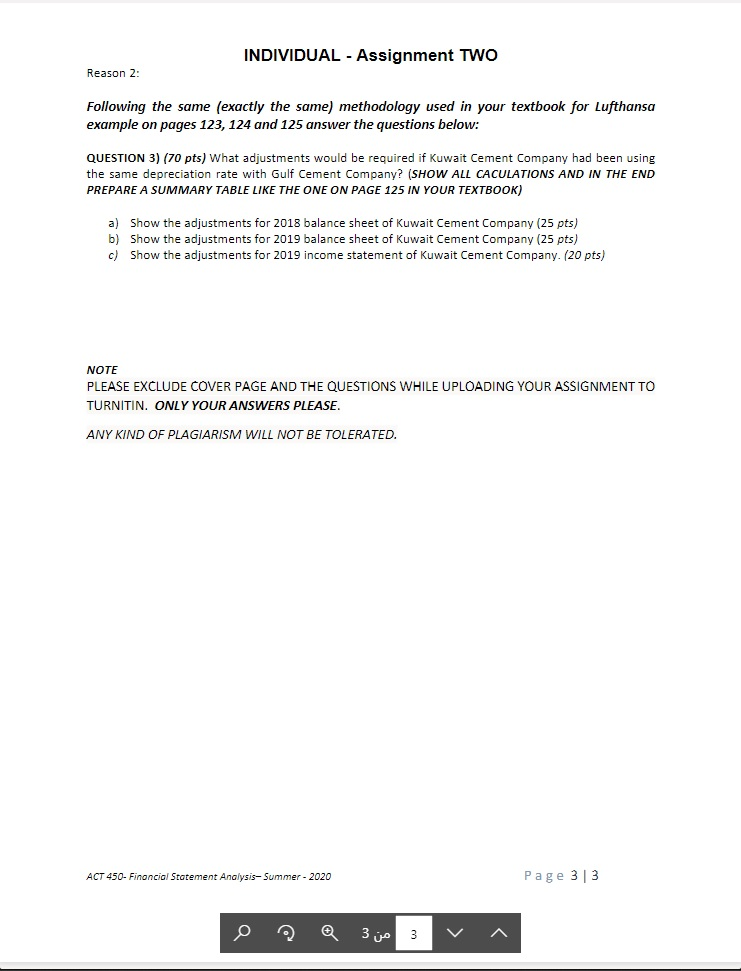

INDIVIDUAL - Assignment TWO Information in the table below extracted from the latest financial reports of two Boursa Kuwait companies, Kuwait Cement Company and Gulf Cement Company. Average depreciation rate, average useful life and average age of the plant, machinery, and equipment are also given for both companies. KUWAIT CEMENT COMPANY Cost of Machinery and Equipment Accumulated Depreciation Book value of Machinery and Equipment Dec 31, 2018 206,413,378 (91,537,736) 114,875,642 Dec 31, 2019 209,941,511 (97,605,912) 112,335,599 5,324,443 6,087,276 0.027 Depreciation Expense of the year Average annual depreciation rate Average age (years) Average useful life(years) 0.026 17.19 38.77 0.029 16.03 34.49 36.63 GULF CEMENT COMPANY Cost of Plant and Machinery Accumulated Depreciation Book value of Plant and Machinery Dec 31, 2018 Dec 31, 2019 1,034,015,381 1,063,371,135 (663,193,114) (721,075,602) 370,822,267 342,295,533 44,288,349 57,882,488 0.049 Depreciation Expense of the year Average annual depreciation rate Average age (years) Average useful life (years) 0.043 14.97 23.35 0.054 12.46 18.37 20.86 QUESTION 1) (15 pts) Provide at least two reasons for using lower depreciation rate as in the Kuwait Cement Company case. (15 pts - 100 words) - (The reasons need to be related to the incentives explained on page 79-80 of your textbook.) Reason 1 Reason 2: QUESTION 2) (15 pts) Provide at least two reasons for using higher depreciation rate as in the Gulf Cement Company case. (15 pts - 100 words) - (The reasons need to be related to the incentives explained on page 79-80 of your textbook.) Reason 1: ACT 450-Financial Statement Analysis-Summer - 2020 Page 23 3 2 INDIVIDUAL - Assignment TWO Reason 2: Following the same (exactly the same) methodology used in your textbook for Lufthansa example on pages 123, 124 and 125 answer the questions below: QUESTION 3) (70 pts) What adjustments would be required if Kuwait Cement Company had been using the same depreciation rate with Gulf Cement Company? (SHOW ALL CACULATIONS AND IN THE END PREPARE A SUMMARY TABLE LIKE THE ONE ON PAGE 125 IN YOUR TEXTBOOK) a) Show the adjustments for 2018 balance sheet of Kuwait Cement Company (25 pts) b) Show the adjustments for 2019 balance sheet of Kuwait Cement Company (25 pts) c) Show the adjustments for 2019 income statement of Kuwait Cement Company. (20 pts) NOTE PLEASE EXCLUDE COVER PAGE AND THE QUESTIONS WHILE UPLOADING YOUR ASSIGNMENT TO TURNITIN. ONLY YOUR ANSWERS PLEASE. ANY KIND OF PLAGIARISM WILL NOT BE TOLERATED. ACT 450- Financial Statement Analysis-Summer - 2020 Page 33 3 3 INDIVIDUAL - Assignment TWO Information in the table below extracted from the latest financial reports of two Boursa Kuwait companies, Kuwait Cement Company and Gulf Cement Company. Average depreciation rate, average useful life and average age of the plant, machinery, and equipment are also given for both companies. KUWAIT CEMENT COMPANY Cost of Machinery and Equipment Accumulated Depreciation Book value of Machinery and Equipment Dec 31, 2018 206,413,378 (91,537,736) 114,875,642 Dec 31, 2019 209,941,511 (97,605,912) 112,335,599 5,324,443 6,087,276 0.027 Depreciation Expense of the year Average annual depreciation rate Average age (years) Average useful life(years) 0.026 17.19 38.77 0.029 16.03 34.49 36.63 GULF CEMENT COMPANY Cost of Plant and Machinery Accumulated Depreciation Book value of Plant and Machinery Dec 31, 2018 Dec 31, 2019 1,034,015,381 1,063,371,135 (663,193,114) (721,075,602) 370,822,267 342,295,533 44,288,349 57,882,488 0.049 Depreciation Expense of the year Average annual depreciation rate Average age (years) Average useful life (years) 0.043 14.97 23.35 0.054 12.46 18.37 20.86 QUESTION 1) (15 pts) Provide at least two reasons for using lower depreciation rate as in the Kuwait Cement Company case. (15 pts - 100 words) - (The reasons need to be related to the incentives explained on page 79-80 of your textbook.) Reason 1 Reason 2: QUESTION 2) (15 pts) Provide at least two reasons for using higher depreciation rate as in the Gulf Cement Company case. (15 pts - 100 words) - (The reasons need to be related to the incentives explained on page 79-80 of your textbook.) Reason 1: ACT 450-Financial Statement Analysis-Summer - 2020 Page 23 3 2 INDIVIDUAL - Assignment TWO Reason 2: Following the same (exactly the same) methodology used in your textbook for Lufthansa example on pages 123, 124 and 125 answer the questions below: QUESTION 3) (70 pts) What adjustments would be required if Kuwait Cement Company had been using the same depreciation rate with Gulf Cement Company? (SHOW ALL CACULATIONS AND IN THE END PREPARE A SUMMARY TABLE LIKE THE ONE ON PAGE 125 IN YOUR TEXTBOOK) a) Show the adjustments for 2018 balance sheet of Kuwait Cement Company (25 pts) b) Show the adjustments for 2019 balance sheet of Kuwait Cement Company (25 pts) c) Show the adjustments for 2019 income statement of Kuwait Cement Company. (20 pts) NOTE PLEASE EXCLUDE COVER PAGE AND THE QUESTIONS WHILE UPLOADING YOUR ASSIGNMENT TO TURNITIN. ONLY YOUR ANSWERS PLEASE. ANY KIND OF PLAGIARISM WILL NOT BE TOLERATED. ACT 450- Financial Statement Analysis-Summer - 2020 Page 33 3 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts