Question: individual incometax class, short answer without explaining please 1. Refundable tax credits include the: a. Foreign tax credit. b. Tax credit for rehabilitation expenses. c.

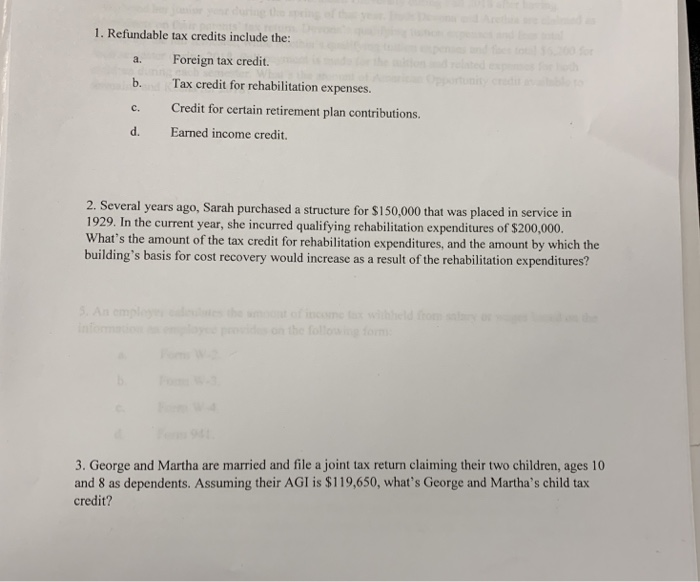

1. Refundable tax credits include the: a. Foreign tax credit. b. Tax credit for rehabilitation expenses. c. Credit for certain retirement plan contributions. d. Earned income credit. 2. Several years ago, Sarah purchased a structure for $150,000 that was placed in service in 1929. In the current year, she incurred qualifying rehabilitation expenditures of $200,000. What's the amount of the tax credit for rehabilitation expenditures, and the amount by which the building's basis for cost recovery would increase as a result of the rehabilitation expenditures? 3. George and Martha are married and file a joint tax return claiming their two children, ages 10 and 8 as dependents. Assuming their AGI is $119,650, what's George and Martha's child tax credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts